Wisconsin Public Relations Agreement - Self-Employed Independent Contractor

Description

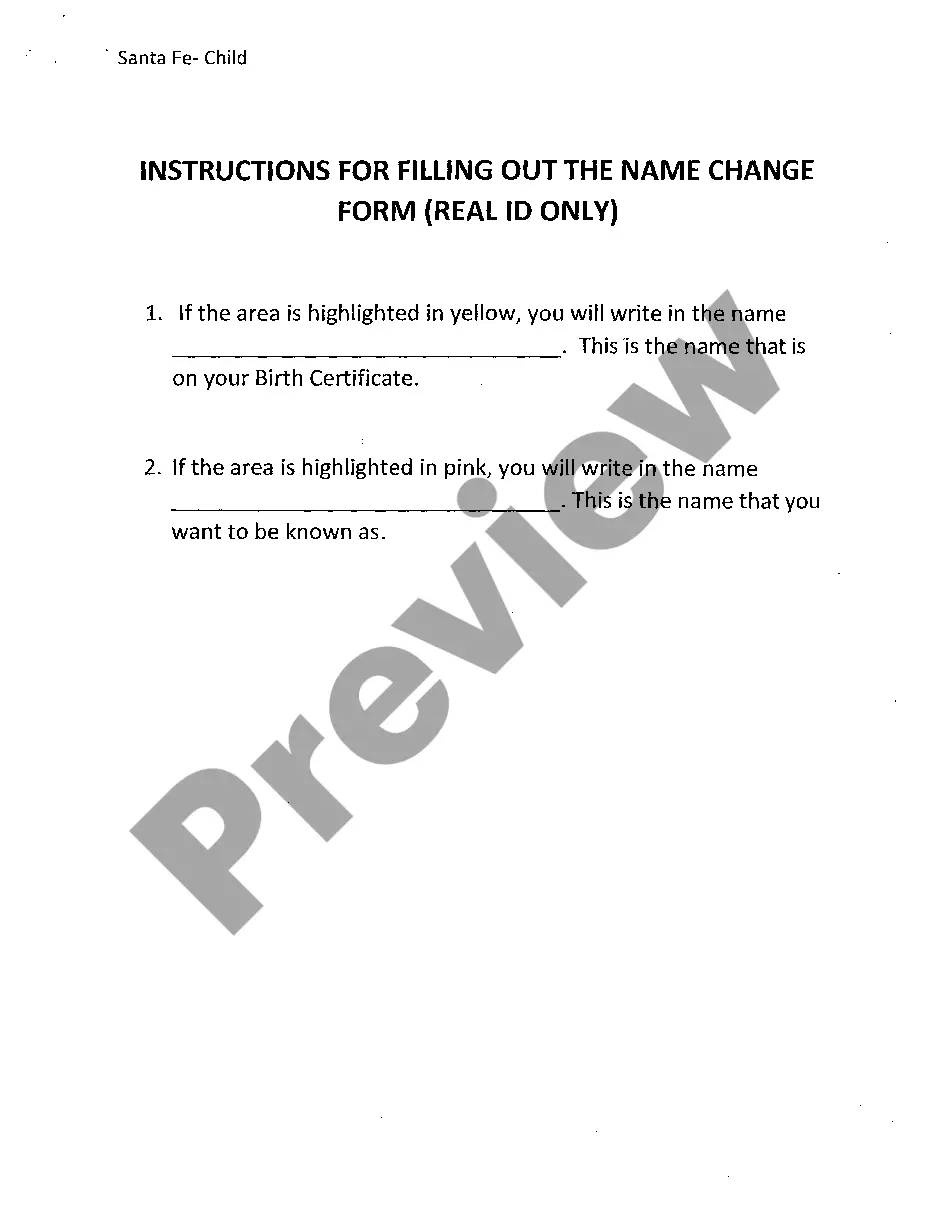

How to fill out Public Relations Agreement - Self-Employed Independent Contractor?

Locating the appropriate legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you find the legal form you need? Use the US Legal Forms website.

The service offers thousands of templates, including the Wisconsin Public Relations Agreement - Self-Employed Independent Contractor, that you can utilize for business and personal purposes. Each template is verified by experts and meets federal and state requirements.

Once you are confident that the form is suitable, click the Get now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Wisconsin Public Relations Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms from which you can find numerous document templates. Use the service to download professionally crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin Public Relations Agreement - Self-Employed Independent Contractor.

- Use your account to review the legal forms you have purchased previously.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the right form for your city/state. You can review the form using the Review button and examine the form details to confirm it is the correct one for you.

- If the form does not meet your needs, utilize the Search feature to find the appropriate form.

Form popularity

FAQ

The independent contractor agreement in Wisconsin is a legal document that governs the relationship between a contractor and a client within the state. It includes specific clauses related to payment, scope of work, and compliance with local regulations. To ensure compliance and clarity, consider using US Legal Forms to generate a customized Wisconsin Public Relations Agreement - Self-Employed Independent Contractor.

A basic independent contractor agreement outlines the mutual understanding between a contractor and a client regarding the services provided. It typically includes information on payment, project timelines, and responsibilities. Utilizing a template for a Wisconsin Public Relations Agreement - Self-Employed Independent Contractor can simplify the process of creating an effective agreement.

Independent contractors must meet specific legal requirements, including proper licensing and compliance with tax obligations. They should also have a written agreement outlining the terms of their work relationship. By using a well-structured Wisconsin Public Relations Agreement - Self-Employed Independent Contractor, you can ensure that all legal requirements are adequately addressed.

To create an independent contractor agreement, start by identifying the involved parties and their roles. Clearly outline the scope of work, payment terms, and deadlines. Using a reliable platform like US Legal Forms can help you generate a comprehensive Wisconsin Public Relations Agreement - Self-Employed Independent Contractor, ensuring all necessary legal aspects are covered.

Writing an independent contractor agreement involves clearly defining the roles and responsibilities of both parties. Begin with an introduction that specifies the parties involved, followed by detailed descriptions of services, compensation, and the duration of the contract. Remember to incorporate the essential elements outlined in a Wisconsin Public Relations Agreement - Self-Employed Independent Contractor. For ease, consider using uslegalforms for a structured and legally sound format.

To fill out an independent contractor agreement, start by providing your name and contact information, followed by the contractor's details. Next, outline the scope of services, payment terms, and deadlines. Finally, include any additional clauses that may pertain to your specific situation. Utilizing the Wisconsin Public Relations Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

A Wisconsin independent contractor agreement is a contract made between an employer conducting business in the state of Wisconsin and an independent worker who is not an employee of the company.