Wisconsin Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

You can spend time on the web searching for the lawful record design which fits the federal and state requirements you want. US Legal Forms supplies 1000s of lawful kinds which can be evaluated by experts. It is simple to download or printing the Wisconsin Form of Anti-Money Laundering Policy from my assistance.

If you currently have a US Legal Forms profile, it is possible to log in and click the Download switch. Next, it is possible to full, edit, printing, or signal the Wisconsin Form of Anti-Money Laundering Policy. Every single lawful record design you buy is yours forever. To have another copy for any obtained develop, go to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms web site the first time, keep to the straightforward recommendations listed below:

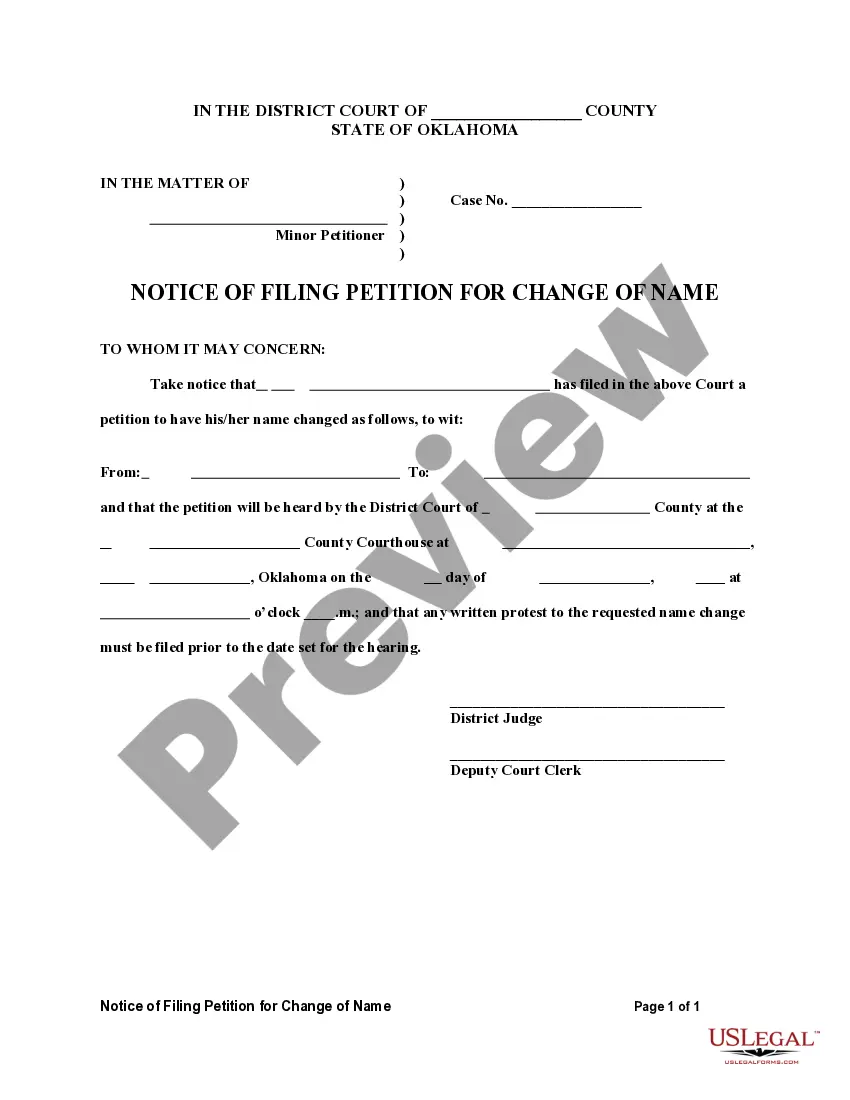

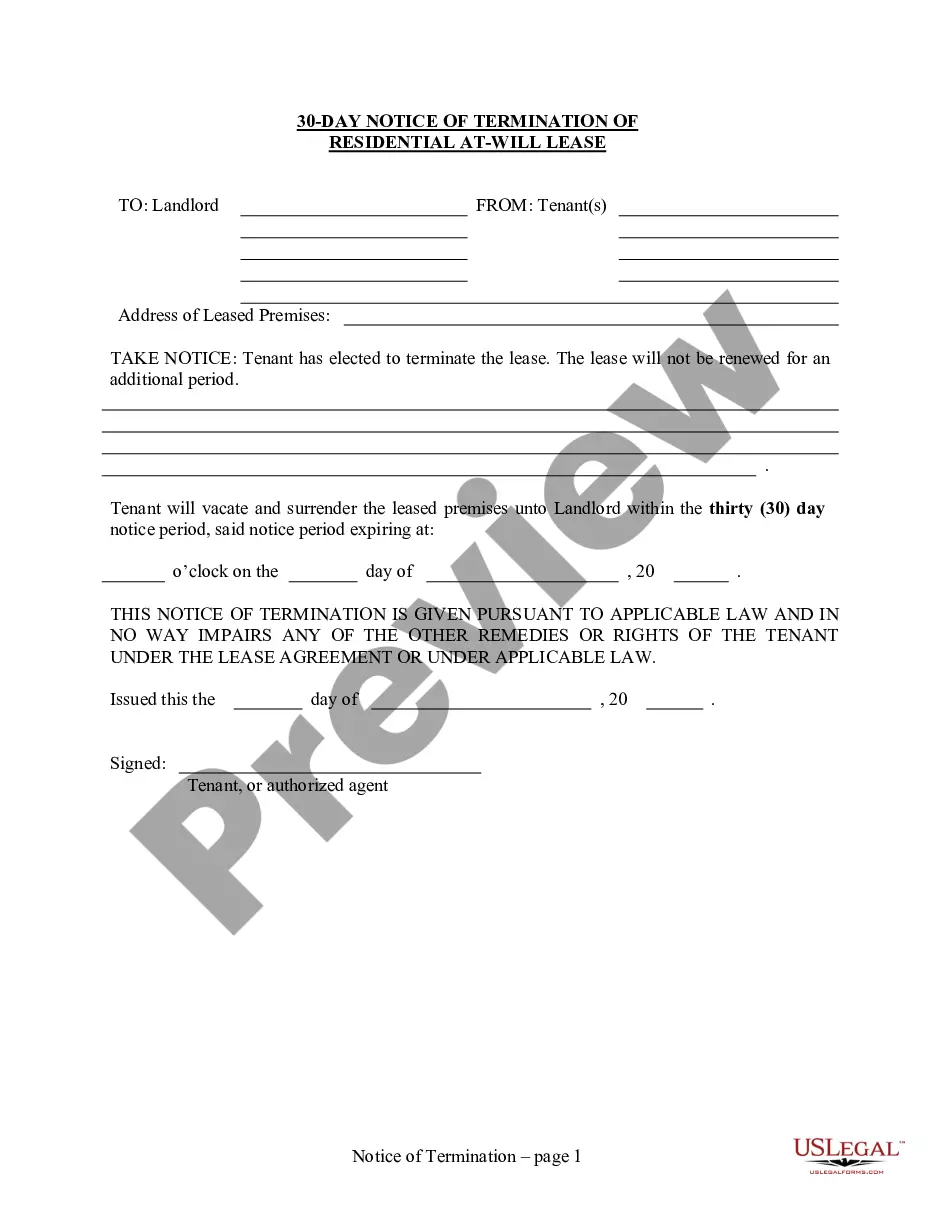

- Initially, make certain you have chosen the proper record design for that county/area that you pick. See the develop outline to make sure you have selected the proper develop. If accessible, make use of the Review switch to search from the record design too.

- In order to locate another model of your develop, make use of the Look for field to discover the design that suits you and requirements.

- When you have found the design you desire, click on Purchase now to carry on.

- Pick the costs prepare you desire, enter your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You can use your credit card or PayPal profile to purchase the lawful develop.

- Pick the file format of your record and download it in your product.

- Make modifications in your record if needed. You can full, edit and signal and printing Wisconsin Form of Anti-Money Laundering Policy.

