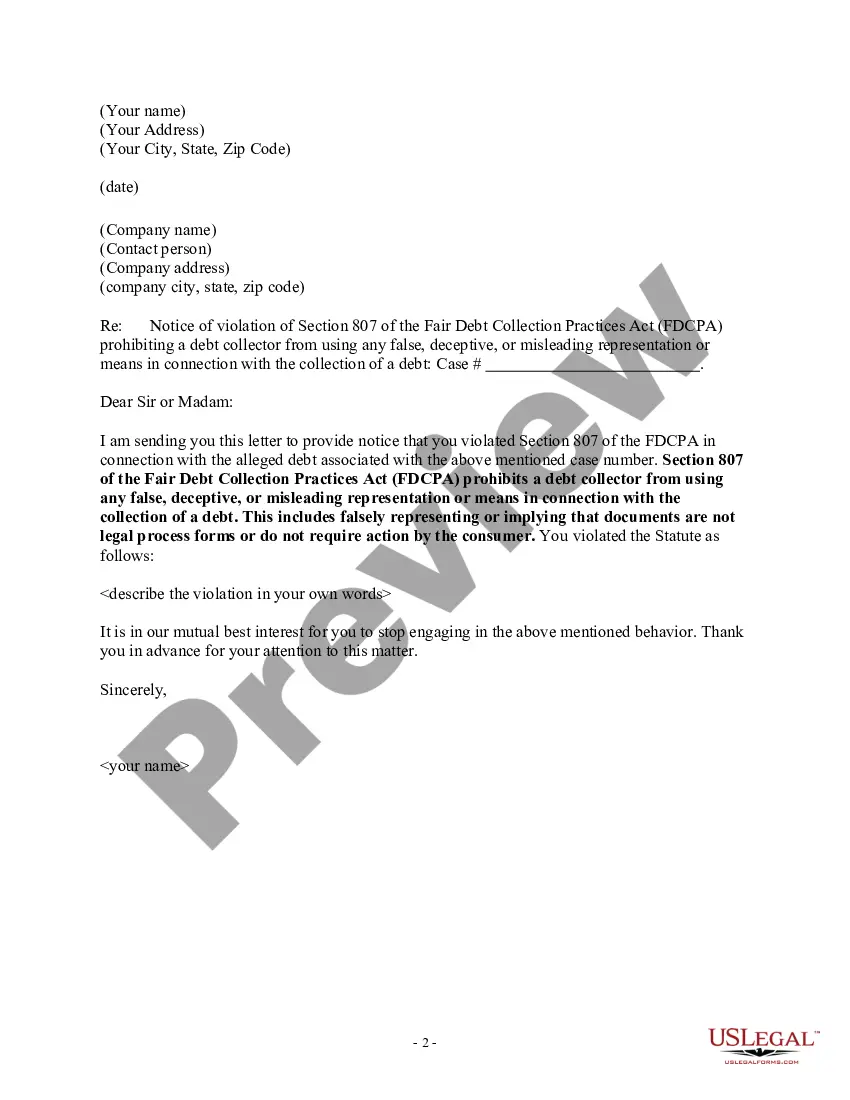

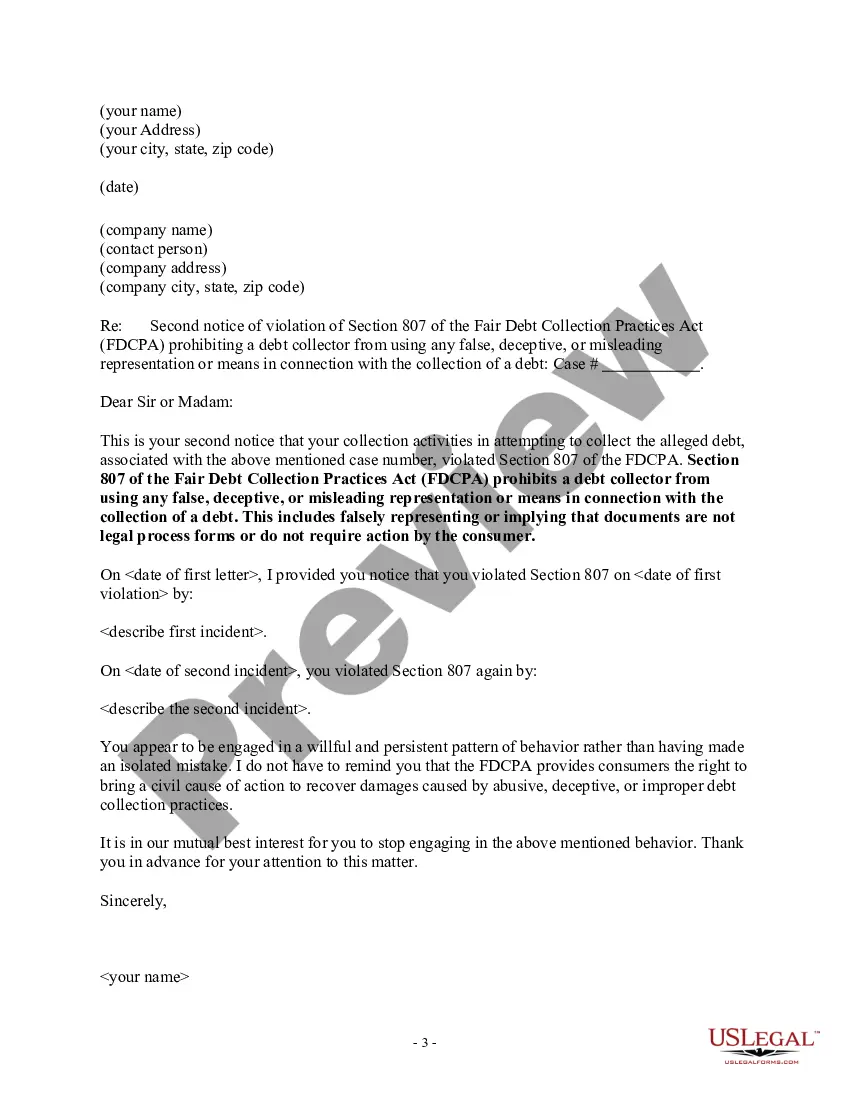

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Wisconsin Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Finding the suitable valid document format can be challenging.

Clearly, there are numerous templates accessible online, but how do you locate the valid form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Wisconsin Notice to Debt Collector - Misrepresenting Documents as Not Legal Process or Not Requiring Action, which can be utilized for business and personal needs.

First, ensure you have selected the correct form for your locality. You can review the form using the Preview button and read the form description to confirm it is the right one for you.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already a registered user, Log In to your account and click the Download button to obtain the Wisconsin Notice to Debt Collector - Misrepresenting Documents as Not Legal Process or Not Requiring Action.

- Use your account to search the valid forms you might have previously acquired.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

Form popularity

FAQ

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.