Wisconsin Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Choosing the best legitimate papers format might be a have a problem. Obviously, there are plenty of layouts available on the net, but how would you find the legitimate kind you will need? Use the US Legal Forms internet site. The assistance delivers a huge number of layouts, such as the Wisconsin Approval of deferred compensation investment account plan, that can be used for enterprise and private requires. All the kinds are checked out by experts and satisfy federal and state specifications.

If you are already authorized, log in to your profile and then click the Down load button to have the Wisconsin Approval of deferred compensation investment account plan. Use your profile to search from the legitimate kinds you possess acquired formerly. Go to the My Forms tab of your profile and obtain yet another copy in the papers you will need.

If you are a whole new customer of US Legal Forms, here are straightforward instructions for you to follow:

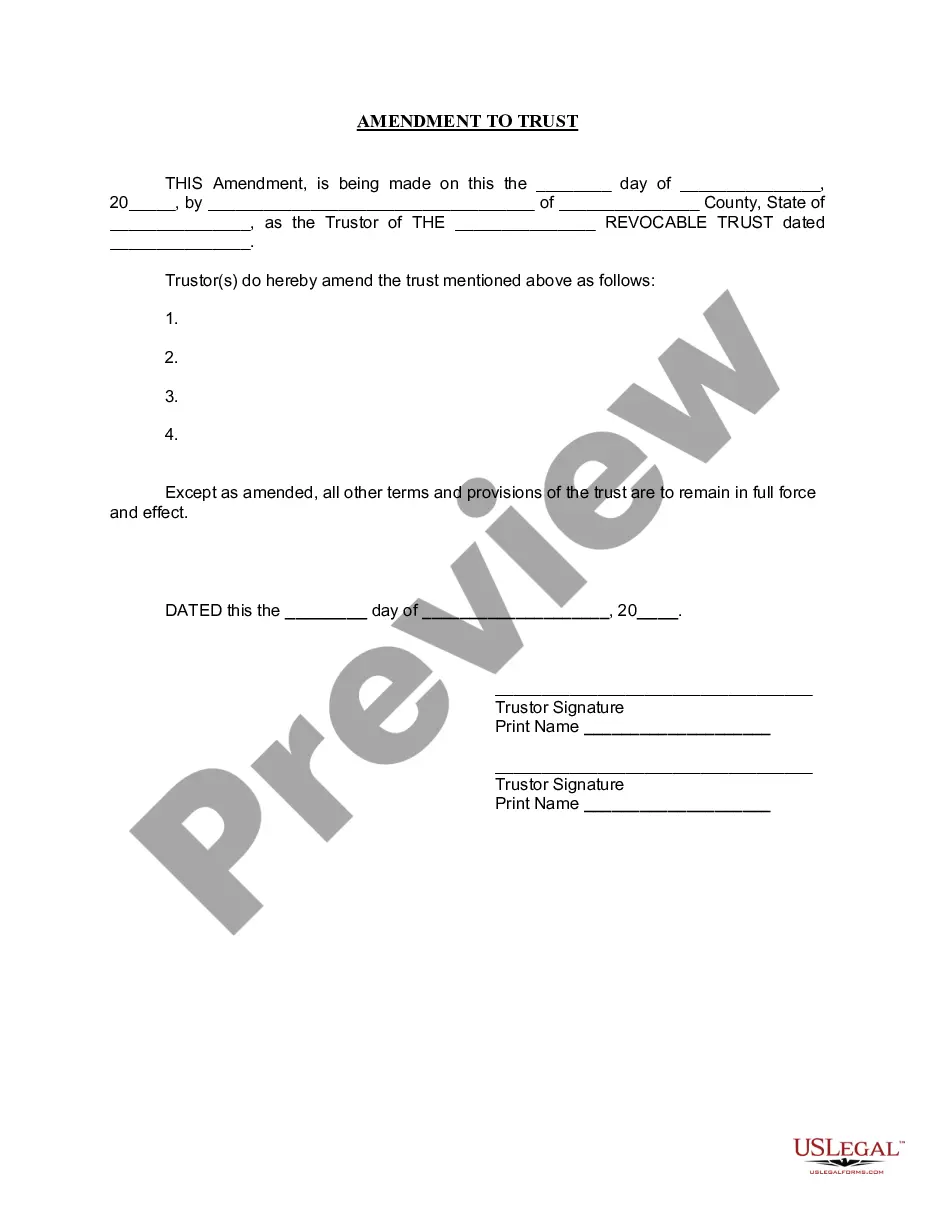

- Initial, make sure you have selected the right kind for your city/area. You may examine the form making use of the Preview button and study the form information to make sure this is the right one for you.

- In case the kind is not going to satisfy your needs, utilize the Seach area to get the right kind.

- Once you are sure that the form is suitable, select the Acquire now button to have the kind.

- Pick the rates prepare you need and enter in the necessary information. Build your profile and purchase the order using your PayPal profile or bank card.

- Pick the data file structure and obtain the legitimate papers format to your gadget.

- Comprehensive, revise and produce and indication the attained Wisconsin Approval of deferred compensation investment account plan.

US Legal Forms will be the most significant library of legitimate kinds that you can find various papers layouts. Use the service to obtain appropriately-produced documents that follow state specifications.

Form popularity

FAQ

457(b) are tax-deferred plans. This means that you don't pay when the money goes in, or should it grow or pay dividends. Typically, you end up paying the tax when you take the money out to spend it, normally in retirement. This means that by using a 457(b) you may save on taxes for your retirement savings.

Cons of 457(b) plans: Fewer investing options than 401(k)s (Not as common today) Only available to certain employees employed by state or local governments or qualifying nonprofits. Employer contributions count toward the annual limit. Non-governmental 457(b) plans are riskier.

A 457(b) plan is a tax-deferred, employer-sponsored retirement plan available to government and tax-exempt nonprofit employees. A 457(b) plan is unique because it operates as a deferred compensation plan rather than a traditional retirement plan.

For most people, the maximum amount you can save in your WDC account in 2023 is $22,500. However: People age 50 or older can make annual catch-up contributions.

The elective deferral limit ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and in 2021). the basic annual limit plus the amount of the basic limit not used in prior years (only allowed if not using age 50 or over catch-up contributions)

For most people, the maximum amount that can be saved in a WDC account in 2023 is $22,500. However: If you are age 50 or older you can make annual catch-up contributions.

To set up a NQDC plan, you'll have to: Put the plan in writing: Think of it as a contract with your employee. Be sure to include the deferred amount and when your business will pay it. Decide on the timing: You'll need to choose the events that trigger when your business will pay an employee's deferred income.

What is a deferred compensation plan? A deferred compensation plan is another name for a 457(b) retirement plan, or ?457 plan? for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

Through the WDC program employees can invest a portion of their income for retirement either on a pre-tax or post-tax (Roth) basis or a combination of both. Participation in the program is voluntary; employees make the entire contribution. There is no employer match.

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).