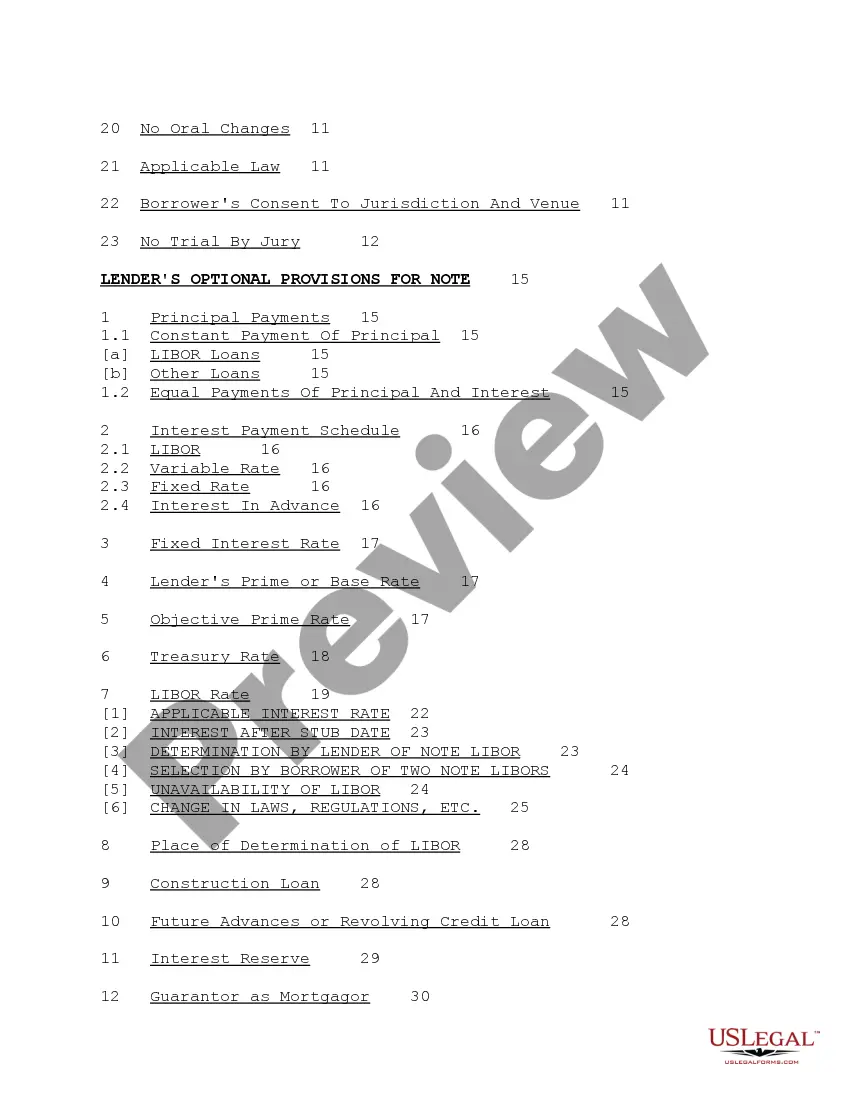

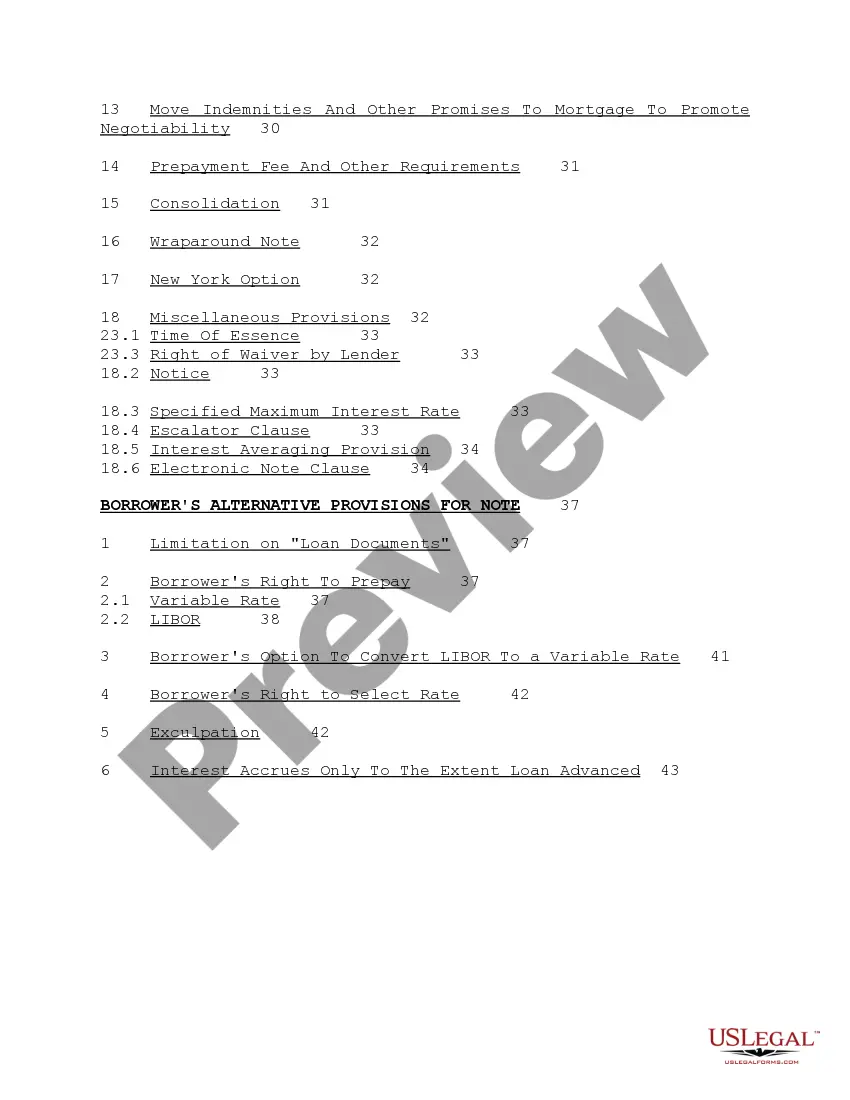

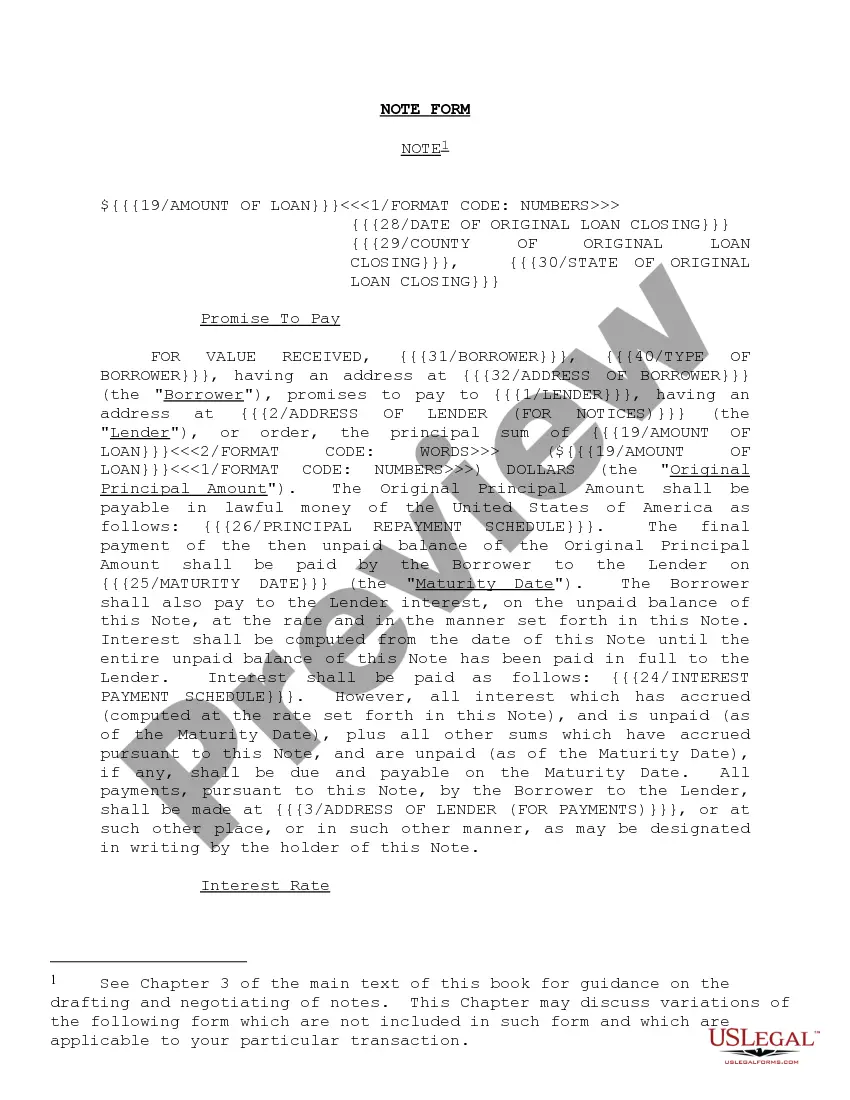

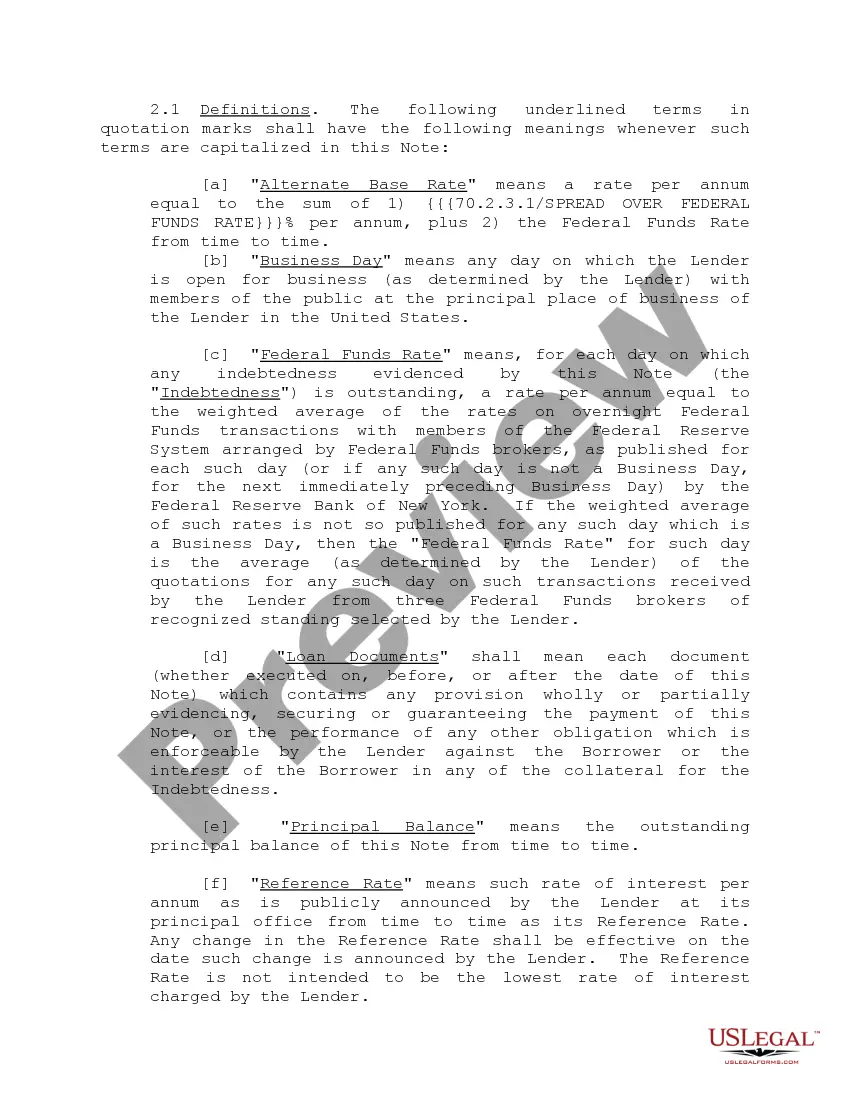

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

North Carolina Note Form and Variations

Description

How to fill out Note Form And Variations?

US Legal Forms - among the largest libraries of legitimate kinds in the States - offers a variety of legitimate document templates you can obtain or print. Making use of the internet site, you can get a large number of kinds for organization and individual uses, sorted by categories, states, or key phrases.You can find the latest types of kinds just like the North Carolina Note Form and Variations within minutes.

If you currently have a subscription, log in and obtain North Carolina Note Form and Variations from the US Legal Forms collection. The Acquire button can look on each and every type you look at. You get access to all previously downloaded kinds inside the My Forms tab of your account.

In order to use US Legal Forms initially, here are simple guidelines to help you started out:

- Be sure to have chosen the correct type for your personal area/state. Select the Review button to analyze the form`s articles. See the type information to ensure that you have selected the right type.

- When the type doesn`t match your needs, utilize the Search field on top of the screen to find the one that does.

- When you are content with the form, affirm your decision by clicking on the Purchase now button. Then, pick the rates prepare you prefer and supply your accreditations to sign up for an account.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal account to accomplish the deal.

- Choose the formatting and obtain the form on your product.

- Make modifications. Fill out, change and print and signal the downloaded North Carolina Note Form and Variations.

Each format you included with your money lacks an expiry time and is the one you have for a long time. So, in order to obtain or print another copy, just visit the My Forms portion and click on in the type you want.

Gain access to the North Carolina Note Form and Variations with US Legal Forms, one of the most substantial collection of legitimate document templates. Use a large number of specialist and status-certain templates that fulfill your business or individual demands and needs.