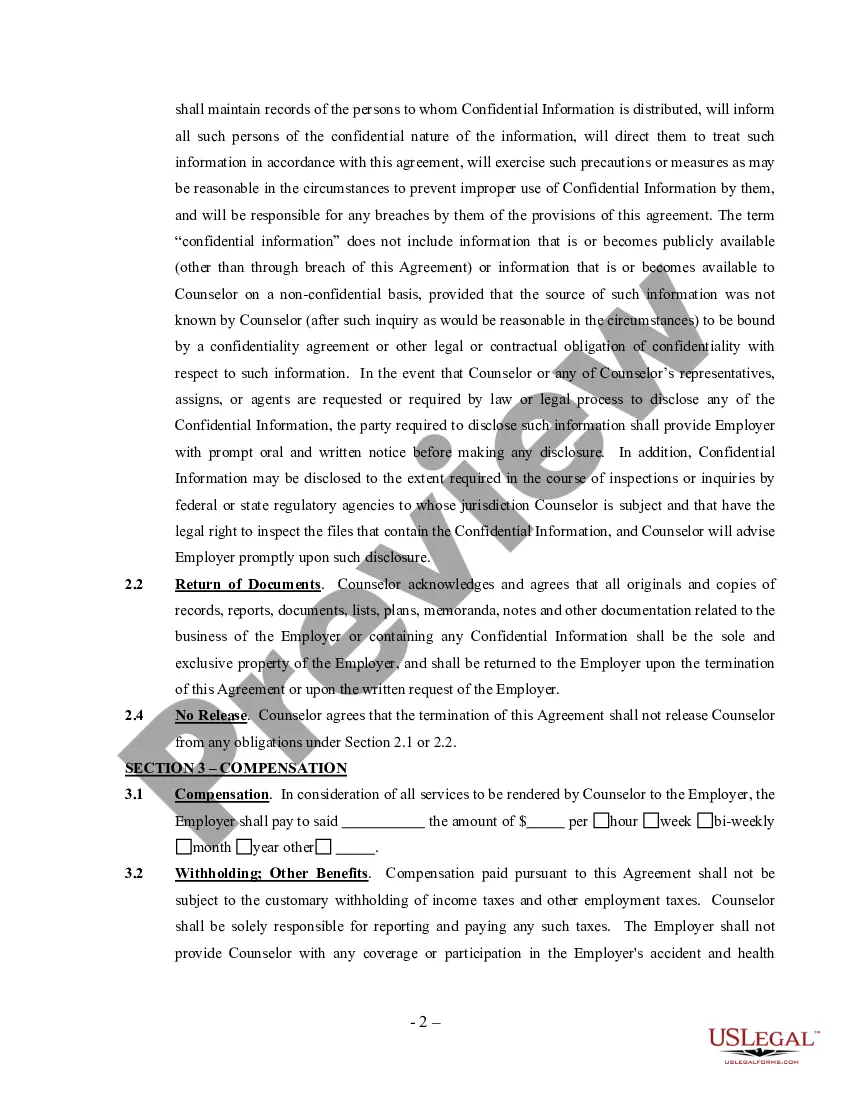

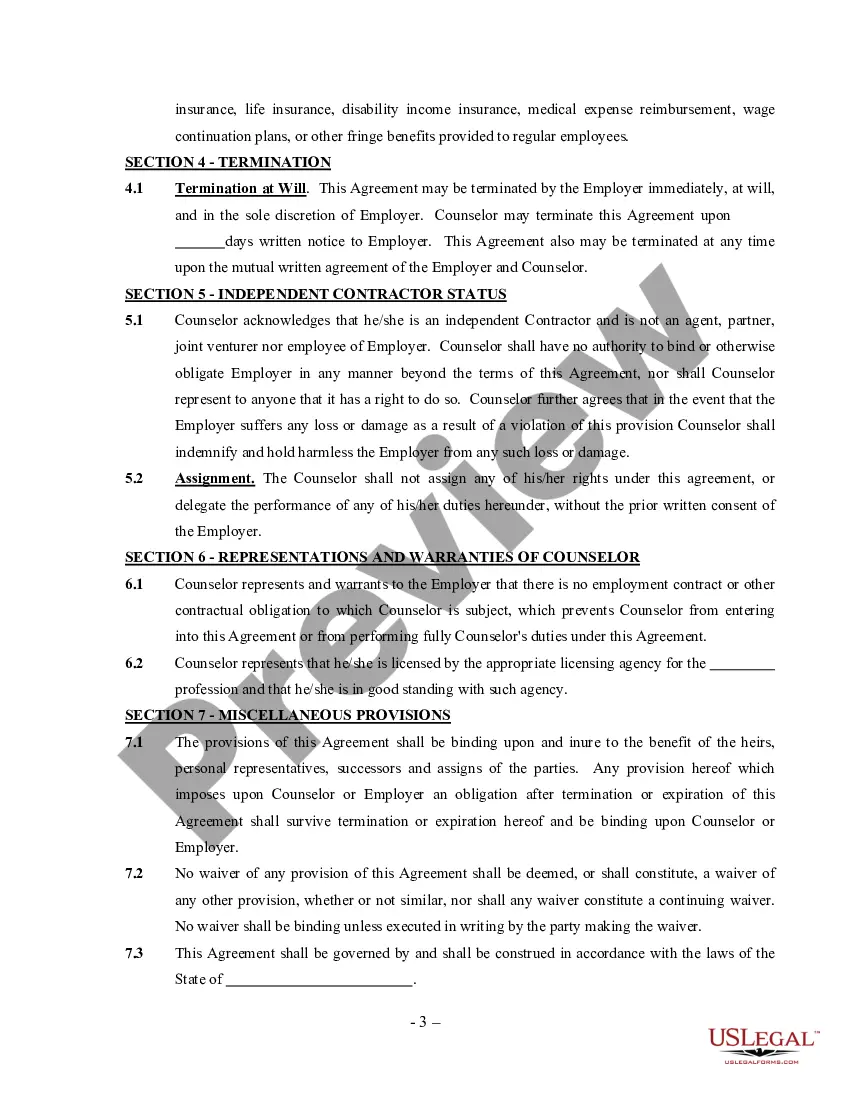

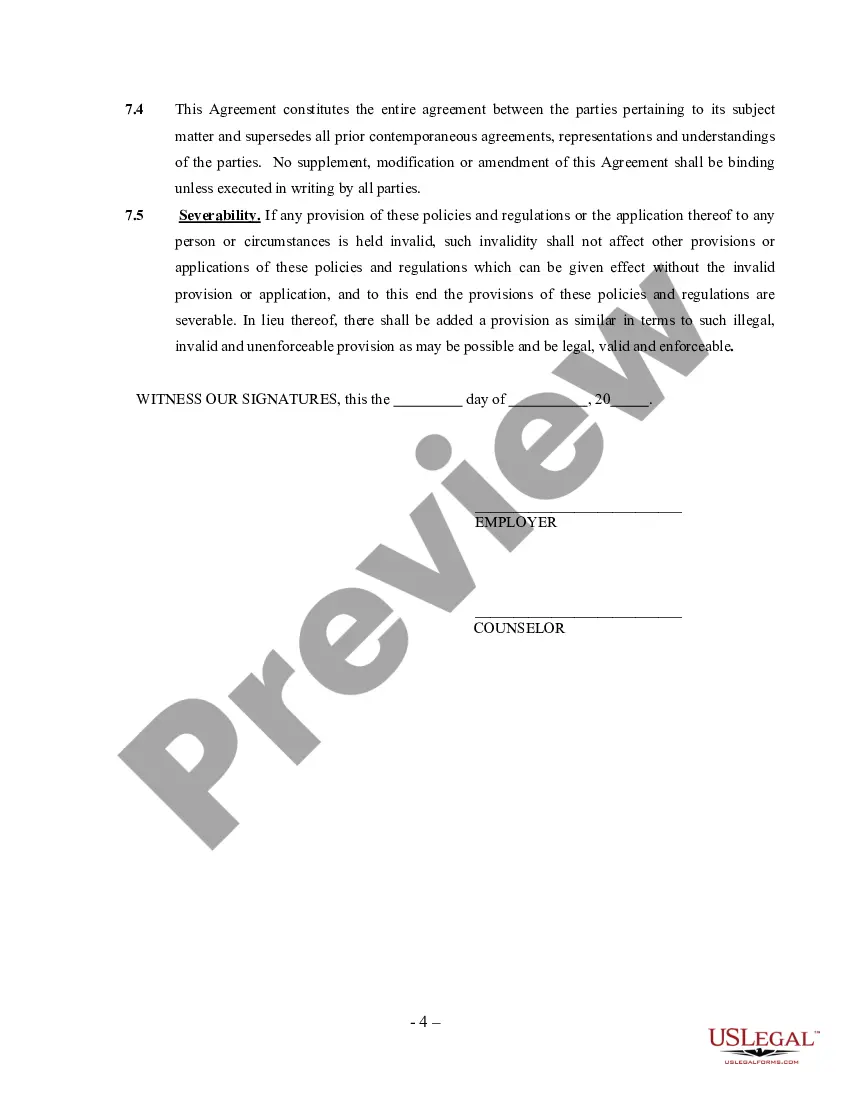

Wisconsin Counselor Agreement - Self-Employed Independent Contractor

Description

How to fill out Counselor Agreement - Self-Employed Independent Contractor?

If you have to full, obtain, or produce authorized file layouts, use US Legal Forms, the most important assortment of authorized kinds, which can be found on the web. Take advantage of the site`s easy and practical lookup to find the papers you require. A variety of layouts for company and specific uses are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to find the Wisconsin Counselor Agreement - Self-Employed Independent Contractor with a couple of mouse clicks.

When you are currently a US Legal Forms buyer, log in for your account and click the Acquire option to find the Wisconsin Counselor Agreement - Self-Employed Independent Contractor. You may also accessibility kinds you in the past saved in the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the proper area/country.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Don`t forget to see the description.

