Wisconsin Breeder Agreement - Self-Employed Independent Contractor

Description

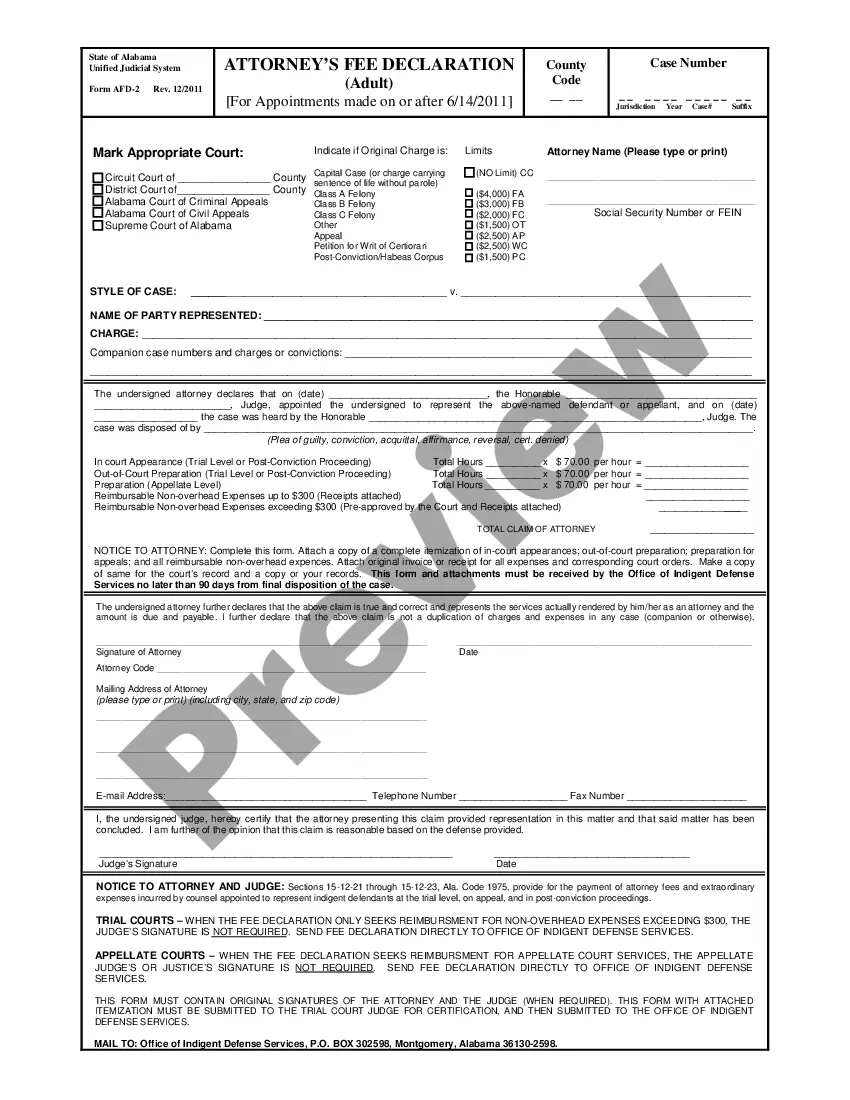

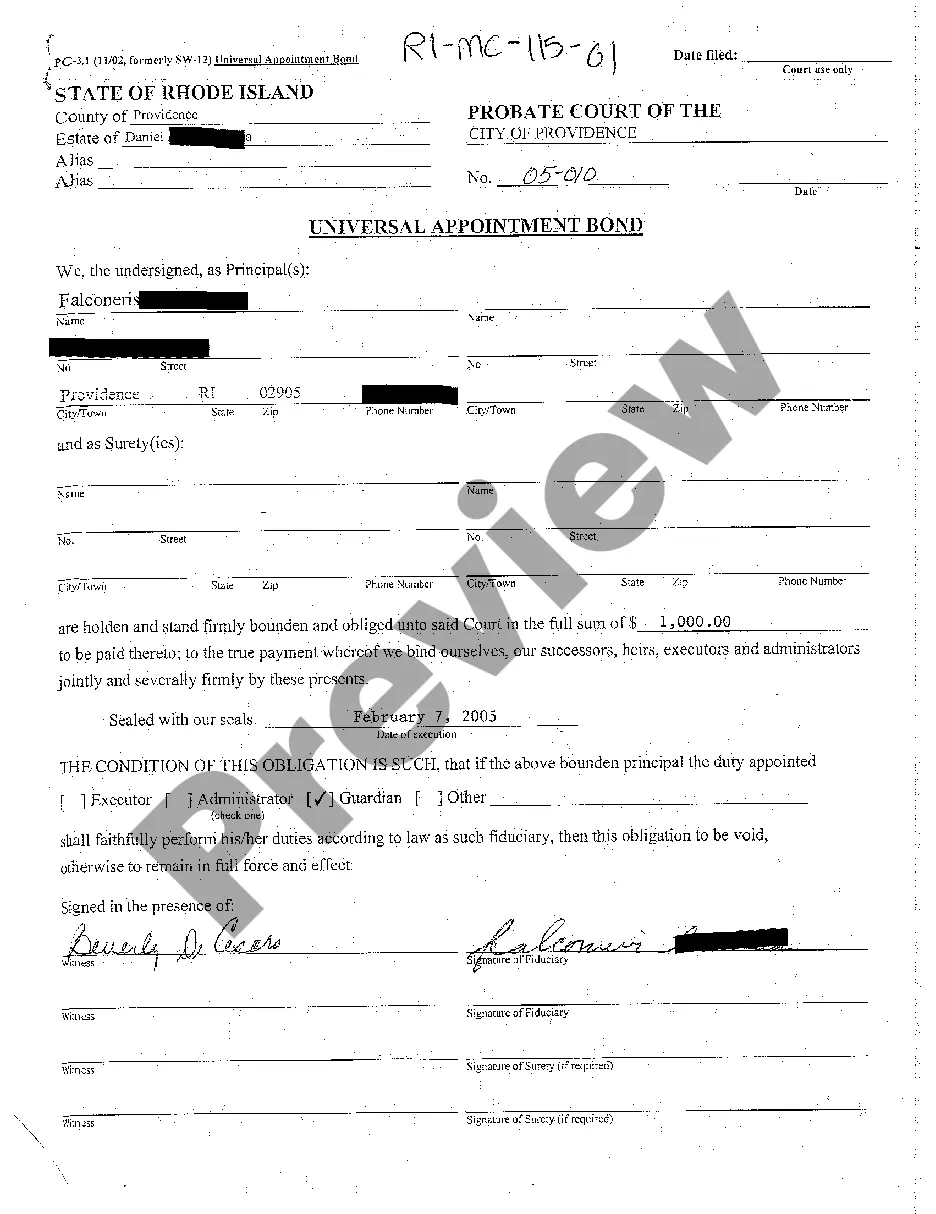

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

If you need to finalize, retrieve, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need. A variety of templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the Wisconsin Breeder Agreement - Self-Employed Independent Contractor with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Download button to locate the Wisconsin Breeder Agreement - Self-Employed Independent Contractor. You can also access forms you have previously acquired in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the appropriate city/state. Step 2. Use the Preview option to review the form's content. Don't forget to read the details. Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find other variations of the legal form template. Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Wisconsin Breeder Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire belongs to you indefinitely.

- You have access to every form you purchased in your account.

- Click the My documents section and select a form to print or download again.

- Stay competitive and download, and print the Wisconsin Breeder Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal requirements.

Form popularity

FAQ

Yes, dog breeding contracts can be enforceable if they meet certain legal criteria. The contract must clearly outline the terms of the breeding arrangement and be agreed upon by both parties. A well-crafted Wisconsin Breeder Agreement - Self-Employed Independent Contractor can provide the necessary legal framework to make your breeding contract enforceable and protect your business interests.

The legal requirements for independent contractors vary by state, but generally, contractors must operate their own business and set their own hours. They also need to adhere to tax obligations and maintain the proper licenses for their trade. It is essential to draft a Wisconsin Breeder Agreement - Self-Employed Independent Contractor that ensures compliance with local laws and protects both parties.

A basic independent contractor agreement outlines the working relationship between a contractor and a client. It details the specific services the contractor will provide, compensation terms, and the timeline for completion. If you seek clarity in your business dealings, a Wisconsin Breeder Agreement - Self-Employed Independent Contractor can help establish clear expectations and responsibilities.

