Wisconsin Modeling Services Contract - Self-Employed

Description

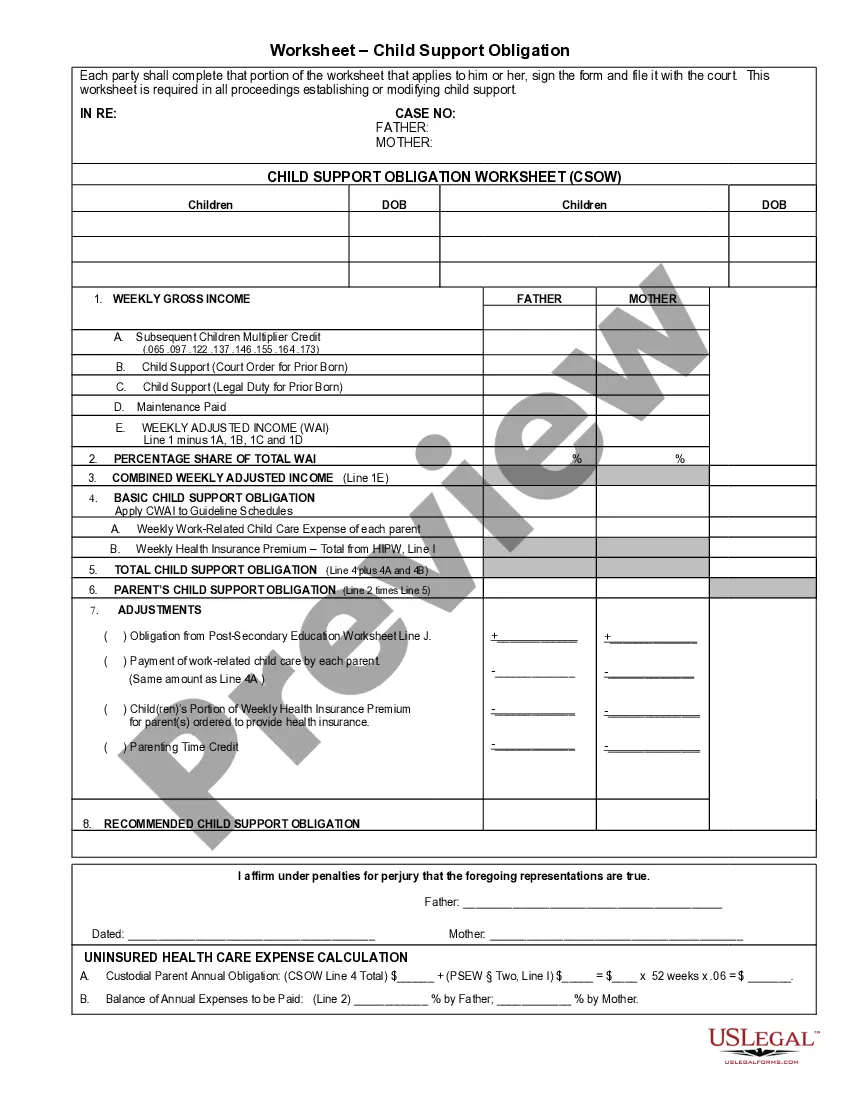

How to fill out Modeling Services Contract - Self-Employed?

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest repository of legal forms available online. Take advantage of the site’s straightforward and user-friendly search to find the documents you require. Various templates for commercial and personal use are categorized by types and regions, or keywords.

Employ US Legal Forms to acquire the Wisconsin Modeling Services Contract - Self-Employed in just a few clicks. If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Wisconsin Modeling Services Contract - Self-Employed. You can also access forms you have previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Make sure you have selected the form for the correct city/state. Step 2. Utilize the Preview option to review the form's content. Be sure to read the description. Step 3. If you are dissatisfied with the form, use the Search section at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account. Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Wisconsin Modeling Services Contract - Self-Employed.

- Every legal document template you obtain is yours permanently.

- You will have access to every form you downloaded in your account.

- Visit the My documents section and select a form to print or download again.

- Compete and acquire, and print the Wisconsin Modeling Services Contract - Self-Employed with US Legal Forms.

- There are millions of professional and state-specific forms you can utilize for your business or personal purposes.

Form popularity

FAQ

Independent contractors in Wisconsin are responsible for reporting their income and paying self-employment taxes. This often includes federal income tax, state income tax, and self-employment tax. It’s crucial to understand these obligations to avoid penalties. A well-drafted Wisconsin Modeling Services Contract - Self-Employed often includes provisions that clarify payment terms related to taxes, making compliance easier for you.

A basic independent contractor agreement typically includes critical components such as the project description, payment terms, and confidentiality clauses. It serves as a foundational document to establish the business relationship between the contractor and the hiring entity. Utilizing a Wisconsin Modeling Services Contract - Self-Employed can simplify your contracting process and ensure that all essential details are covered.

Legal requirements for independent contractors in Wisconsin include proper business registration and compliance with tax regulations. They must also adhere to any relevant federal and state laws that apply to their specific type of work. Using a Wisconsin Modeling Services Contract - Self-Employed provides a solid foundation for these legal requirements and can help avoid misunderstandings about roles and responsibilities.

An independent contractor agreement in Wisconsin outlines the terms and conditions between a business and a self-employed worker. This contract clarifies the expectations for services rendered, payment terms, and responsibilities of both parties. With a Wisconsin Modeling Services Contract - Self-Employed, you can ensure legal protection and clarity about project scope, working hours, and deliverables.

To write a contract for a 1099 employee, make sure to include the scope of work, payment details, and the duration of the engagement. It’s important to classify them correctly and specify that they are not employees, especially in the context of a Wisconsin Modeling Services Contract - Self-Employed. A well-crafted contract ensures both parties are aware of their rights and responsibilities.

Writing a self-employment contract requires clarity on the nature of services, payment frequencies, and the start and end dates of the contract. Include any clauses that might be relevant to both you and your client, particularly if you are drafting a Wisconsin Modeling Services Contract - Self-Employed. This will help you create a legally sound agreement.

To write a model contract, begin by outlining the specific services you will offer and the compensation structure. It's crucial to include any terms specific to your industry, especially in a Wisconsin Modeling Services Contract - Self-Employed. By being thorough, you can reduce misunderstandings and ensure a smooth working relationship.

Writing a self-employed contract involves detailing the services you provide, payment terms, and duration of work. Make sure to specify the rights and obligations of both parties, especially if you are drafting a Wisconsin Modeling Services Contract - Self-Employed. Utilizing clear language will help both you and your clients understand the agreement.

To prove you are self-employed, collect documents such as your business registration, tax returns, and invoices. Additionally, a Wisconsin Modeling Services Contract - Self-Employed can serve as evidence of your business relationship with clients. Keeping organized records will not only aid in proving your status but also assist in managing your finances.

Yes, you can create your own legally binding contract, including a Wisconsin Modeling Services Contract - Self-Employed. To ensure validity, include clear terms, the signatures of both parties, and date the contract. Consider using templates from reliable sources, like US Legal Forms, to guide you in creating a comprehensive agreement.