Wisconsin Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you obtain the legal form you require? Use the US Legal Forms website. This service offers thousands of templates, including the Wisconsin Account Executive Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal needs. All forms are reviewed by experts and meet federal and state requirements.

If you are already registered, Log In to your account and click on the Download option to get the Wisconsin Account Executive Agreement - Self-Employed Independent Contractor. Use your account to review the legal forms you have purchased previously. Go to the My documents tab of your account and obtain another copy of the document you need.

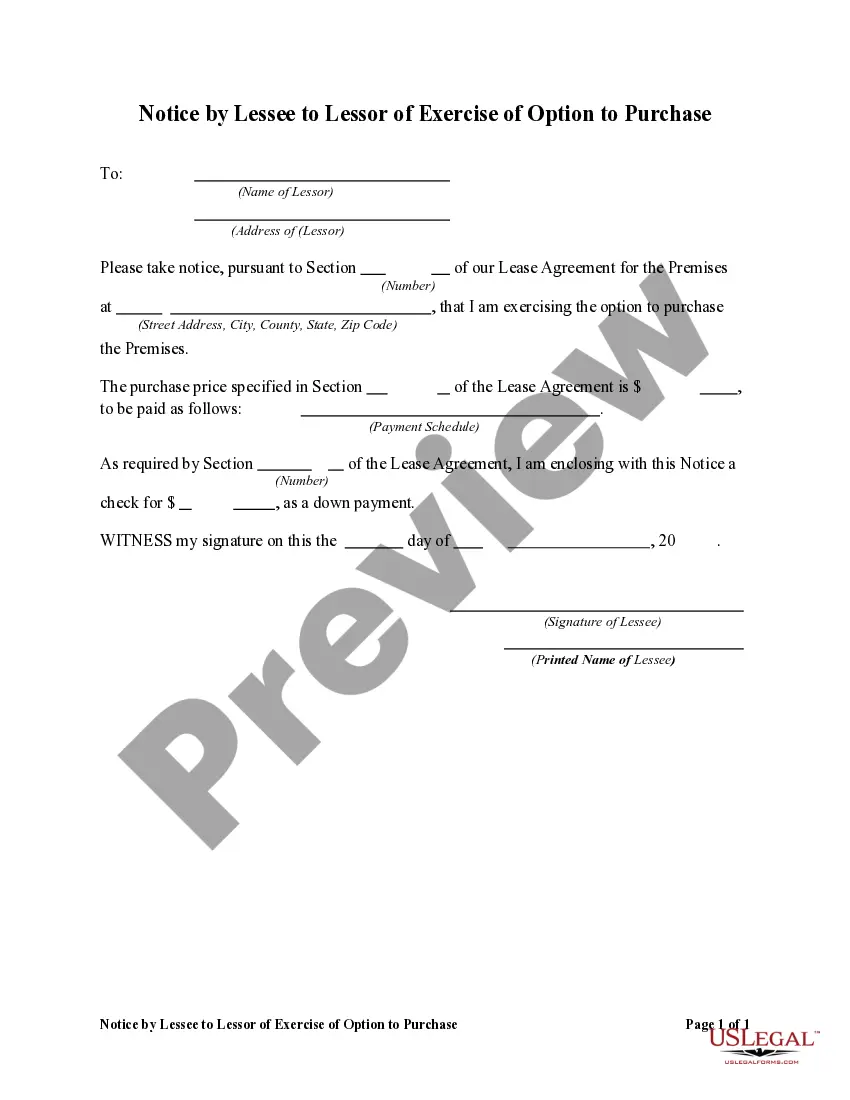

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your region/area. You can review the form using the Review option and check the form details to confirm this is indeed the right one for you. If the form does not meet your requirements, use the Search section to find the appropriate form. Once you are certain the form is suitable, click the Purchase now option to obtain the form. Select the payment plan you want and enter the necessary information. Create your account and pay for an order using your PayPal account or credit card. Choose the submission format and download the legal document template to your system. Fill out, modify, print, and sign the acquired Wisconsin Account Executive Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Use the service to download professionally-crafted documents that comply with state regulations.

- Ensure to review the form details carefully before making a purchase.

- Utilize the search feature effectively to find the exact legal form needed.

- Select appropriate payment methods for your transaction.

- Access your previous documents easily through your account.

Form popularity

FAQ

Creating a Wisconsin Account Executive Agreement - Self-Employed Independent Contractor can be straightforward. Start by outlining the scope of work, payment terms, and duration of the agreement. It’s important to include clauses that address confidentiality and termination to protect both parties. Consider using a platform like USLegalForms, which provides templates and guidelines to help you craft a thorough and legally sound agreement.

The new federal rule on independent contractors clarifies the classification criteria for workers. Under this rule, it is more important to assess the degree of control and independence a worker has in their role. A Wisconsin Account Executive Agreement - Self-Employed Independent Contractor should carefully reflect these conditions. Staying informed about these changes can help you maintain compliance and protect your business.

Legal requirements for independent contractors vary, but basic guidelines apply in Wisconsin. A Wisconsin Account Executive Agreement - Self-Employed Independent Contractor may need to address licensing, tax obligations, and insurance needs. It’s crucial to comply with local and federal laws to avoid penalties. Using a reliable platform like uslegalforms can assist you in ensuring your agreement covers all necessary legal aspects.

Yes, an independent contractor operates as a self-employed individual, which means they manage their own business and workload. Under a Wisconsin Account Executive Agreement - Self-Employed Independent Contractor, you set your hours and choose your projects. This independence is appealing for many who prefer flexibility in their careers. Remember, self-employment also means handling your taxes and business expenses.

A Wisconsin Account Executive Agreement - Self-Employed Independent Contractor establishes the working relationship between a company and an independent contractor. It outlines the terms of engagement, payment, and responsibilities. This type of agreement helps prevent misunderstandings and provides clarity for both parties. Using a well-drafted agreement can protect your interests and ensure compliance with state regulations.

When filling out an independent contractor agreement, start by entering the parties' information and defining the services to be provided. Be sure to include terms about payment, deadlines, and any legal requirements specific to Wisconsin. If you want a straightforward approach, consider using US Legal Forms for an easy-to-fill Wisconsin Account Executive Agreement - Self-Employed Independent Contractor template.

Filling out an independent contractor form involves providing your personal information, such as name, address, and tax identification number. Additionally, you need to details about the work being performed, payment rate, and duration of the engagement. Ensure you check the requirements for Wisconsin, as using the Wisconsin Account Executive Agreement - Self-Employed Independent Contractor template can guide you in the right direction.

To write an independent contractor agreement, start by clearly stating the names and contact information of both parties. Next, outline the scope of work, payment terms, and any deadlines or milestones. Utilizing a platform like US Legal Forms can simplify this process, providing templates tailored to the Wisconsin Account Executive Agreement - Self-Employed Independent Contractor.

The independent contractor agreement in Wisconsin outlines the relationship between a contractor and a business. This document specifies the terms of work, payment, and responsibilities, ensuring both parties understand their roles. It is essential for self-employed independent contractors to formalize their work agreements for legal protection and clarity.