Wisconsin Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

Have you ever been in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of template designs, such as the Wisconsin Self-Employed Ceiling Installation Contract, that are designed to comply with federal and state regulations.

Once you find the right form, click Acquire now.

Select the pricing plan you want, enter the required information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You may obtain an additional copy of the Wisconsin Self-Employed Ceiling Installation Contract any time you wish. Just click on the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legal templates, to save time and avoid mistakes. The service offers properly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Self-Employed Ceiling Installation Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

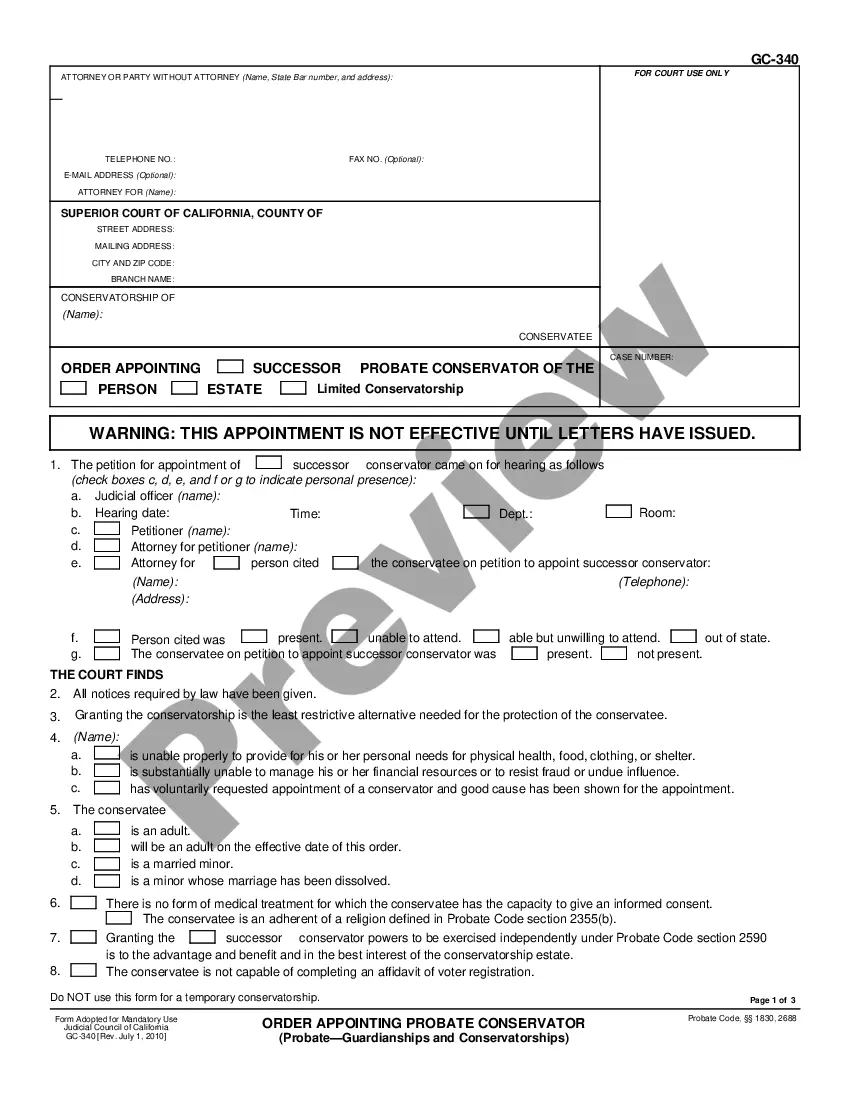

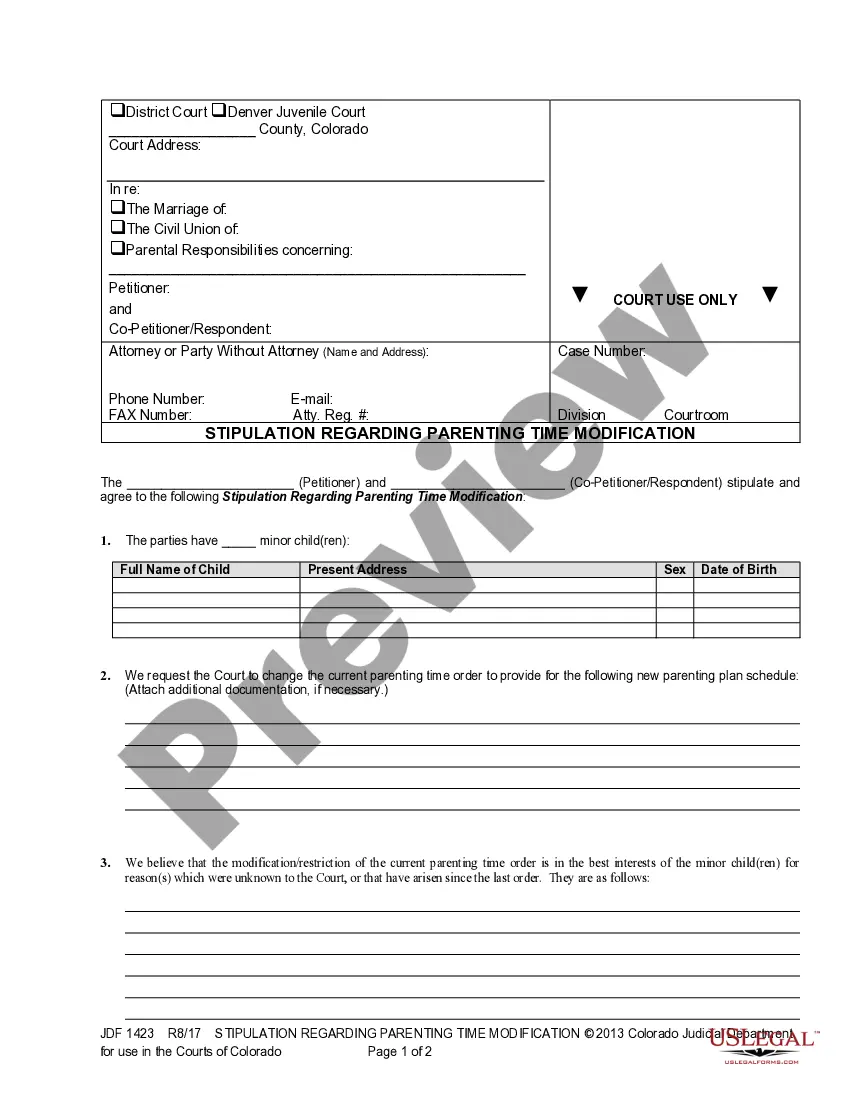

- Use the Review button to examine the form.

- Read the details to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

Yes, you can act as your own general contractor in Wisconsin. This approach allows you to manage your own projects, including those covered under a Wisconsin Self-Employed Ceiling Installation Contract. However, you must ensure that you comply with local building codes and obtain the necessary permits. Additionally, using platforms like US Legal Forms can help you find the right contract templates and legal resources to streamline your project.

Yes, Arkansas requires certain contractors to obtain a license before starting work. This requirement can vary based on the type and scope of the work. If you are considering expanding your business to include Wisconsin Self-Employed Ceiling Installation Contracts or other areas, it is crucial to understand the licensing requirements in each state. US Legal Forms can assist you in navigating these legal necessities.

A contractor is not required to have an LLC, but it can be beneficial. An LLC can provide protection against personal liability and may simplify tax reporting. For individuals taking on Wisconsin Self-Employed Ceiling Installation Contracts, an LLC can bolster your business's legitimacy and help you manage risks more effectively.

You do not necessarily need an LLC to operate as a contractor. However, forming an LLC can offer you certain legal protections and tax benefits. It is essential to consider how you want to structure your business, especially if you are planning to take on Wisconsin Self-Employed Ceiling Installation Contracts. Consulting with a professional can help clarify your options.

