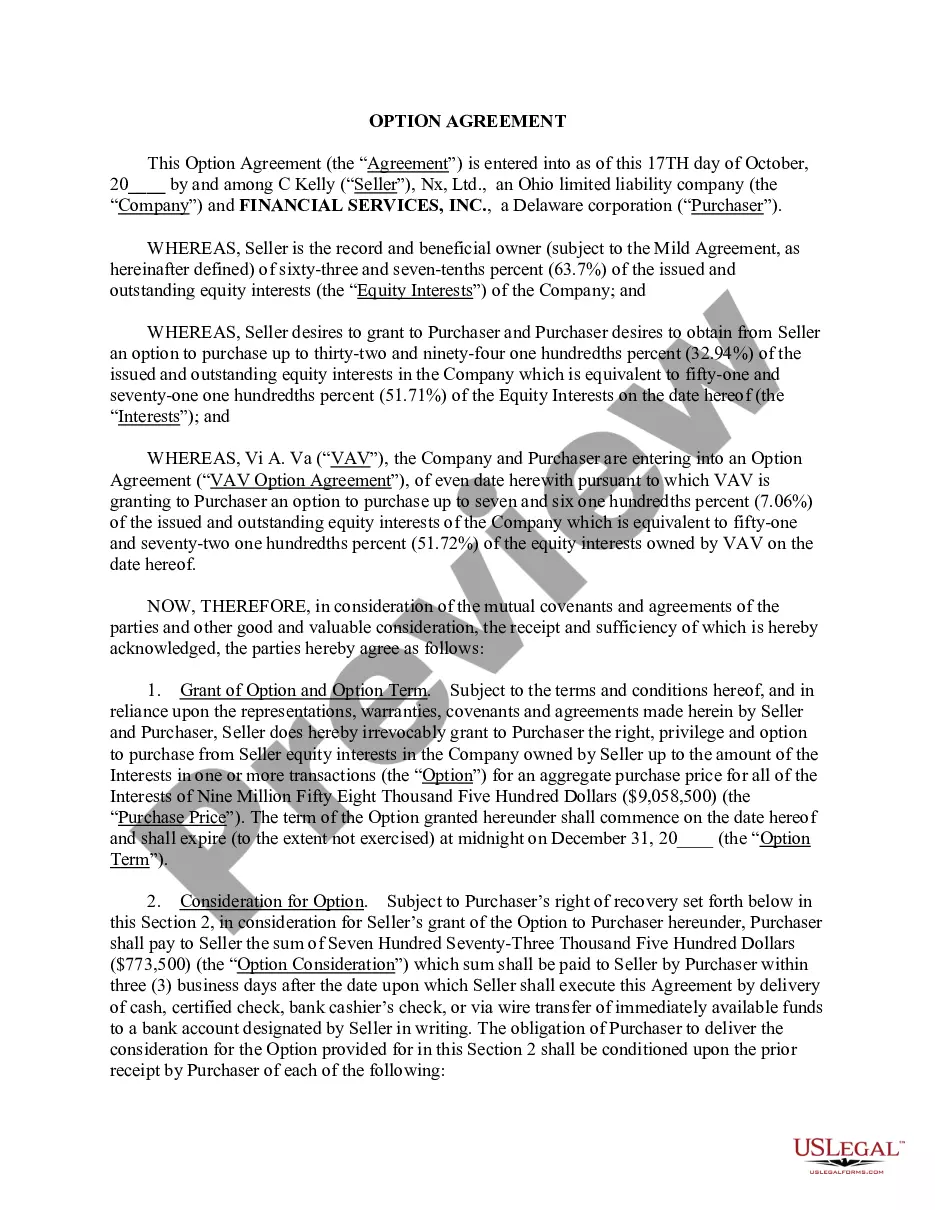

"Construction Loan Agreements and Variations" is a American Lawyer Media form. This form is to be used as a construction loan agreement.

Wisconsin Construction Loan Agreements and Variations

Description

How to fill out Construction Loan Agreements And Variations?

If you want to full, acquire, or print legal file themes, use US Legal Forms, the greatest assortment of legal types, which can be found on-line. Utilize the site`s simple and handy lookup to discover the files you want. Different themes for company and personal functions are sorted by groups and suggests, or search phrases. Use US Legal Forms to discover the Wisconsin Construction Loan Agreements and Variations with a handful of mouse clicks.

When you are presently a US Legal Forms consumer, log in in your profile and click the Down load key to find the Wisconsin Construction Loan Agreements and Variations. You can even gain access to types you in the past downloaded within the My Forms tab of your profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape to the appropriate city/region.

- Step 2. Take advantage of the Review method to examine the form`s articles. Do not forget about to read the description.

- Step 3. When you are unhappy using the kind, utilize the Research discipline near the top of the display screen to locate other types from the legal kind format.

- Step 4. When you have discovered the shape you want, click on the Purchase now key. Select the rates plan you like and add your references to register on an profile.

- Step 5. Approach the deal. You can utilize your bank card or PayPal profile to complete the deal.

- Step 6. Select the format from the legal kind and acquire it on your own device.

- Step 7. Full, revise and print or sign the Wisconsin Construction Loan Agreements and Variations.

Every single legal file format you acquire is yours for a long time. You might have acces to each kind you downloaded inside your acccount. Click the My Forms portion and choose a kind to print or acquire once more.

Be competitive and acquire, and print the Wisconsin Construction Loan Agreements and Variations with US Legal Forms. There are thousands of expert and condition-distinct types you can utilize for your company or personal demands.

Form popularity

FAQ

706.11(1m)(a)2. 2. ?Construction mortgage" means a mortgage that secures an obligation incurred for the construction of an improvement on land, including the acquisition cost of the land.

Many loan agreements contain an 'events of default' clause. This type of clause is designed to protect the lender from non-repayment of the loan and provide them with contractual rights under the loan agreement. As a borrower, events of default clauses can have significant financial consequences.

What terms are important to have in a loan agreement? Your loan agreement should clearly outline the interest rate that you will pay, allow you to repay the loan early, detail what will occur in the event of default and specify whether the loan is secured or unsecured.

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause: ... #2: 'Default' Definition Clause: ... #3: Security Cover Clause: ... #4: Disbursement Clause: ... #5: Force Majeure Clause: ... #6: Reset Clause: ... #7: Prepayment Clause: ... #8: Other Balances Set Off Clause:

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.