Wisconsin Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

It is possible to invest hours on-line looking for the legal record design that fits the state and federal demands you want. US Legal Forms supplies thousands of legal types that are evaluated by specialists. You can easily download or produce the Wisconsin Acquisition Due Diligence Report from our services.

If you already possess a US Legal Forms account, you are able to log in and then click the Download switch. Afterward, you are able to complete, revise, produce, or sign the Wisconsin Acquisition Due Diligence Report. Every legal record design you get is your own property forever. To get one more copy of the obtained kind, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms web site the first time, adhere to the easy directions under:

- First, make sure that you have chosen the best record design for the county/metropolis that you pick. Browse the kind description to ensure you have selected the proper kind. If readily available, use the Review switch to check from the record design too.

- If you wish to locate one more version from the kind, use the Look for discipline to discover the design that meets your needs and demands.

- When you have discovered the design you need, click on Purchase now to carry on.

- Pick the pricing strategy you need, key in your accreditations, and register for an account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal account to pay for the legal kind.

- Pick the structure from the record and download it for your gadget.

- Make alterations for your record if needed. It is possible to complete, revise and sign and produce Wisconsin Acquisition Due Diligence Report.

Download and produce thousands of record templates utilizing the US Legal Forms website, which offers the biggest assortment of legal types. Use skilled and status-specific templates to tackle your business or individual requires.

