Wisconsin Freelance Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Freelance Writer Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the greatest libraries of legal types in the USA - offers a variety of legal file themes it is possible to obtain or printing. Using the website, you will get a huge number of types for enterprise and specific uses, sorted by categories, says, or keywords and phrases.You can get the latest types of types just like the Wisconsin Freelance Writer Agreement - Self-Employed Independent Contractor within minutes.

If you have a monthly subscription, log in and obtain Wisconsin Freelance Writer Agreement - Self-Employed Independent Contractor from your US Legal Forms catalogue. The Download switch will show up on each form you see. You gain access to all in the past saved types in the My Forms tab of the account.

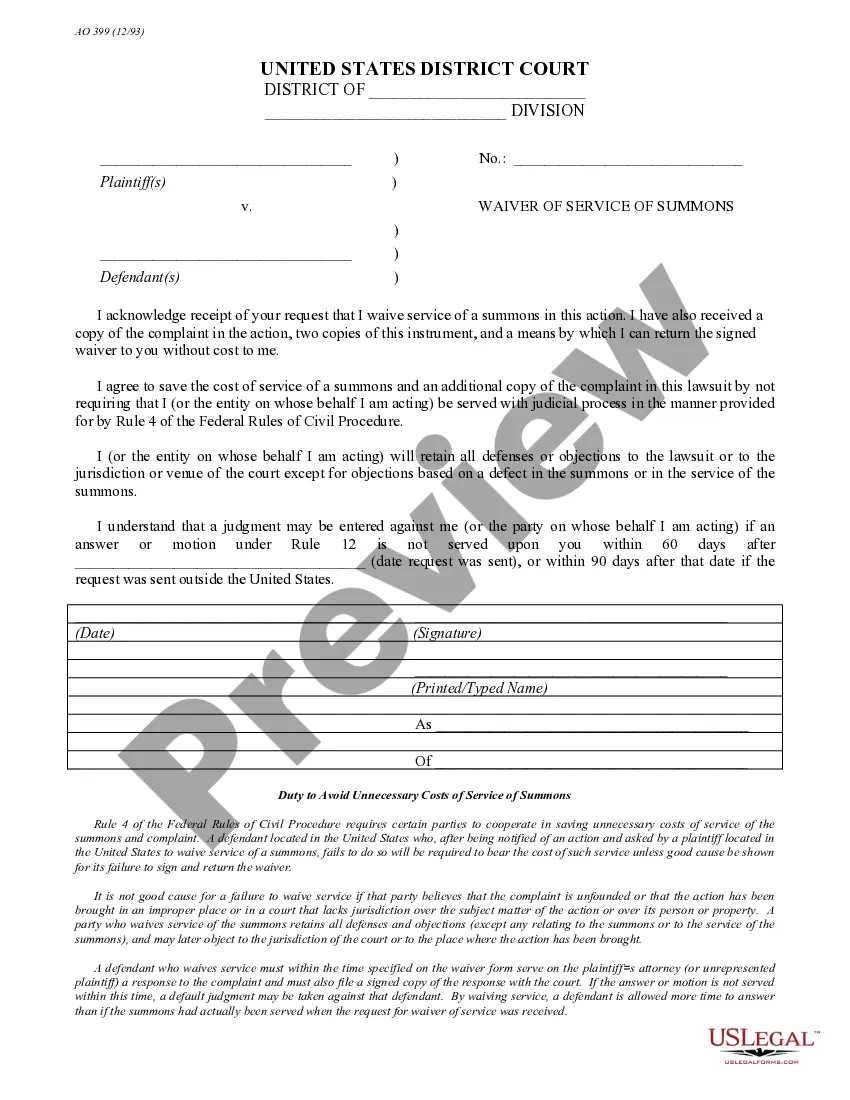

If you wish to use US Legal Forms for the first time, listed below are straightforward instructions to help you get started:

- Be sure you have chosen the best form to your town/area. Click the Review switch to analyze the form`s content. Read the form description to ensure that you have selected the proper form.

- If the form does not fit your requirements, utilize the Research discipline towards the top of the display screen to get the one which does.

- If you are content with the shape, validate your option by visiting the Get now switch. Then, choose the prices prepare you favor and give your qualifications to register on an account.

- Procedure the deal. Make use of your bank card or PayPal account to perform the deal.