To create an independent contractor agreement, start by clearly defining the terms of the relationship between the parties involved. This includes outlining the scope of work, payment terms, and deadlines. It's important to specify that this is a Wisconsin Breeder Agreement - Self-Employed Independent Contractor to ensure legal clarity. Additionally, consider using a platform like US Legal Forms, which offers templates to help streamline the process and ensure compliance with state regulations.

In Wisconsin, you generally need a license to breed dogs when you operate as a commercial breeder. A Wisconsin Breeder Agreement - Self-Employed Independent Contractor outlines your responsibilities and legal obligations. It is crucial to comply with local regulations to avoid potential penalties. Consulting a legal platform like US Legal Forms can help you navigate the licensing process and ensure you meet all necessary requirements.

Filling out an independent contractor form involves providing accurate details about yourself and the services you offer. Ensure you include your legal name, contact information, and the specifics of the agreement. By utilizing a Wisconsin Breeder Agreement - Self-Employed Independent Contractor, you can easily structure this form to meet legal requirements while protecting your business.

An independent contractor agreement in Wisconsin is a legal document that outlines the relationship between a contractor and a client. This document includes terms of service, payment details, and project specifications. For those in the breeding industry, a Wisconsin Breeder Agreement - Self-Employed Independent Contractor is vital for ensuring compliance and safeguarding your interests.

Writing an independent contractor agreement begins with a clear structure. Start with the title, followed by an introductory section explaining the relationship. Include a detailed description of services, payment terms, and any obligations. By crafting a Wisconsin Breeder Agreement - Self-Employed Independent Contractor, you can protect both parties and clarify expectations.

To fill out an independent contractor agreement effectively, first, gather all necessary information such as names, contact details, and services provided. Make sure to incorporate essential clauses such as payment terms, project deadlines, and termination conditions. If you focus on a Wisconsin Breeder Agreement - Self-Employed Independent Contractor, ensure you include specific provisions relevant to breeders and comply with state laws.