This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Wisconsin Acquisition Divestiture Merger Agreement Summary

Description

How to fill out Acquisition Divestiture Merger Agreement Summary?

Are you in a situation where you require documents for a certain organization or individual utilizes almost daily.

There are numerous legal document templates accessible on the internet, but locating ones you can rely on isn’t straightforward.

US Legal Forms offers a vast array of form templates, including the Wisconsin Acquisition Divestiture Merger Agreement Summary, which are crafted to fulfill federal and state requirements.

Once you find the right form, click on Buy now.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient file format and download your copy. You can access all the document templates you’ve purchased in the My documents menu. You can obtain an additional copy of the Wisconsin Acquisition Divestiture Merger Agreement Summary at any time, if required. Just select the needed form to download or print out the document template. Utilize US Legal Forms, the most extensive selection of legal forms, to save time and avoid errors. The service provides professionally designed legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you may download the Wisconsin Acquisition Divestiture Merger Agreement Summary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it is for the correct city/region.

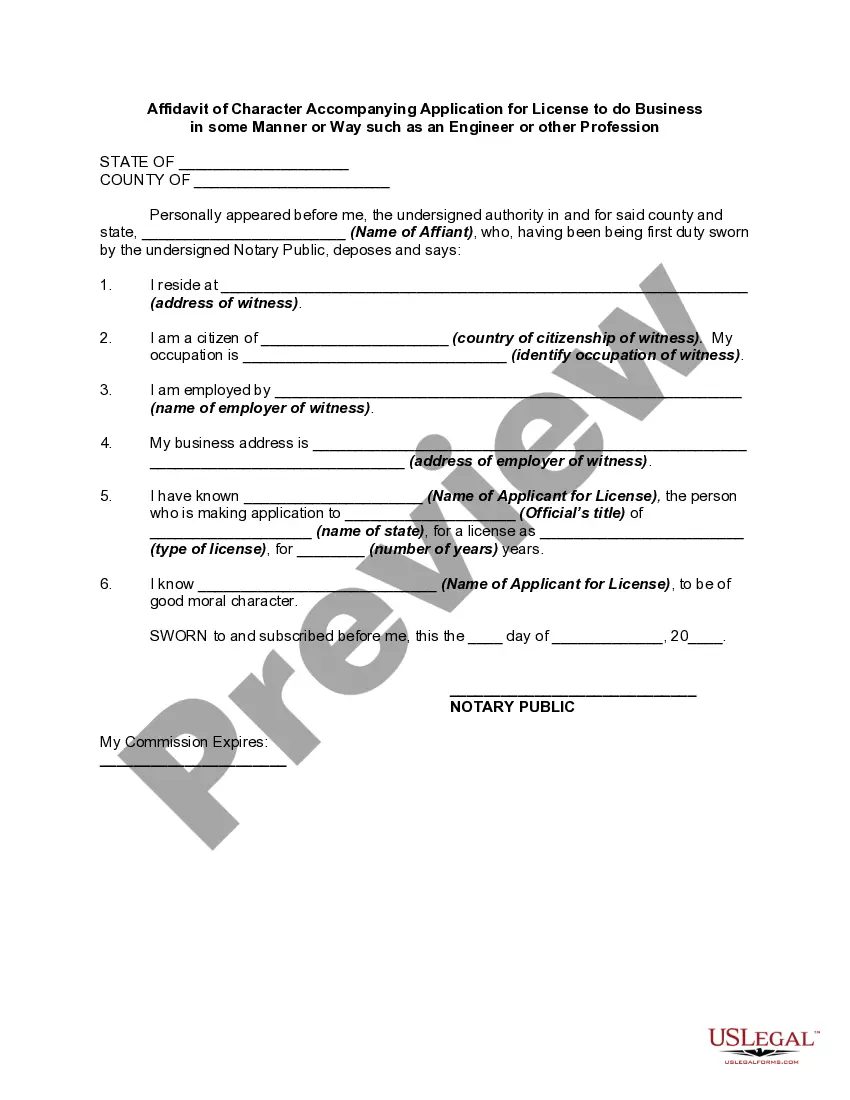

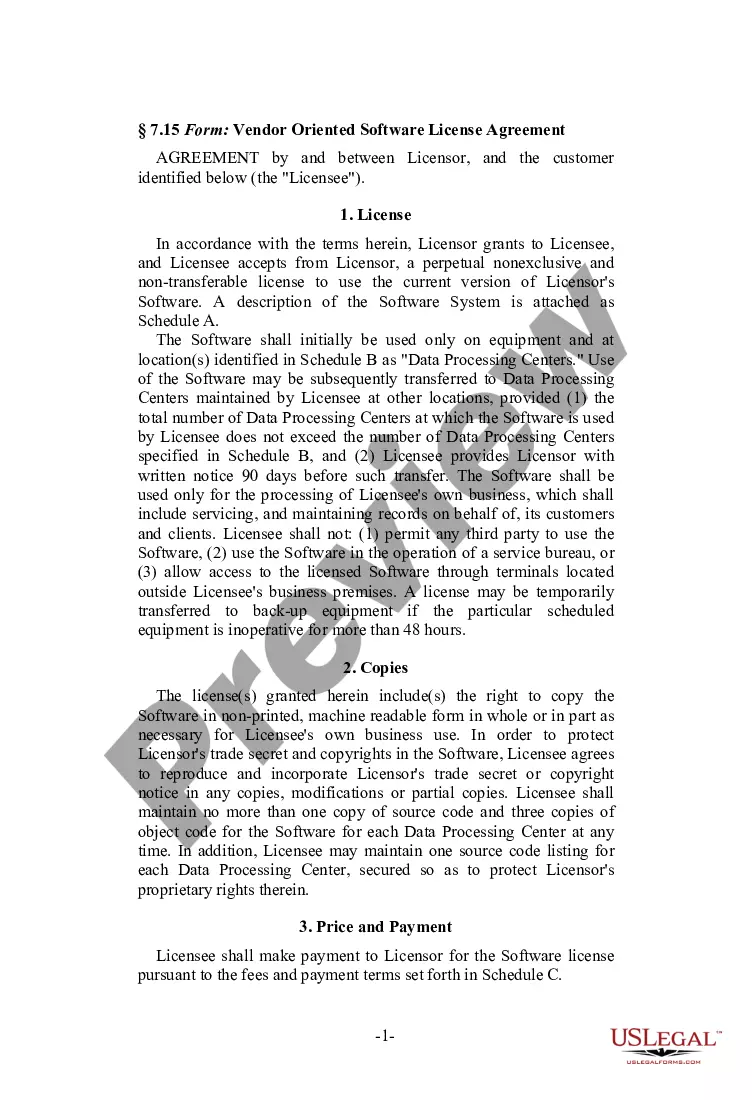

- 2. Use the Review option to view the form.

- 3. Check the details to confirm that you have selected the appropriate form.

- 4. If the form isn’t what you’re looking for, utilize the Lookup area to find the form that suits your criteria.

Form popularity

FAQ

One key step in performing a merger or acquisition involves conducting due diligence to assess the financial health and legal standing of the target company. This process helps identify potential risks and ensures that both parties are well-informed before entering into the Wisconsin Acquisition Divestiture Merger Agreement Summary. Consulting platforms like uslegalforms can provide templates and guidance throughout this process.

The structure of a merger generally features a combination of company assets, equity, and liabilities to form a new entity or integrate two existing entities. It also includes legal frameworks that dictate how corporate governance will operate post-merger. A solid understanding of this structure helps in creating an accurate Wisconsin Acquisition Divestiture Merger Agreement Summary.

A merger agreement contains essential components like the definitions of the parties involved, transaction details, and the timeline for implementation. Furthermore, it may include clauses addressing termination rights, indemnification, and legal compliance obligations. For an effective Wisconsin Acquisition Divestiture Merger Agreement Summary, you should ensure that these elements are clearly articulated.

