Idaho Acoustical Contractor Agreement - Self-Employed

Description

How to fill out Acoustical Contractor Agreement - Self-Employed?

Are you presently in a circumstance where you require documents for either business or personal purposes frequently.

There are numerous legitimate document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the Idaho Acoustical Contractor Agreement - Self-Employed, that are designed to meet state and federal requirements.

Once you find the correct form, click on Get now.

Choose the pricing plan you prefer, enter the necessary details to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have acquired in the My documents menu. You can obtain another copy of the Idaho Acoustical Contractor Agreement - Self-Employed at any time, if needed. Just click on the desired form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho Acoustical Contractor Agreement - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

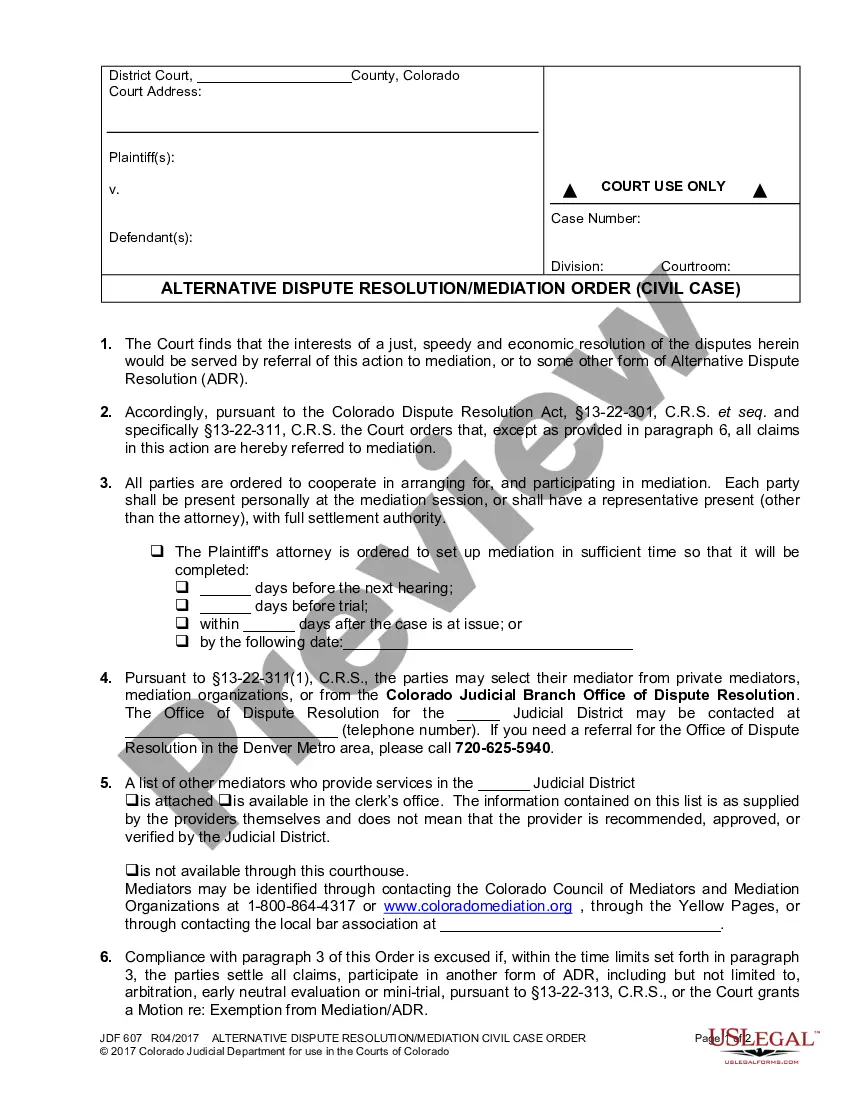

- Use the Preview button to review the form.

- Check the summary to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Search box to find the form that fits your requirements.

Form popularity

FAQ

Yes, an independent contractor is always considered self-employed. This classification refers to individuals who provide services on a contract basis rather than as employees of a company. Using an Idaho Acoustical Contractor Agreement - Self-Employed helps in defining the nature of this relationship, ensuring clarity and compliance with state laws. Be sure to protect your rights and interests as a self-employed individual.

Writing an independent contractor agreement involves several key steps. First, outline the scope of work, detailing deliverables and timelines. Next, include payment terms, confidentiality agreements, and termination clauses. Finally, utilizing a reliable platform like uslegalforms can simplify this process, allowing you to create an Idaho Acoustical Contractor Agreement - Self-Employed tailored to your needs.

Yes, an independent contractor is indeed considered self-employed. They manage their own schedules, set their rates, and often work for multiple clients simultaneously. When using an Idaho Acoustical Contractor Agreement - Self-Employed, you clarify your status and ensure you adhere to state regulations. This agreement helps both parties understand their rights and responsibilities.

When filling out an Idaho Acoustical Contractor Agreement - Self-Employed, it is essential to include all necessary details, such as contact information and project specifics. Clearly state payment amounts, due dates, and any terms related to revisions or additional work. Make sure both parties review and sign the agreement to ensure it is legally binding. You can rely on uslegalforms to provide templates that simplify this task.

To set up as a self-employed contractor in Idaho, begin by choosing your business structure, such as a sole proprietorship or LLC. Register your business with the appropriate state agencies and obtain any necessary licenses or permits. Familiarize yourself with tax obligations and consider drafting an Idaho Acoustical Contractor Agreement - Self-Employed to formalize your client relationships. Resources on uslegalforms can guide you through this setup process.

Filling out an independent contractor form for the Idaho Acoustical Contractor Agreement - Self-Employed involves providing your personal details, including your name, address, and tax identification number. Next, specify the services you will offer and indicate the payment structure. Ensure all sections are completed accurately to avoid potential legal issues. Using uslegalforms can streamline this process with accessible templates.

To write an Idaho Acoustical Contractor Agreement - Self-Employed, begin by outlining the scope of work. Clearly define the services you will provide, the payment terms, and the project timeline. Include clauses related to confidentiality and termination to protect both parties. You can use the uslegalforms platform to find templates and guidance tailored to your needs.

Independent contractors in Idaho must follow certain legal requirements, including tax obligations and proper licensing when necessary. An Idaho Acoustical Contractor Agreement - Self-Employed should detail the terms of the working relationship to protect both parties involved. It is essential to adhere to state and federal regulations concerning employment classification. For a more thorough understanding, USLegalForms offers resources that can help clarify these requirements.

Yes, independent contractors working in Idaho may need to obtain a business license, depending on their specific services. This requirement helps ensure compliance with local regulations. It is advisable to check with local authorities for specific criteria related to the Idaho Acoustical Contractor Agreement - Self-Employed. Consult USLegalForms for guidance on the licensing process and ensure your business operates legally.

To create an Idaho Acoustical Contractor Agreement - Self-Employed, start by clearly defining the scope of work, payment terms, and timelines. Specify both parties' responsibilities and include termination clauses to protect your interests. Consider using platforms like USLegalForms, which provide templates tailored to Idaho laws, making the process smoother. This ensures that your agreement meets all necessary legal criteria.