Wisconsin Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

Locating the appropriate authentic documents template can be somewhat challenging.

Clearly, there are numerous templates accessible online, but how do you discover the genuine form you require.

Utilize the US Legal Forms website. The service provides a vast selection of templates, including the Wisconsin Social Worker Agreement - Self-Employed Independent Contractor, which can be utilized for both business and personal needs.

If the form does not satisfy your needs, use the Search field to find the appropriate form. When you are confident that the form is suitable, click the Buy Now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Select the format and download the legal documents template to your device. Complete, edit, print, and sign the obtained Wisconsin Social Worker Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- All of the forms are vetted by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Wisconsin Social Worker Agreement - Self-Employed Independent Contractor.

- Use your account to search for the legal forms you may have purchased previously.

- Visit the My documents tab in your account and access another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can view the form using the Review button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

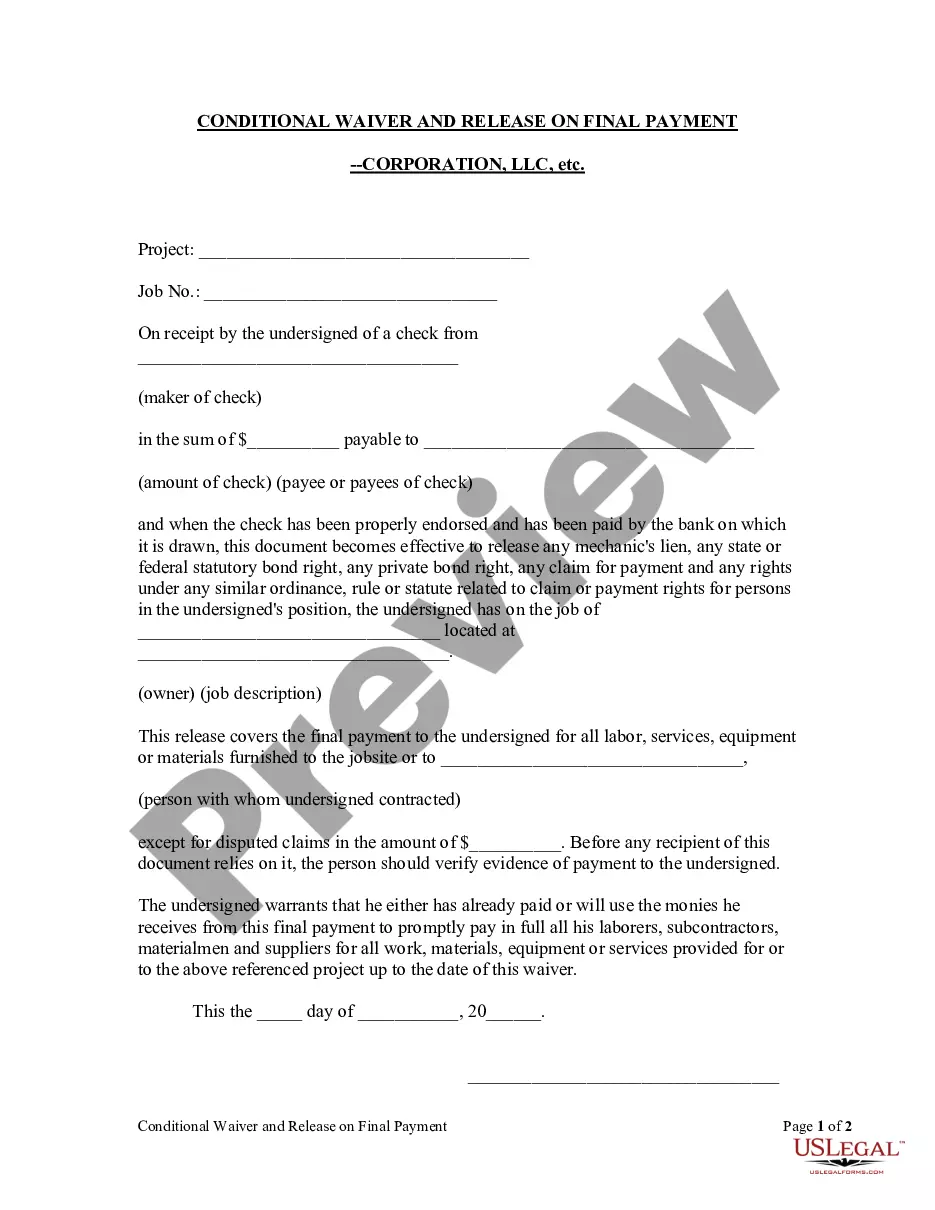

To write an effective independent contractor agreement, start by clearly outlining the terms of the relationship between you and the contractor. Include essential details such as the scope of work, payment terms, timeline, and confidentiality clauses. Make sure to specify that this is a Wisconsin Social Worker Agreement - Self-Employed Independent Contractor, as it defines the nature of the work and legal obligations. By using the US Legal Forms platform, you can access templates and resources that simplify this process, ensuring your agreement is thorough and compliant with state laws.

Filling out a Wisconsin Social Worker Agreement - Self-Employed Independent Contractor involves several key steps. Start by entering your personal information, such as your name and contact details, followed by the client’s information. Next, outline the services you will provide, specifying the terms of payment, deadlines, and any necessary conditions. Finally, ensure both parties review and sign the document to make it legally binding.

To establish yourself as a self-employed independent contractor in Wisconsin, begin by creating a formal business structure. You may choose to register your business name and obtain any necessary licenses or permits. Additionally, sign a Wisconsin Social Worker Agreement - Self-Employed Independent Contractor to outline your working relationships and obligations. Using a service like US Legal Forms can simplify this process, ensuring that you have all necessary documentation and compliance in place.

Creating an independent contractor agreement involves outlining the project requirements, payment terms, deadlines, and responsibilities clearly. You can draft this document yourself or use platforms like uslegalforms, which offer templates tailored for a Wisconsin Social Worker Agreement - Self-Employed Independent Contractor. Using a structured approach ensures all vital details are included, reducing the likelihood of disputes.

The independent contractor agreement in Wisconsin is a legally binding document that outlines the relationship between a contractor and client. This contract covers expectations, payment details, and project deliverables. A Wisconsin Social Worker Agreement - Self-Employed Independent Contractor is tailored specifically to social workers in Wisconsin, addressing unique needs and legal stipulations.

Breaking an independent contractor agreement can lead to various consequences, such as financial penalties or legal action. Clients may seek damages or terminate contracts based on the terms outlined in the document. It's crucial to understand the implications and to have a well-structured Wisconsin Social Worker Agreement - Self-Employed Independent Contractor to minimize risks and misunderstandings.

Legal requirements for independent contractors vary by state, including Wisconsin. Generally, independent contractors must comply with tax regulations, obtain necessary licenses, and adhere to specific contractual obligations. A comprehensive Wisconsin Social Worker Agreement - Self-Employed Independent Contractor can help you meet these legal requirements, ensuring protection for both parties.

The basic independent contractor agreement outlines the terms of engagement between a client and a self-employed independent contractor. This agreement specifies the scope of work, payment terms, deadlines, and responsibilities. For social workers in Wisconsin, a specific Wisconsin Social Worker Agreement - Self-Employed Independent Contractor defines these relationships, ensuring clarity and professionalism.