Idaho Audio Systems Contractor Agreement - Self-Employed

Description

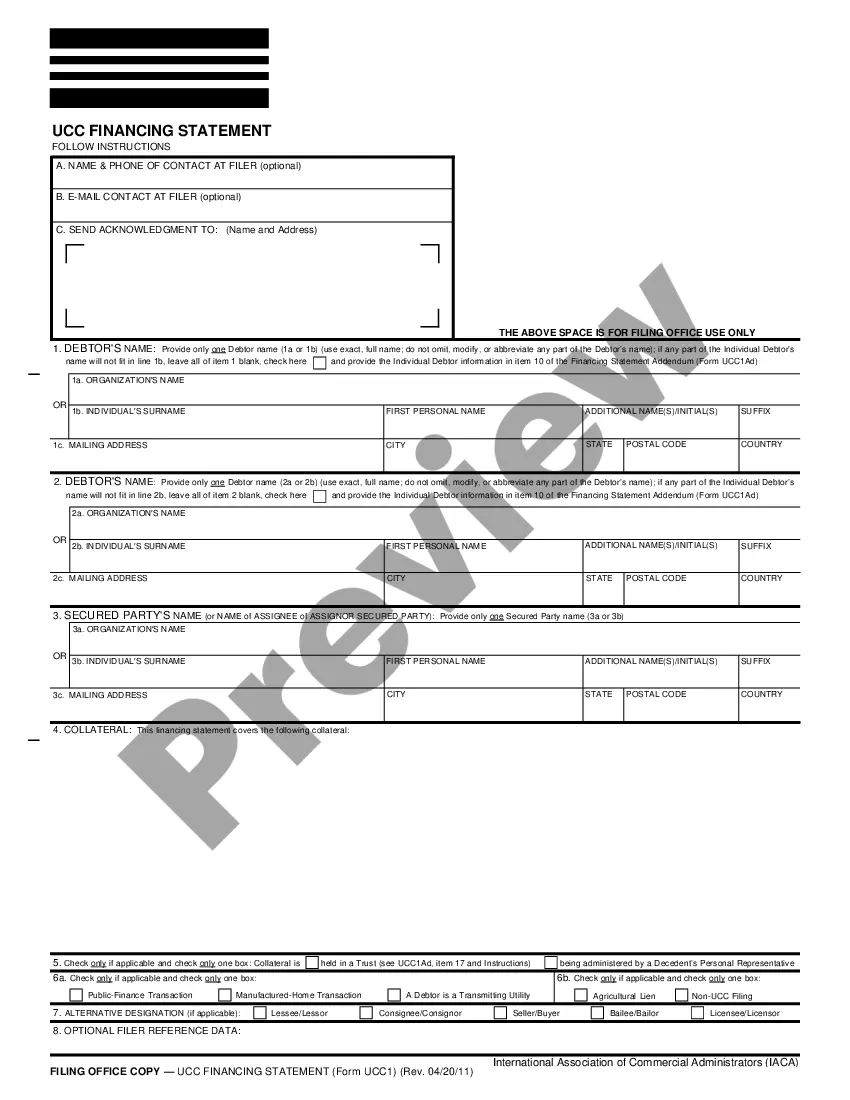

How to fill out Audio Systems Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print. By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Idaho Audio Systems Contractor Agreement - Self-Employed in just moments.

If you already have an account, sign in and download the Idaho Audio Systems Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously obtained forms from the My documents tab of your account.

If you are using US Legal Forms for the first time, here are some simple instructions to get you started: Make sure to select the correct form for your area/county. Click the Review button to examine the form's content. Check the form details to confirm that you have chosen the right form. If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does. Once you are satisfied with the form, validate your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your information to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Idaho Audio Systems Contractor Agreement - Self-Employed. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Idaho Audio Systems Contractor Agreement - Self-Employed with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

Form popularity

FAQ

To create an Idaho Audio Systems Contractor Agreement - Self-Employed, start by defining the scope of work and payment terms. Include essential details such as deadlines, deliverables, and confidentiality clauses. Utilizing a reliable platform like US Legal Forms can streamline the process, offering you easy-to-use templates and guidance. This will help you ensure that the agreement meets legal standards while protecting both parties' interests.

Typically, the party hiring the independent contractor writes the Idaho Audio Systems Contractor Agreement - Self-Employed. This ensures that the terms reflect the needs of the project and protect both parties. However, it is wise for both sides to review the agreement, possibly with legal advice, to ensure fairness and clarity. You can find comprehensive templates on platforms like US Legal Forms, which simplify the process.

Idaho does not legally require an operating agreement for LLCs, but having one is strongly recommended. An operating agreement can outline ownership and operational procedures, reducing misunderstandings in business dealings. When structuring your work as a self-employed contractor, reference the Idaho Audio Systems Contractor Agreement - Self-Employed for additional guidance on contractual relationships.

Yes, independent contractors may need a business license based on local laws. This requirement varies by city or county, so it’s essential to check local regulations. Using the Idaho Audio Systems Contractor Agreement - Self-Employed can also clarify your business operations and whether a license is necessary.

Independent contractors in Idaho must comply with local laws and regulations, including business registration and tax obligations. Federal and state guidelines also mandate proper documentation for taxes. To assist in meeting these requirements, consider the Idaho Audio Systems Contractor Agreement - Self-Employed, which helps establish clear terms and conditions for your services.

An independent contractor in Idaho is an individual providing services to clients under a specific agreement, without being an employee. This arrangement grants flexibility in work hours and project choices. Utilizing the Idaho Audio Systems Contractor Agreement - Self-Employed can clarify the terms while ensuring that both parties understand their rights and responsibilities.

To set up as a self-employed contractor, begin by choosing a business structure that suits your needs. Then, obtain the necessary licenses and permits. As you navigate this process, consider using the Idaho Audio Systems Contractor Agreement - Self-Employed to standardize your contracts, ensuring they meet legal requirements and protect your business.

Yes, if you wish to operate as an independent contractor in Idaho, you should register your business. Registration legitimizes your operations and allows you to enter into contracts, such as the Idaho Audio Systems Contractor Agreement - Self-Employed. Ensure you follow local guidelines for registration to maintain compliance and gain credibility.

In Idaho, any business operating within a city or county may need a business license. This includes self-employed contractors. If you plan to use the Idaho Audio Systems Contractor Agreement - Self-Employed for your audio system projects, checking local regulations for licensing requirements will help confirm your business's compliance.

In Idaho, you can perform limited work without a contractor license. For instance, jobs valued under $2,000 do not require a license. However, as you consider larger projects and enter agreements as a self-employed contractor, understanding the Idaho Audio Systems Contractor Agreement - Self-Employed becomes essential to ensure compliance and protect your interests.