Download and printing 1000s of record layouts utilizing the US Legal Forms website, which provides the largest selection of lawful kinds. Use skilled and condition-distinct layouts to deal with your company or individual needs.

Form popularity

FAQ

Anti-Money Laundering Form (RIGHT TO BUY)

Anti-money laundering (AML) refers to legally recognized rules for preventing money laundering. Customer due diligence (CDD) refers to practices financial institutions implement to detect and report AML violations.

A policy statement is a document that includes your anti-money laundering policy, controls and the procedures your business will take to prevent money laundering. The document provides a framework for how your business will deal with the threat of money laundering.

The AML policy for your organization must specify in writing how your business verifies the identities of its clients. Know Your Customer or KYC requirements are the common name for these regulations. These regulations are frequently grouped together since they are similar to the OFAC identification requirements.

An anti-money laundering (AML) compliance program helps businesses, including traditional financial institutions?as well as those entities identified in government regulations, such as money-service businesses and insurance companies?uncover suspicious activity associated with criminal acts, including money laundering ...

Firms must comply with the Bank Secrecy Act and its implementing regulations ("AML rules"). The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

Who regulates the process? Steps to creating an AML policy. Step 1: draft an AML policy statement. Step 2: appoint a Money Laundering Reporting Officer (MLRO) Step 3: perform Customer Due Diligence (CDD) Step 4: verifying client identity. Step 5: report to Financial Intelligence Units (FIU)