- Find the formatting and obtain the shape on your system.

- Make alterations. Complete, revise and printing and indication the saved Wisconsin Freelance Writer Agreement - Self-Employed Independent Contractor.

Every single format you included with your account lacks an expiry date and it is your own permanently. So, if you wish to obtain or printing another version, just proceed to the My Forms section and then click around the form you will need.

Obtain access to the Wisconsin Freelance Writer Agreement - Self-Employed Independent Contractor with US Legal Forms, by far the most comprehensive catalogue of legal file themes. Use a huge number of skilled and status-particular themes that meet your small business or specific needs and requirements.

Form popularity

FAQ

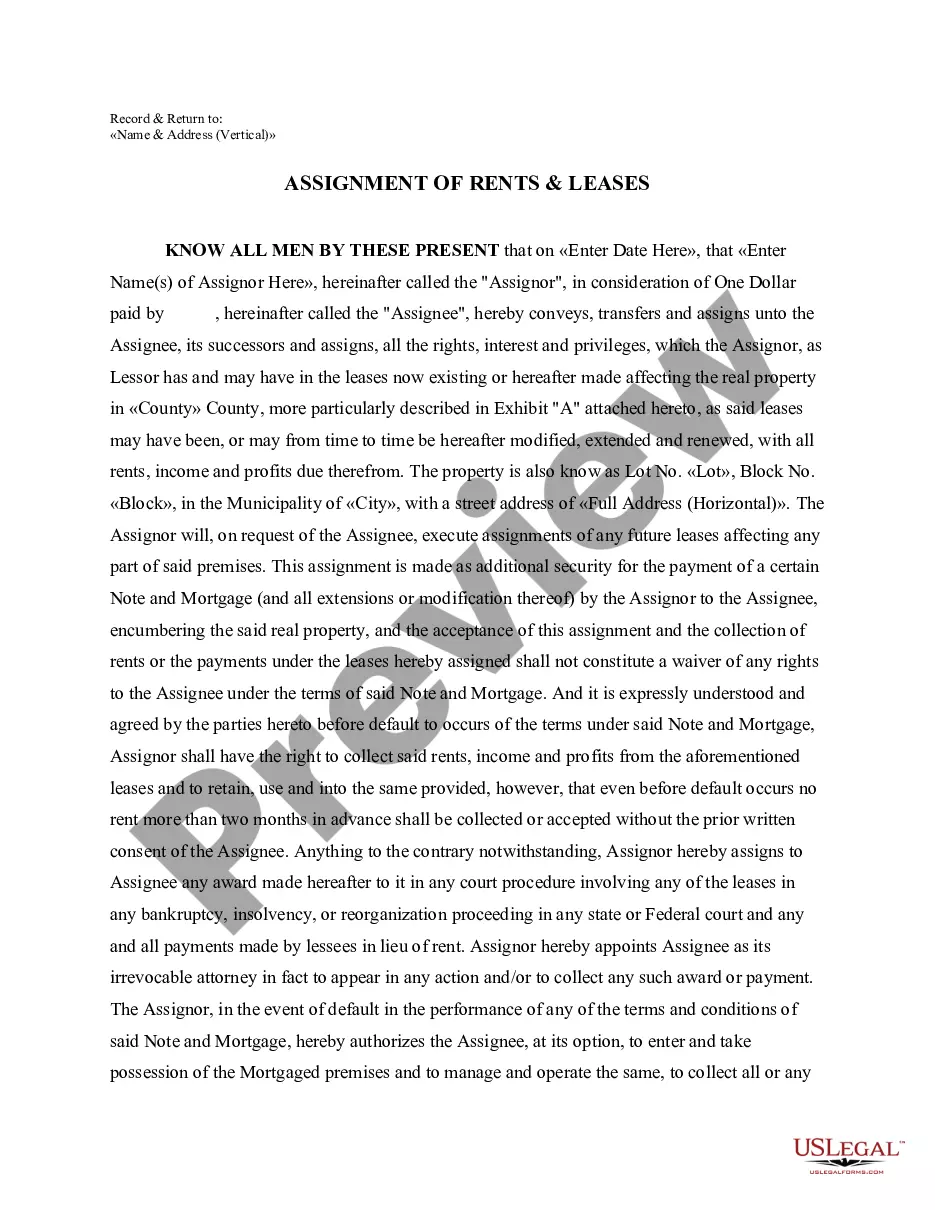

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

Copyright and the freelance writerCopyright protects original work and the exclusive right to publish it. This law applies to writing, music, painting, sculpture, games, graphic design, photographs, computer programs, and websites. In fact, any work which has a distinct and original form.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

