Wisconsin Building Loan Agreement between Lender and Borrower

Description

How to fill out Building Loan Agreement Between Lender And Borrower?

US Legal Forms - one of several greatest libraries of legal varieties in the United States - offers an array of legal document web templates you are able to acquire or print. Utilizing the website, you can get 1000s of varieties for organization and specific reasons, categorized by groups, states, or search phrases.You will discover the newest variations of varieties much like the Wisconsin Building Loan Agreement between Lender and Borrower in seconds.

If you have a subscription, log in and acquire Wisconsin Building Loan Agreement between Lender and Borrower through the US Legal Forms library. The Obtain key will show up on each and every kind you see. You have accessibility to all previously delivered electronically varieties in the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, here are simple guidelines to help you get started:

- Ensure you have chosen the best kind for your personal metropolis/region. Select the Review key to analyze the form`s articles. See the kind information to ensure that you have chosen the appropriate kind.

- When the kind does not suit your specifications, utilize the Research industry near the top of the display to obtain the one that does.

- When you are satisfied with the form, validate your choice by visiting the Get now key. Then, choose the pricing plan you like and offer your accreditations to sign up for an bank account.

- Approach the deal. Utilize your credit card or PayPal bank account to finish the deal.

- Pick the format and acquire the form on your own gadget.

- Make alterations. Complete, modify and print and signal the delivered electronically Wisconsin Building Loan Agreement between Lender and Borrower.

Each and every format you put into your money lacks an expiry particular date and is also your own property for a long time. So, if you would like acquire or print another backup, just go to the My Forms portion and then click on the kind you require.

Get access to the Wisconsin Building Loan Agreement between Lender and Borrower with US Legal Forms, one of the most substantial library of legal document web templates. Use 1000s of skilled and express-certain web templates that meet your small business or specific demands and specifications.

Form popularity

FAQ

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A loan agreement (also known as a lending agreement) is a contract between a borrower and a lender which regulates the mutual promises made by each party.

Ing to the Corporate Finance Institute (CFI), an ICA can also be called an intercreditor deed. Thus, as per CFI, an Intercreditor Agreement is a legal document between two or more creditors.

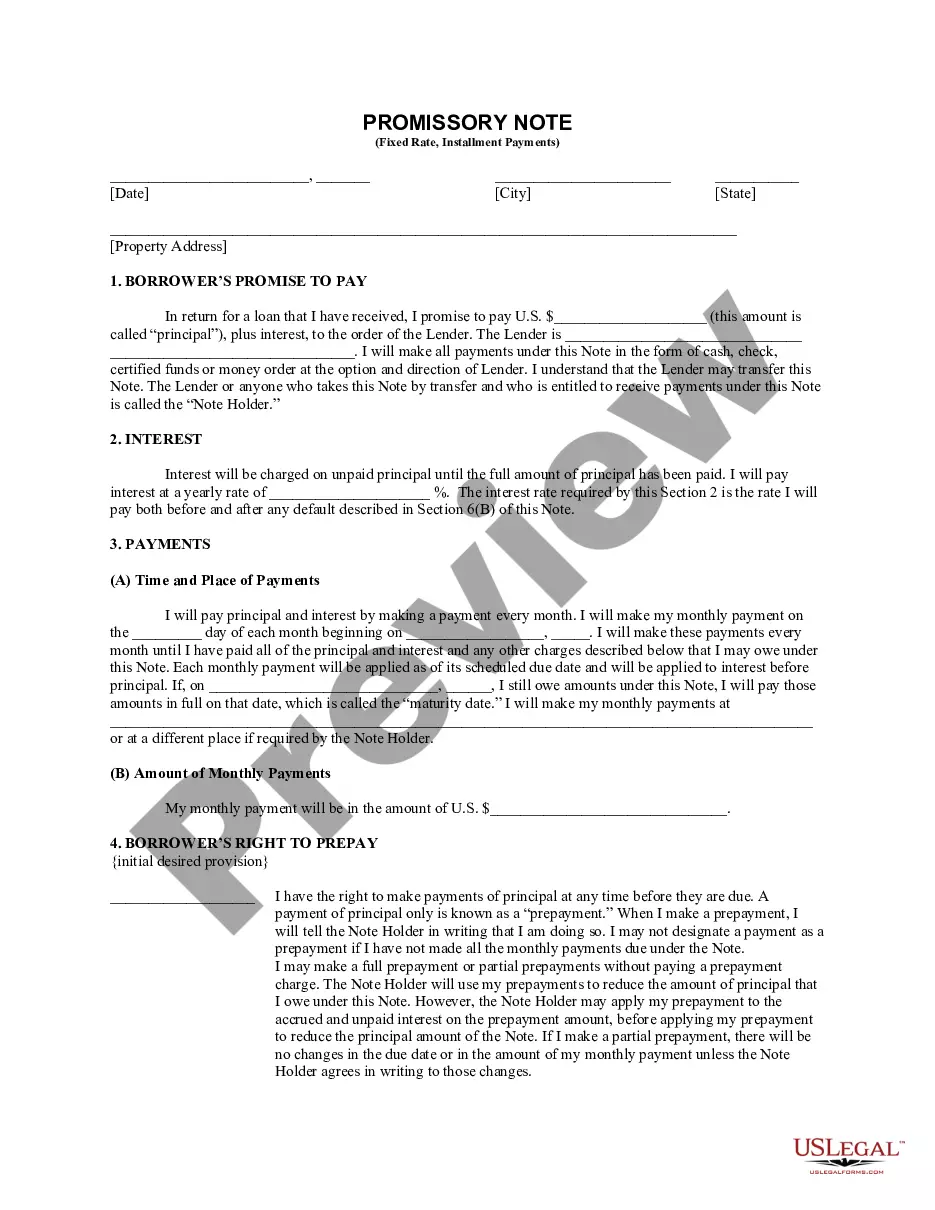

A promissory note is essential in any transaction where money is being lent by a person, bank, company, or other organization to another entity. This document is a contract that protects the lender from the risk of the borrower not paying the full amount agreed to by both parties.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A loan agreement is a legally binding contract between the borrower(s) and the lender that states the terms of borrowing the loan, including the amount to be repaid, the interest rate, and any other conditions.