Form popularity

FAQ

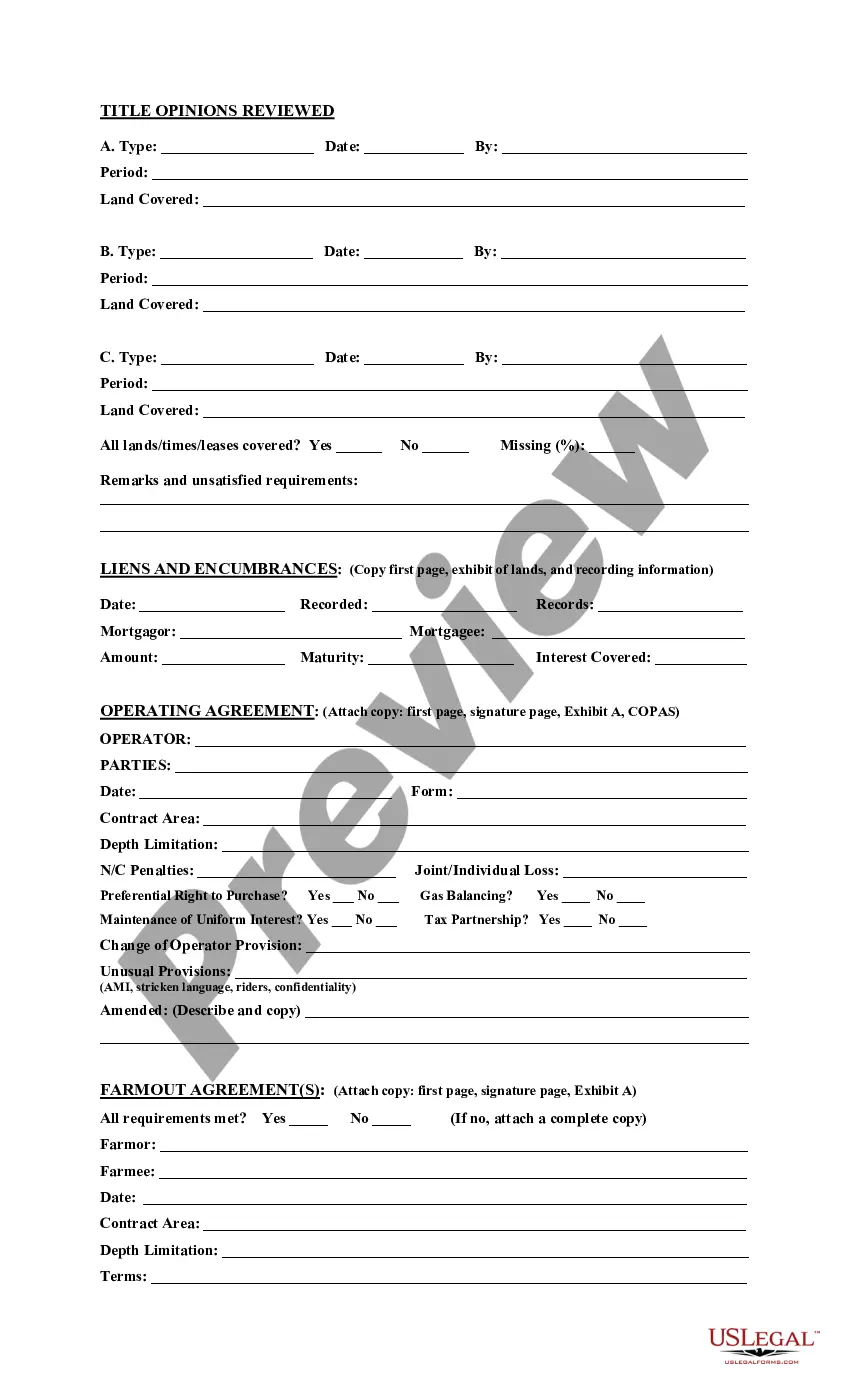

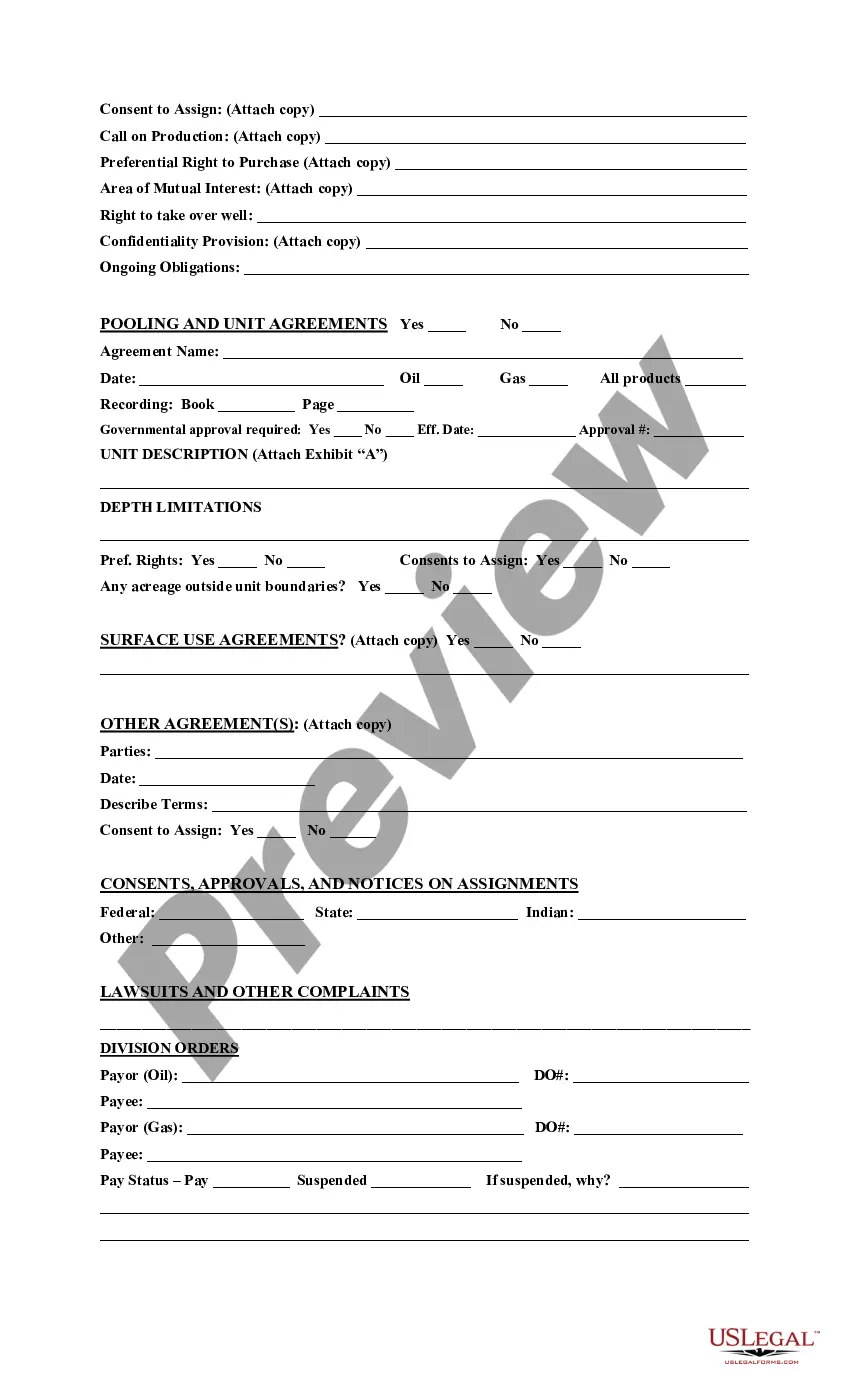

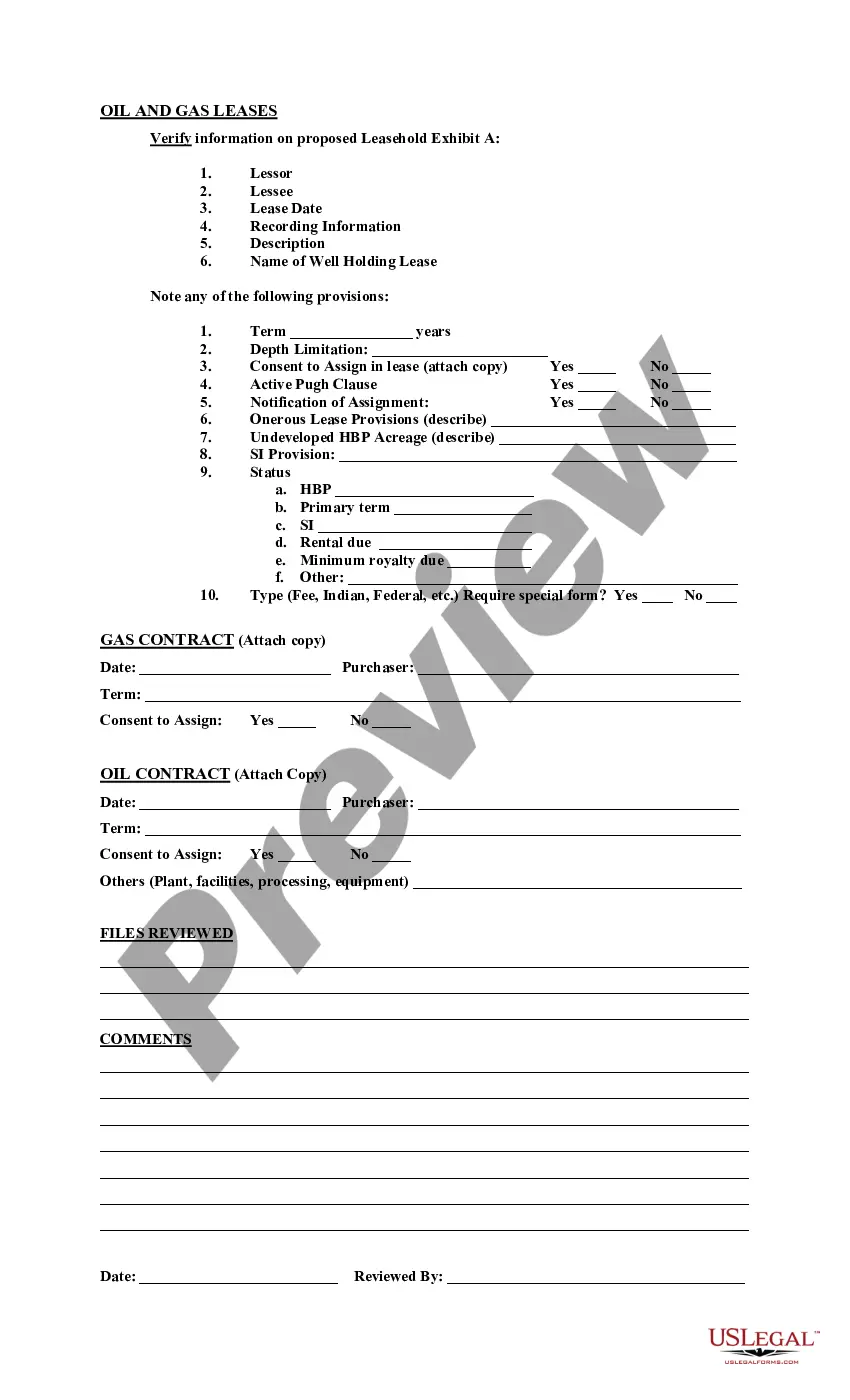

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Top due diligence questions every VC firm should be asking General company information. Detailed company activity. Contracts and commitments. Competitor information. Accounting and finance. Asset information. Employment information. Risk and compliance.

Financial due diligence checklist Balance sheets (past five years) showing company assets and liabilities. Cash flow statements (past five years) showing all cash inflows and cash outflows. Management discussions around financials, including meeting minutes and emails.

1. Company information. This should be the first bullet in your due diligence checklist because this information will provide you with insights into the business's decision-making processes, strategic direction, management style, priorities, labor relations, and potential issues. Who owns the company?

Areas to target for scrutiny in the due diligence checklist should include: Historical Financial Statements. ... Revenue and Expense Analysis. ... Assets and Liabilities Review. ... Taxation and Tax Compliance. ... Debt and Financing Agreements. ... Working Capital Analysis. ... Financial Projections and Assumptions. ... Cash Flow Analysis.

Technical Questions : What is your understanding of Financial Due Diligence? What are the main scopes of Financial Due Diligence? Explain broad differences in NPV and IRR. Given the WACC equation, a company should have 100% debt, because that is the point where the cost of capital will be minimized.