Wisconsin Herd Health Specialist Agreement - Self-Employed Independent Contractor

Description

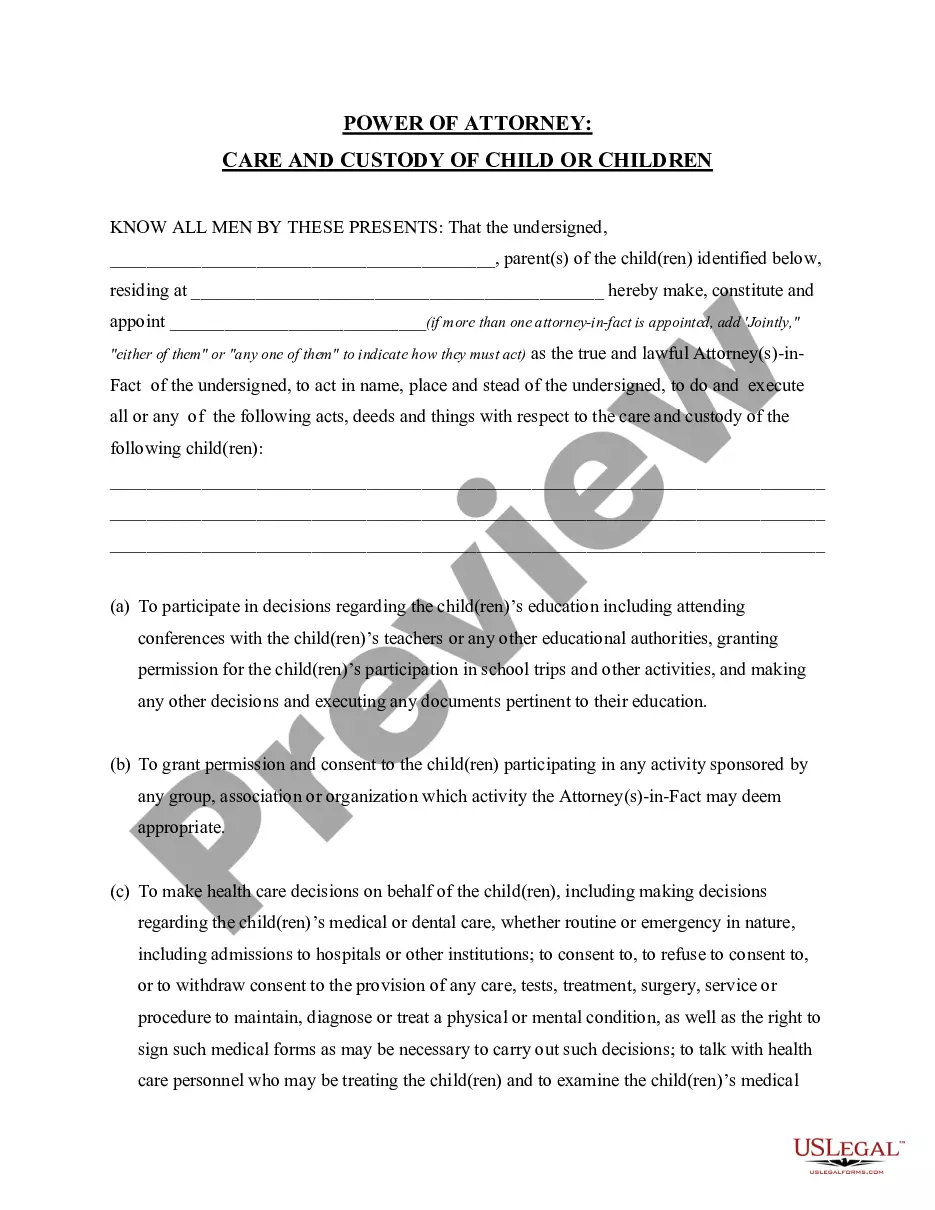

How to fill out Herd Health Specialist Agreement - Self-Employed Independent Contractor?

If you want to total, download, or print lawful file web templates, use US Legal Forms, the largest collection of lawful forms, which can be found online. Make use of the site`s simple and easy practical look for to obtain the papers you want. Different web templates for company and specific functions are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the Wisconsin Herd Health Specialist Agreement - Self-Employed Independent Contractor with a few click throughs.

Should you be previously a US Legal Forms client, log in to the accounts and click the Obtain button to find the Wisconsin Herd Health Specialist Agreement - Self-Employed Independent Contractor. You may also entry forms you formerly downloaded in the My Forms tab of your respective accounts.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape to the right metropolis/land.

- Step 2. Use the Review choice to check out the form`s articles. Do not neglect to see the outline.

- Step 3. Should you be unsatisfied together with the kind, make use of the Research field towards the top of the screen to discover other variations in the lawful kind design.

- Step 4. After you have found the shape you want, click on the Acquire now button. Pick the pricing plan you favor and add your references to sign up for an accounts.

- Step 5. Process the purchase. You may use your bank card or PayPal accounts to complete the purchase.

- Step 6. Pick the file format in the lawful kind and download it in your gadget.

- Step 7. Full, revise and print or indicator the Wisconsin Herd Health Specialist Agreement - Self-Employed Independent Contractor.

Each lawful file design you get is your own eternally. You have acces to every single kind you downloaded in your acccount. Go through the My Forms area and select a kind to print or download again.

Contend and download, and print the Wisconsin Herd Health Specialist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of skilled and express-distinct forms you can use for your personal company or specific needs.

Form popularity

FAQ

To be eligible for PUA, you must be unemployed, partially unemployed, or unable or unavailable to work due to one of the COVID-19 related reasons listed below: You have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 and are seeking a medical diagnosis.

Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

Employees are covered by the unemployment insurance law; independent contractors are not covered. If a worker is or has been "performing services for pay" for an employing unit, there is a presumption in the law that the worker is an "employee," not an independent contractor.

If there's a contract of service, meaning the payer controls what type of work you do and how it should be done, you have an employer-employee relationship. If there's a contract for service, meaning the payer can control only the outcome of the work, you're an independent contractor for the payer.

A Wisconsin independent contractor agreement is a contract made between an employer conducting business in the state of Wisconsin and an independent worker who is not an employee of the company.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

WEEKLY BENEFIT RATEIf you are self- employed, your WBR will be based on your net earnings from self-employment. The PUA WBR will not be lower than 50% of the average payment for a full week of regular UI benefits and will not exceed the current maximum UI WBR. The minimum PUA WBR is $163. The maximum PUA WBR is $370.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.