Wisconsin Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of template forms, including the Wisconsin Auditor Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Wisconsin Auditor Agreement - Self-Employed Independent Contractor at any time, if desired. Just select the necessary form to download or print the document template. Utilize US Legal Forms, one of the largest selections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Auditor Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

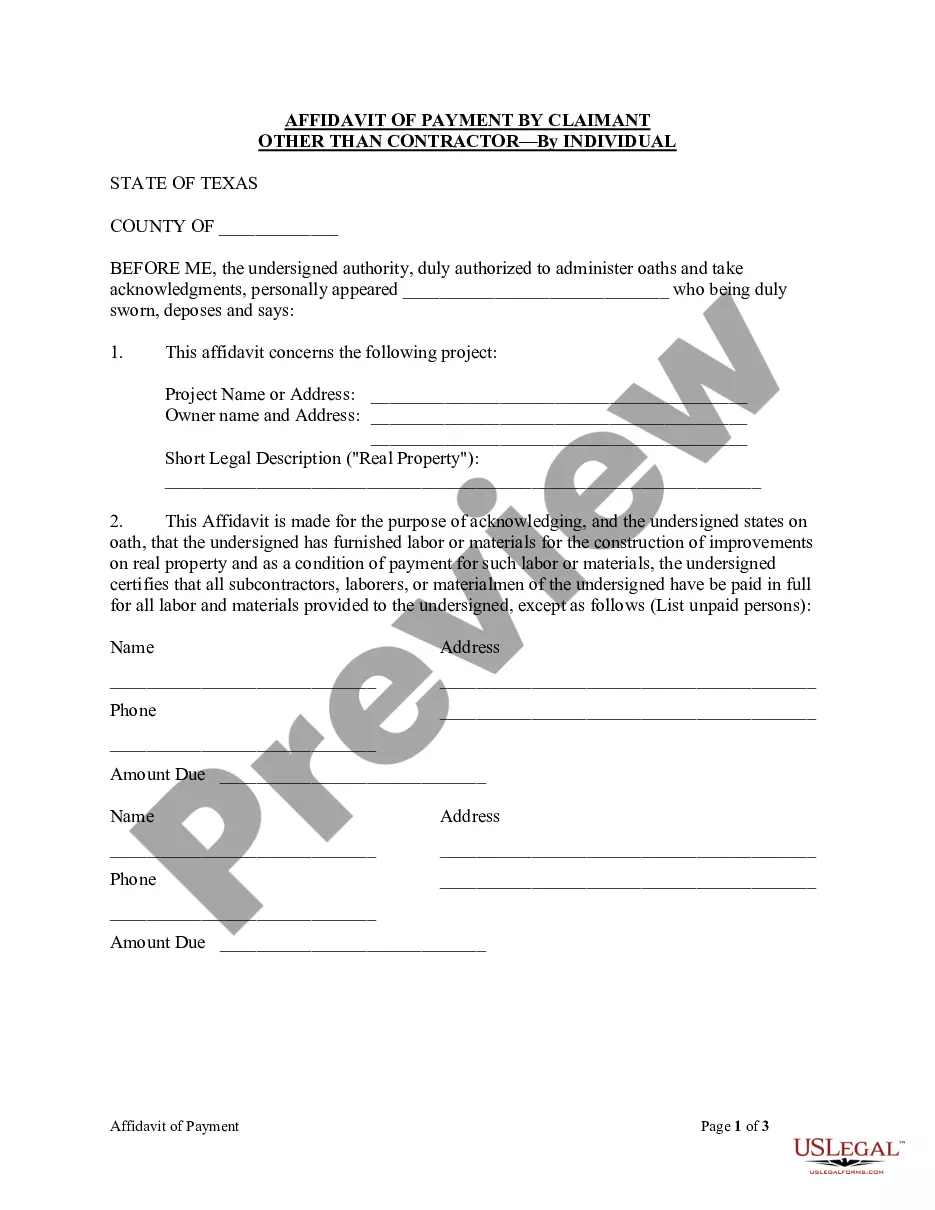

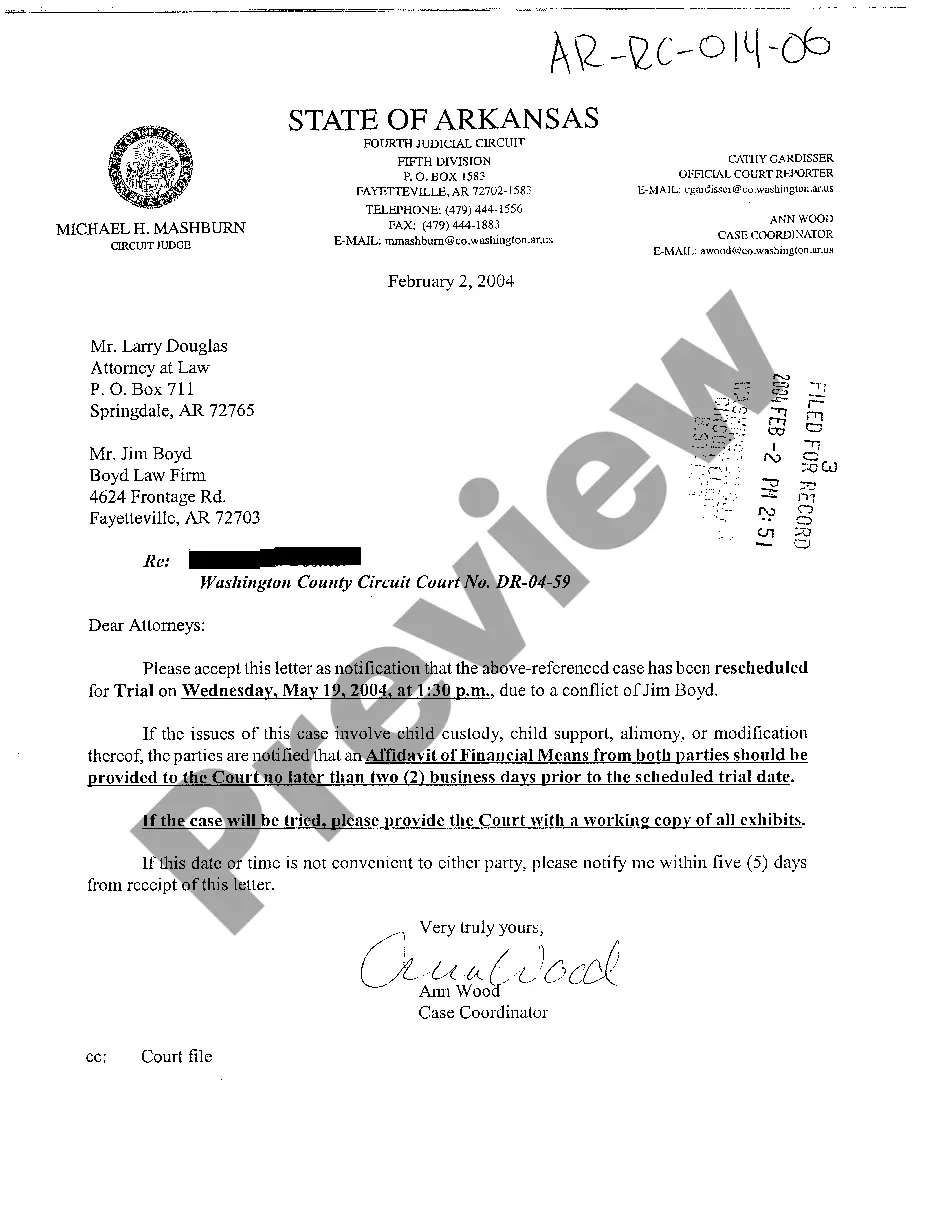

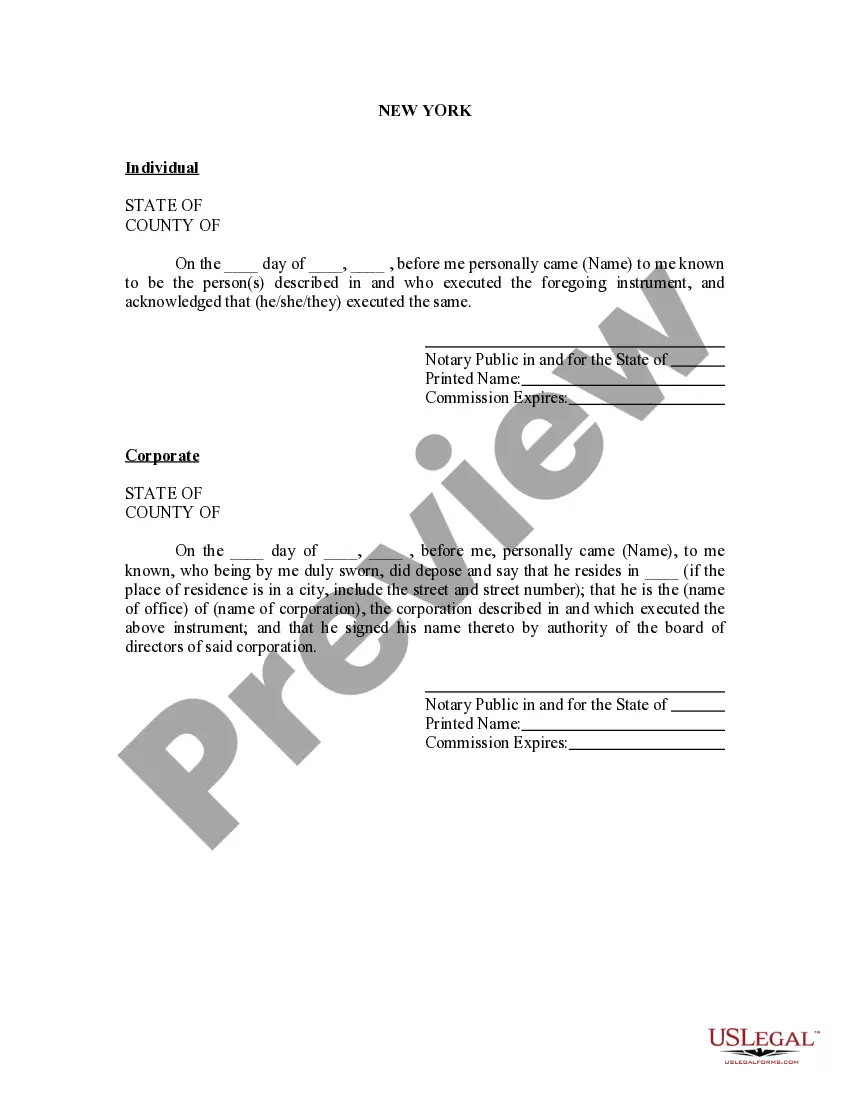

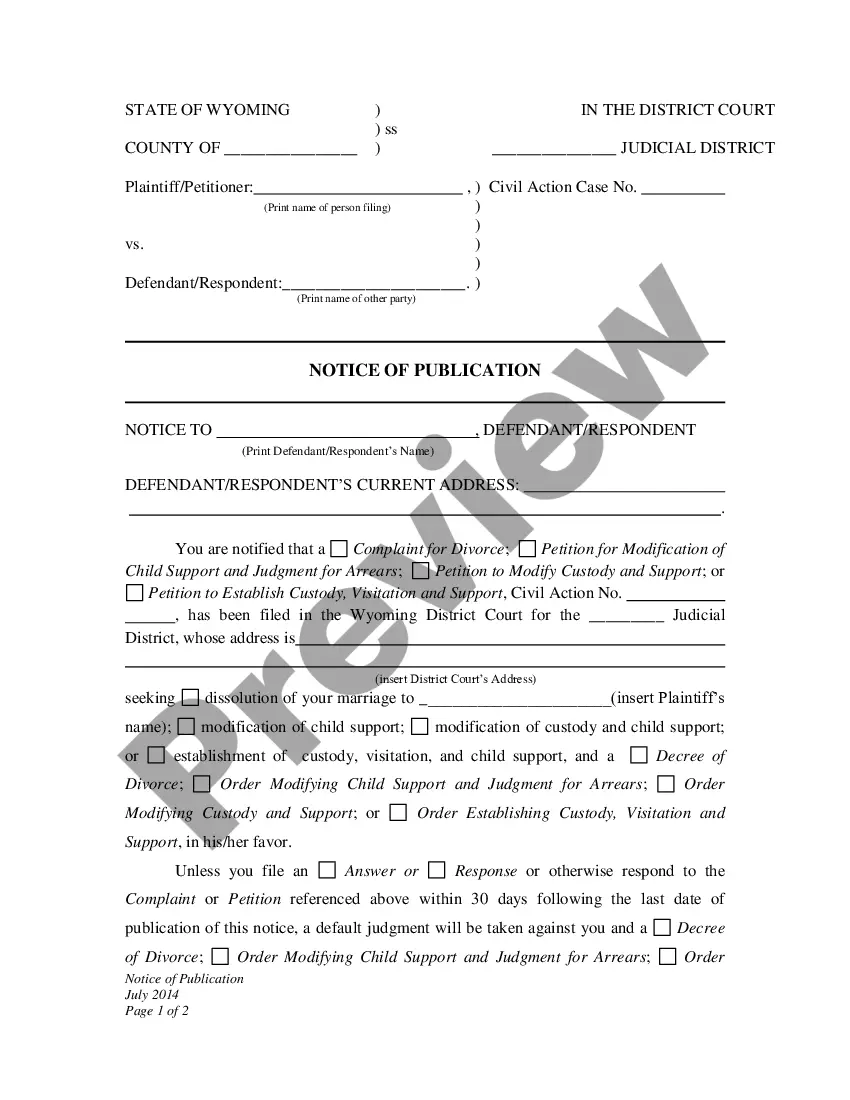

- Use the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

Writing an independent contractor agreement is straightforward and essential for a clear working relationship. Begin by outlining the scope of work, payment terms, and deadlines. Include clauses that clarify the independent status and any legal considerations. Utilize platforms like USLegalForms to draft a compliant Wisconsin Auditor Agreement - Self-Employed Independent Contractor, ensuring both parties understand their rights and responsibilities.