- Step 3. When you are not satisfied with all the form, take advantage of the Research industry towards the top of the monitor to find other models of your authorized form format.

- Step 4. Once you have identified the shape you require, go through the Buy now option. Select the prices strategy you prefer and put your references to register to have an account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to perform the purchase.

- Step 6. Select the formatting of your authorized form and obtain it on the product.

- Step 7. Full, change and produce or indicator the Wisconsin Counselor Agreement - Self-Employed Independent Contractor.

Every single authorized file format you buy is your own permanently. You possess acces to each form you saved inside your acccount. Go through the My Forms section and pick a form to produce or obtain yet again.

Compete and obtain, and produce the Wisconsin Counselor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of expert and status-certain kinds you may use for your company or specific requires.

Form popularity

FAQ

(225 ILCS 107/18) Sec. 18. LPCs can not be in independent practice. The LPC must practice at all times under the order, control, and full professional responsibility.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

Medicaid Billing Illinois has limited funds. LCPCs will be eligible under the Legislation passed 5/31/21 individually eligible to bill medicaid directly for client services. Many medicaid eligible SB2294 Clients who are in managed care systems that are managed by ILBCBS, Aetna, etc.

Every independent contractor agreement should feature an indemnity clause. The purpose of this clause is to ensure that the independent contractor will be held liable for any damage or injury resulting from the independent contractor's work performed under the contract.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

You'll use Form 8995-A if your taxable income is over a certain threshold. In all other cases, you'll use Form 8995. You should complete and attach your Form 8995 or Form 8995-A to your Form 1040. If you're filing for a tax year prior to tax year 2019, there is no form required.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.