The Internal Revenue Service considers freelancers to be self-employed, so if you earn income as a freelancer you must file your taxes as a business owner.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

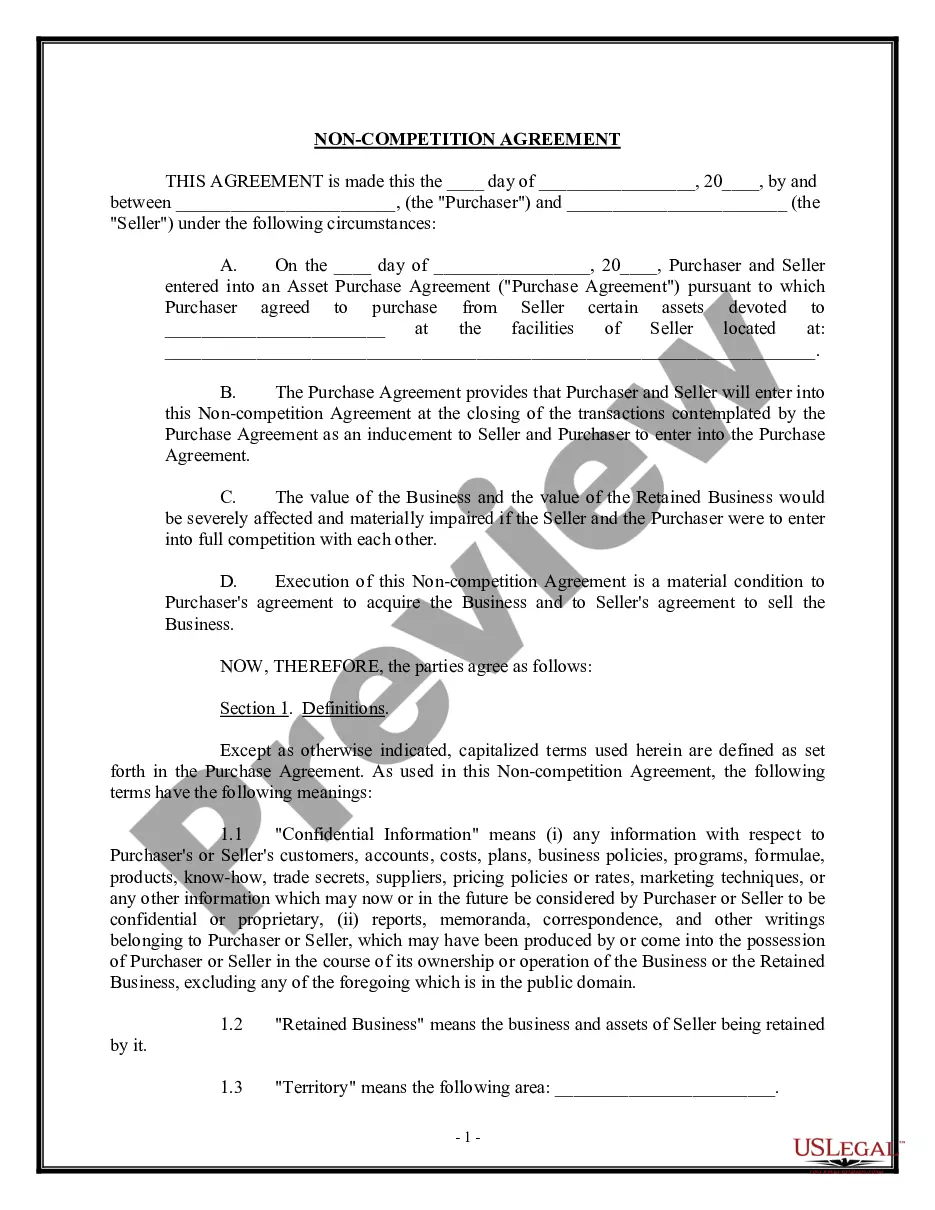

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.