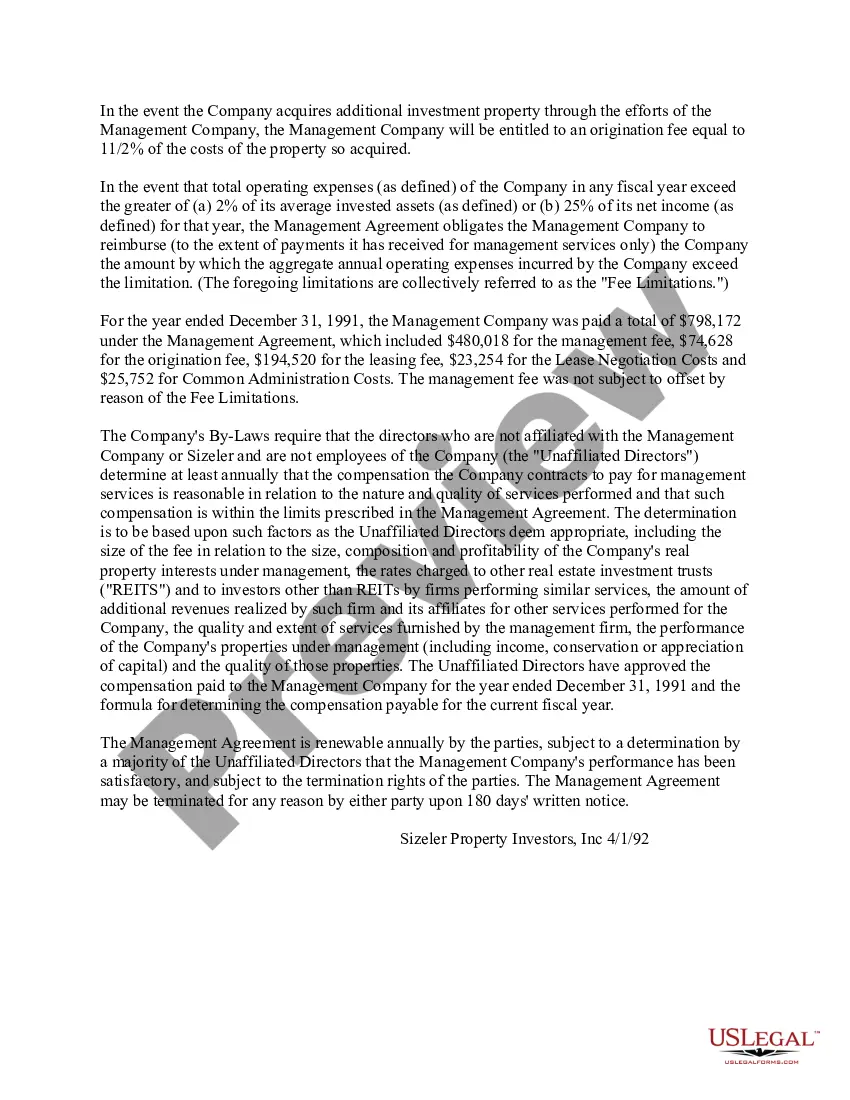

Wisconsin Services provided to the corporation under a Management Agreement

Description

How to fill out Services Provided To The Corporation Under A Management Agreement?

If you need to comprehensive, download, or print authorized record web templates, use US Legal Forms, the most important assortment of authorized varieties, which can be found on the web. Use the site`s simple and hassle-free look for to get the files you will need. Various web templates for enterprise and personal purposes are categorized by types and says, or key phrases. Use US Legal Forms to get the Wisconsin Services provided to the corporation under a Management Agreement in a number of mouse clicks.

In case you are already a US Legal Forms client, log in for your profile and click on the Obtain key to have the Wisconsin Services provided to the corporation under a Management Agreement. You may also gain access to varieties you formerly delivered electronically from the My Forms tab of the profile.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the appropriate metropolis/region.

- Step 2. Take advantage of the Preview choice to examine the form`s content. Don`t neglect to see the information.

- Step 3. In case you are not satisfied with all the develop, make use of the Lookup field on top of the display to find other types in the authorized develop web template.

- Step 4. After you have located the shape you will need, select the Buy now key. Select the prices prepare you like and include your qualifications to sign up to have an profile.

- Step 5. Approach the transaction. You can use your bank card or PayPal profile to perform the transaction.

- Step 6. Pick the formatting in the authorized develop and download it on your gadget.

- Step 7. Comprehensive, revise and print or indicator the Wisconsin Services provided to the corporation under a Management Agreement.

Every authorized record web template you acquire is your own eternally. You have acces to every develop you delivered electronically inside your acccount. Click on the My Forms section and select a develop to print or download yet again.

Remain competitive and download, and print the Wisconsin Services provided to the corporation under a Management Agreement with US Legal Forms. There are many professional and condition-distinct varieties you can use to your enterprise or personal requirements.

Form popularity

FAQ

What are the requirements to form an LLC in Wisconsin? You must file articles of organization, appoint a registered agent, and pay a $130 filing fee. An operating agreement is recommended but not required.

To maintain an LLC in Wisconsin state, you must comply with the state's requirements for active businesses. You must file an annual report each year with the Department of Financial Institutions. The fee is $25 to file online and $40 to file by paper.

The form 5 is mandatory and must be used to file the REQUIRED ANNUAL REPORT for a Domestic or Foreign Nonstock Corporation and Domestic or Foreign Limited Liability Company. Failure to file this report may result in administrative dissolution for domestic entities under ss. 181.1420 & 183.0708, Wis.

Wisconsin doesn't charge penalty fees for failing to file an annual report; however, your business will lose its good standing and risk being administratively dissolved or revoked.

The Wisconsin LLC annual report is required for all Wisconsin LLCs, both domestic and foreign.

Do you have to pay an annual fee for a Wisconsin LLC? Yes, all Wisconsin LLCs need to pay $25 per year for the Annual Report. These state fees are paid to the Wisconsin DFI. You have to pay this to keep your LLC in good standing.

An LLC operating agreement is not required by law in Wisconsin, but it is highly recommended. The operating agreement provides a clear understanding of the company's structure and helps to prevent misunderstandings and conflicts among members.

To make amendments to your Wisconsin LLC's articles of organization, provide Wisconsin Department of Financial Institutions Form 504, Articles of Amendment ? Limited Liability Company. The form is optional; you may draft your own Articles of Amendment.

The state of Illinois doesn't require LLCs to have an LLC operating agreement, but it's highly recommended. The operating agreement is a legally binding document that breaks down the management structure of the LLC and each owner's duties and profit share.

The online Wisconsin LLC filing fee is $130. Note: Filing the paper form by postal mail costs $170. You can save $40 by filing online or by letting Incfile process the paperwork for you.