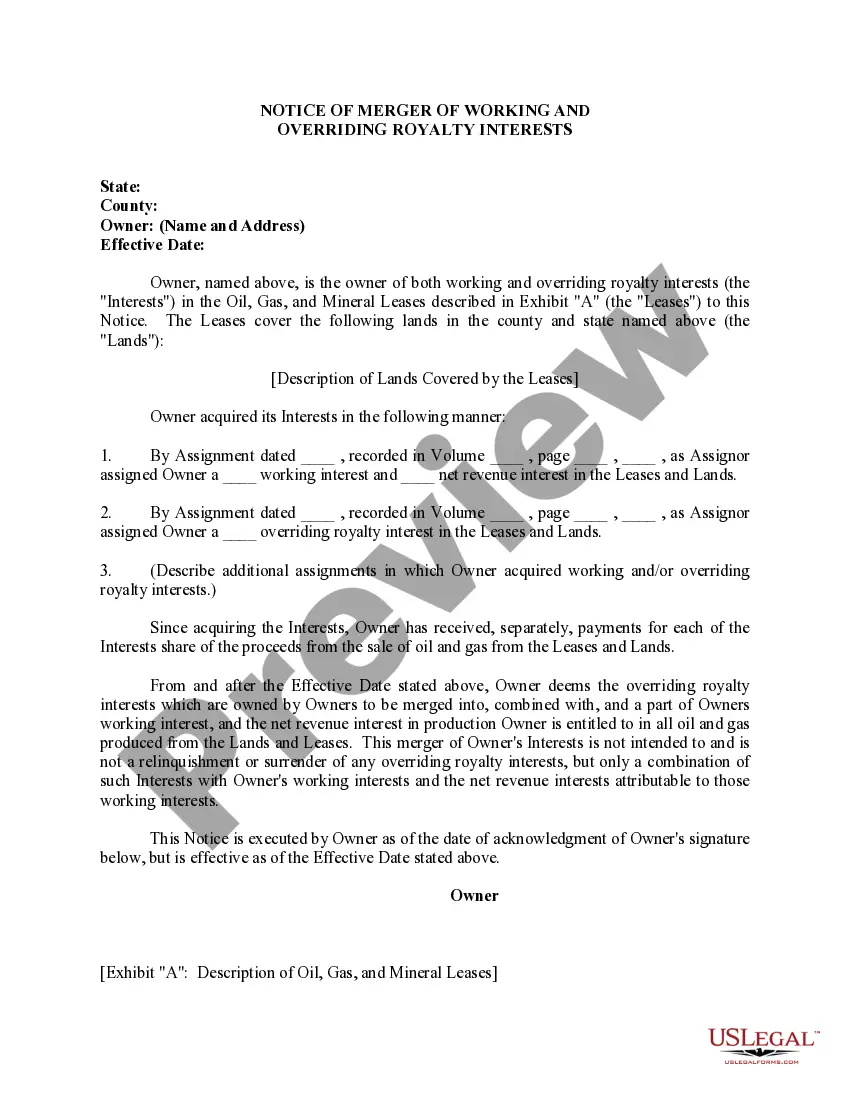

This form is used by the Owner to provide notice that the overriding royalty interests which are owned by Owners are to be merged into, combined with, and a part of Owners working interest, and the net revenue interest in production Owner is entitled to in all oil and gas produced from the Lands and Leases.

Wisconsin Notice of Merger of Working and Overriding Royalty Interests

Description

How to fill out Notice Of Merger Of Working And Overriding Royalty Interests?

US Legal Forms - one of many greatest libraries of lawful types in the United States - provides an array of lawful record themes it is possible to download or printing. Using the web site, you can get thousands of types for organization and specific reasons, categorized by categories, says, or keywords and phrases.You can find the latest models of types like the Wisconsin Notice of Merger of Working and Overriding Royalty Interests in seconds.

If you already have a monthly subscription, log in and download Wisconsin Notice of Merger of Working and Overriding Royalty Interests in the US Legal Forms library. The Obtain option can look on each form you perspective. You have access to all earlier saved types from the My Forms tab of your bank account.

If you wish to use US Legal Forms for the first time, listed here are easy instructions to help you started:

- Make sure you have selected the correct form to your city/county. Click the Preview option to review the form`s information. Look at the form description to ensure that you have chosen the proper form.

- When the form does not match your demands, make use of the Look for area towards the top of the monitor to obtain the one that does.

- Should you be content with the shape, validate your selection by visiting the Get now option. Then, pick the prices strategy you prefer and supply your references to register for the bank account.

- Method the financial transaction. Utilize your credit card or PayPal bank account to perform the financial transaction.

- Select the file format and download the shape on your own gadget.

- Make changes. Fill up, edit and printing and sign the saved Wisconsin Notice of Merger of Working and Overriding Royalty Interests.

Each template you included with your account lacks an expiry time and is also your own permanently. So, in order to download or printing yet another version, just go to the My Forms portion and click on in the form you will need.

Get access to the Wisconsin Notice of Merger of Working and Overriding Royalty Interests with US Legal Forms, probably the most comprehensive library of lawful record themes. Use thousands of expert and condition-particular themes that satisfy your business or specific needs and demands.

Form popularity

FAQ

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

The value of non-producing minerals is usually determined by a price per net acre multiplier. This represents how much of the land is owned, and how much of that acreage is valuable.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.