Wisconsin Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

If you have to full, download, or print legitimate file templates, use US Legal Forms, the biggest collection of legitimate varieties, which can be found on the web. Utilize the site`s simple and easy practical research to discover the files you will need. A variety of templates for enterprise and personal reasons are categorized by categories and states, or keywords. Use US Legal Forms to discover the Wisconsin Summary of Terms of Proposed Private Placement Offering in a handful of mouse clicks.

When you are previously a US Legal Forms client, log in to the account and click the Acquire key to get the Wisconsin Summary of Terms of Proposed Private Placement Offering. Also you can access varieties you in the past saved inside the My Forms tab of your account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that right city/land.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Never overlook to read the explanation.

- Step 3. When you are not satisfied with the type, take advantage of the Lookup field on top of the display screen to find other models of your legitimate type format.

- Step 4. Once you have identified the form you will need, click on the Purchase now key. Select the prices prepare you choose and add your qualifications to sign up on an account.

- Step 5. Method the transaction. You should use your bank card or PayPal account to finish the transaction.

- Step 6. Select the formatting of your legitimate type and download it in your product.

- Step 7. Total, modify and print or indicator the Wisconsin Summary of Terms of Proposed Private Placement Offering.

Each legitimate file format you buy is yours eternally. You might have acces to every type you saved in your acccount. Click the My Forms segment and select a type to print or download once again.

Contend and download, and print the Wisconsin Summary of Terms of Proposed Private Placement Offering with US Legal Forms. There are millions of professional and condition-specific varieties you can utilize for your enterprise or personal needs.

Form popularity

FAQ

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

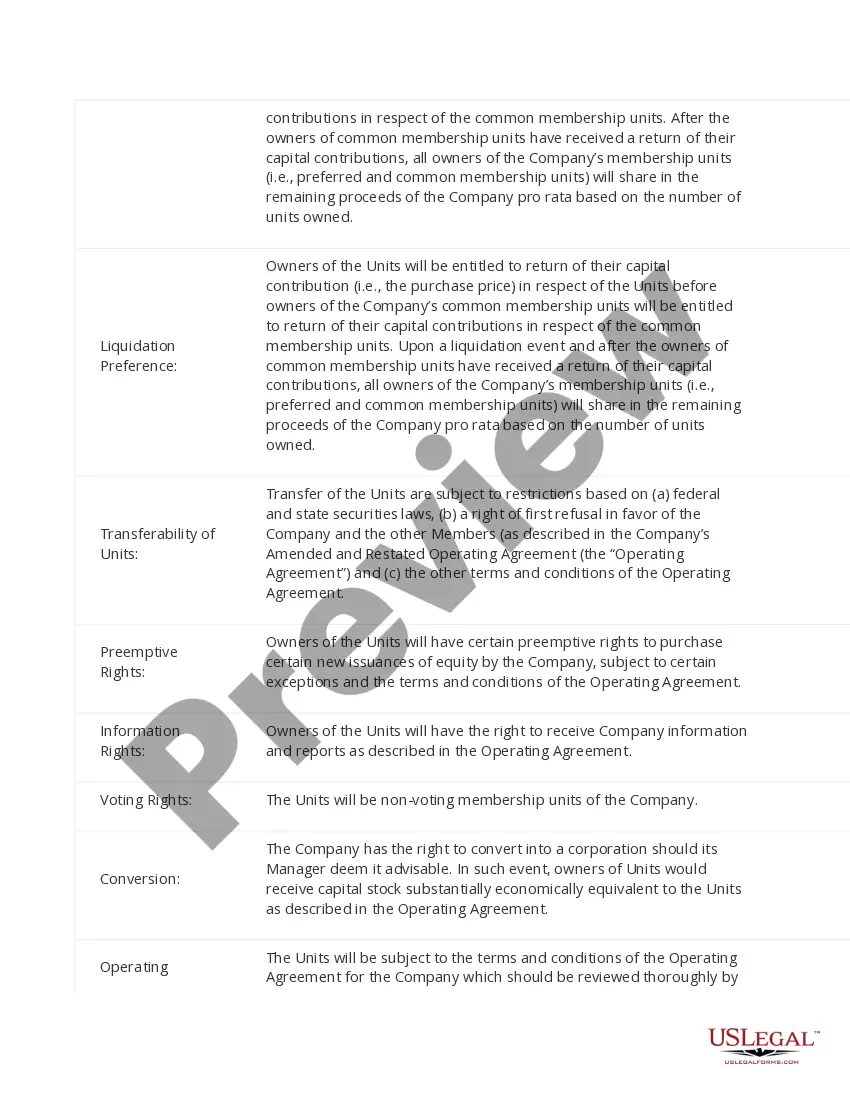

The following are among the key sections of a PPM: Summary of Offering Terms. ... Risk Factors. ... Estimated Use of Proceeds/Expenses Disclosures. ... Description of the Securities. ... Business & Management Section. ... Other Offering Documents.

Outline of a PPM Introduction. ... Summary of Offering Terms. ... Risk Factors. ... Description of the Company and the Management. ... Use of Proceeds. ... Description of Securities. ... Subscription Procedures. ... Exhibits.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.