Choosing between forming an LLC or working as an independent contractor largely depends on your business goals. An LLC provides liability protection, separating your personal assets from your business debts. Additionally, having an LLC can enhance your credibility with clients. If you are engaging in Wisconsin Self-Employed Ceiling Installation Contracts, an LLC might be the more secure option.

Theft by contractors in Wisconsin occurs when a contractor unlawfully takes funds or property intended for a project. This can include misappropriating client payments or failing to provide the agreed-upon services. To protect yourself from such situations, using a Wisconsin Self-Employed Ceiling Installation Contract can establish clear expectations and reduce the risk of potential disputes.

Legal requirements for independent contractors vary by state, but generally, they must comply with tax regulations, maintain proper licenses, and adhere to safety standards. In Wisconsin, specific regulations govern ceiling installation work, making it essential to have a valid Wisconsin Self-Employed Ceiling Installation Contract. This contract helps ensure that you meet all necessary legal requirements while protecting your rights.

When you are your own contractor, it is often referred to as being a self-employed individual or an independent contractor. This status allows you to manage your projects, set your schedule, and make decisions about your work. In the realm of ceiling installation, a Wisconsin Self-Employed Ceiling Installation Contract is essential for outlining your responsibilities and rights.

The primary purpose of an independent contractor agreement is to define the scope of work and protect the interests of both parties. It clarifies expectations, payment terms, and deadlines, reducing the risk of disputes. For ceiling installers in Wisconsin, a Wisconsin Self-Employed Ceiling Installation Contract serves as a vital tool for establishing clear communication and accountability.

To terminate an independent contractor agreement, you must review the contract for termination clauses. Generally, providing notice in writing is essential, and depending on the agreement, it may require a specific notice period. If you need assistance navigating this process, consider utilizing resources like USLegalForms to find templates that guide you through the termination.