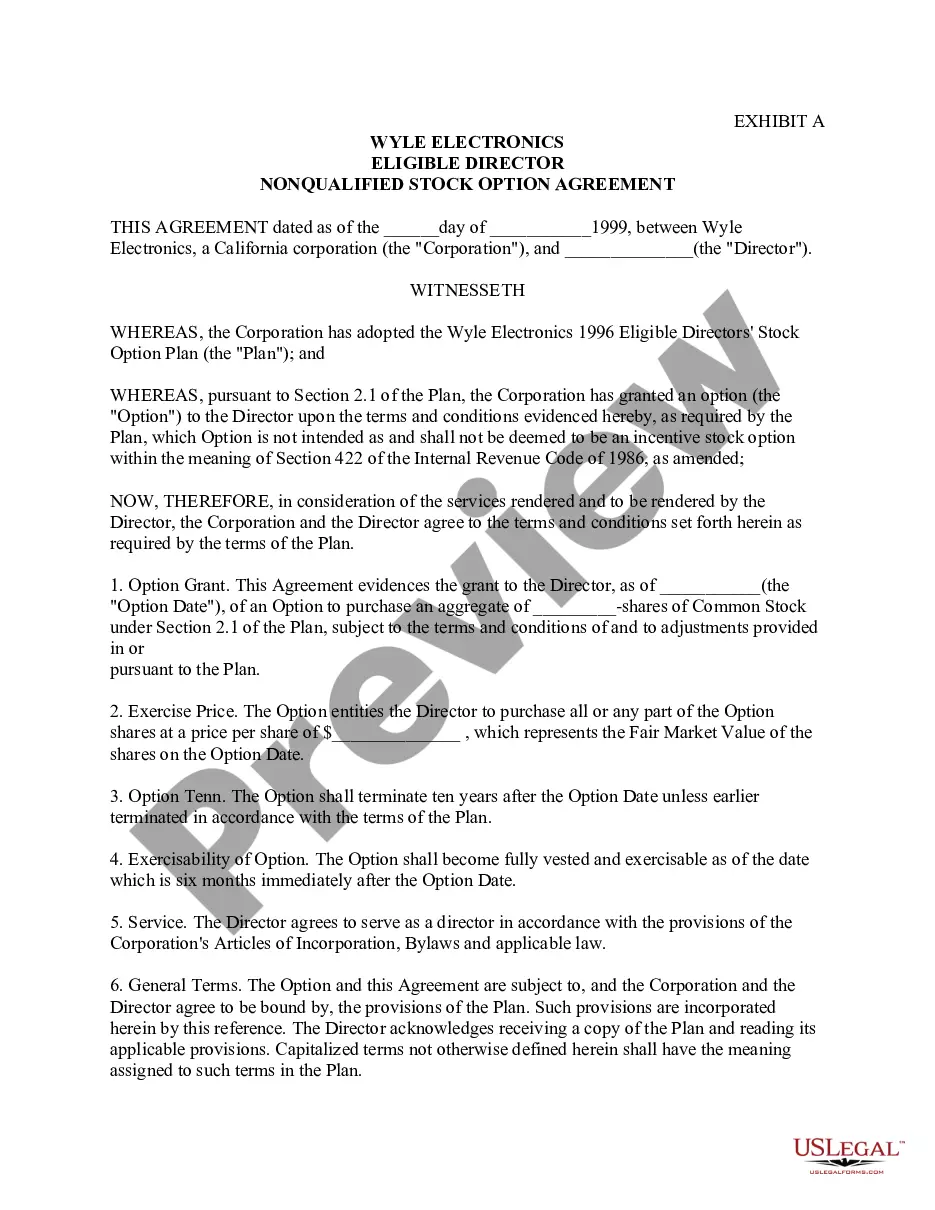

Wisconsin Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

How to fill out Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

You may invest several hours on-line looking for the legal papers format that suits the state and federal specifications you require. US Legal Forms gives a large number of legal types which are analyzed by pros. You can actually download or printing the Wisconsin Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics from our assistance.

If you already have a US Legal Forms accounts, you can log in and click the Obtain switch. Following that, you can total, edit, printing, or indication the Wisconsin Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics. Each and every legal papers format you purchase is your own property forever. To acquire another backup of any bought kind, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site for the first time, stick to the basic instructions under:

- Initially, be sure that you have chosen the correct papers format for the area/town of your choice. Look at the kind description to ensure you have selected the proper kind. If accessible, use the Preview switch to search from the papers format also.

- If you want to discover another version in the kind, use the Search industry to get the format that fits your needs and specifications.

- When you have discovered the format you need, just click Buy now to move forward.

- Pick the costs strategy you need, enter your references, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your charge card or PayPal accounts to purchase the legal kind.

- Pick the structure in the papers and download it in your device.

- Make alterations in your papers if required. You may total, edit and indication and printing Wisconsin Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics.

Obtain and printing a large number of papers layouts utilizing the US Legal Forms website, that provides the greatest assortment of legal types. Use skilled and status-particular layouts to take on your company or personal requires.

Form popularity

FAQ

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

Time-based stock vesting is when you earn options or shares over a specified period of time. Most time-based vesting schedules have a vesting cliff. Cliff vesting is when the first portion of your option grant vests on a specific date and the remaining options gradually vest each month or quarter afterward.

Non-qualified stock options often reduce the cash compensation employees earn from employment. The price of these stock options is typically the same as the market value of the shares when the company makes such options available, also known as the grant date.

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.