Filling out an independent contractor form involves several key steps. First, gather necessary information such as your name, address, and Social Security number. Next, specify the services you will provide and the payment terms. Once you complete these sections, ensure that you sign the form to formalize the Wisconsin Auditor Agreement - Self-Employed Independent Contractor, providing both parties with clear expectations.

Yes, an independent contractor is considered self-employed. In the context of the Wisconsin Auditor Agreement - Self-Employed Independent Contractor, this means that you are not working as an employee of a company but rather as an independent entity. As a self-employed individual, you manage your own taxes, benefits, and business expenses. This arrangement often provides more flexibility and control over your work compared to traditional employment.

While Wisconsin does not legally require an operating agreement for an LLC, having one is highly beneficial. It outlines the management structure and operating procedures, thus helping to prevent disputes among members. Using a robust template for your operating agreement, like the Wisconsin Auditor Agreement - Self-Employed Independent Contractor, ensures clarity and supports the legal standing of your business.

To prove independent contractor status, you must demonstrate that you operate your own business and control how you complete jobs. Key factors include deciding working hours, using your tools, and offering services to multiple clients. Documentation such as the Wisconsin Auditor Agreement - Self-Employed Independent Contractor can provide evidence of your independent status, which is crucial for tax purposes and compliance.

Creating an independent contractor agreement is a straightforward process. First, outline the scope of work and specific tasks required. Next, define payment terms, deadlines, and any confidentiality clauses necessary for your project. Utilizing a template like the Wisconsin Auditor Agreement - Self-Employed Independent Contractor can streamline this process and ensure you cover all essential details.

Independent contractors must meet several legal requirements to operate within Wisconsin. This includes obtaining any necessary licenses, adhering to tax obligations, and following applicable labor laws. It's crucial for contractors to maintain clear records and agreements to demonstrate compliance. The Wisconsin Auditor Agreement - Self-Employed Independent Contractor provides the clarity and structure needed to meet these legal standards effectively.

To fill out an independent contractor agreement, start by entering the essential details such as names, addresses, and the nature of the work. Next, outline the payment structure, deadlines, and any specific requirements for the project. It's vital to review the agreement thoroughly to ensure that all terms align with both parties' expectations. Utilizing the Wisconsin Auditor Agreement - Self-Employed Independent Contractor can simplify this process remarkably.

The basic independent contractor agreement defines the roles, responsibilities, and obligations of independent contractors and their clients. It typically includes clauses on payment, deadlines, and confidentiality to safeguard all involved parties. This agreement serves as a foundational tool for anyone entering a contractual arrangement. For those seeking a tailored solution, the Wisconsin Auditor Agreement - Self-Employed Independent Contractor is a beneficial resource.

The independent contractor agreement in Wisconsin is a legal document that outlines the terms of the working relationship between a contractor and a client. This agreement specifies the scope of work, payment terms, and other key details. By formalizing the arrangement, both parties can ensure mutual understanding and protection under the law. Using the Wisconsin Auditor Agreement - Self-Employed Independent Contractor can help you navigate this process effectively.