Structuring a merger deal requires careful planning and consideration of various business factors. Begin by identifying the goals of the merger and assessing the financial implications for both parties. Following this, consult documents like the Wisconsin Acquisition Divestiture Merger Agreement Summary to craft terms that align with your strategic objectives.

A merger agreement typically includes the parties involved, the terms of the merger, and the overall objective of the merger. The structure may also detail the method of payment, representations and warranties, and conditions that must be met for the merger to proceed. Understanding this structure is essential when considering a Wisconsin Acquisition Divestiture Merger Agreement Summary, as it outlines the legal framework guiding the merger process.

Mergers and divestitures are two essential components of business strategy that involve combining or separating companies. A merger occurs when two firms join forces to operate as one entity, often enhancing market reach or resources. On the other hand, a divestiture involves selling off a part of a business to streamline operations. The Wisconsin Acquisition Divestiture Merger Agreement Summary provides valuable insights into how these actions can reshape a company's structure.

Divestiture in mergers and acquisitions refers to the process where a company sells or spins off a portion of its business. This can happen for various reasons, including focusing on core operations or improving financial health. In the context of a Wisconsin Acquisition Divestiture Merger Agreement Summary, understanding divestiture helps clarify how assets are strategically reorganized during a deal. Utilizing a solid legal framework can ensure effective management of this process.

Mergers, acquisitions, and divestitures are strategic actions companies take to grow, consolidate, or separate parts of their business. A merger involves combining two companies, while an acquisition is when one company purchases another. Divestiture refers to the process of selling off a section of a company. Understanding these concepts is crucial, especially when navigating documents like the Wisconsin Acquisition Divestiture Merger Agreement Summary.

To find information about mergers and acquisitions, start by utilizing reputable financial news websites and market analysis reports. Additionally, exploring resources like USLegalForms can provide access to legal documents and summaries, including those related to the Wisconsin Acquisition Divestiture Merger Agreement Summary. Staying updated with industry news helps you identify ongoing and upcoming transactions.

Finding merger documents can be accomplished by searching online databases and legal websites that focus on business law. Platforms such as USLegalForms offer access to crucial forms and guidelines that facilitate understanding of Wisconsin Acquisition Divestiture Merger Agreement Summary. Simply input specific keywords in the search bar to quickly access the documents you need.