North Carolina Property Management Package

Understanding this form package

The North Carolina Property Management Package contains essential forms specifically designed to assist landlords and property managers in efficiently leasing premises while complying with state legal requirements. This package is unique because it includes a variety of state-specific forms tailored for both residential and commercial properties, ensuring that users can maintain good relationships with tenants while protecting their interests.

Forms provided in this package

- Residential Rental Lease Application

- Inventory and Condition of Leased Premises for Pre Lease and Post Lease

- Property Manager Agreement

- Residential Rental Lease Agreement

- Landlord Tenant Closing Statement to Reconcile Security Deposit

- Commercial Building or Space Lease

- Security Deposit Agreement

- Agreement to Lease Commercial Property with Option to Purchase at End of Lease Term - Rent to Own - Real Estate Rental

- Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property - Lease or Rent to Own

Situations where these forms applies

This package is ideal for situations where a property owner is looking to rent out a residential or commercial space. It provides the necessary documentation to:

- Lease a property to tenants.

- Collect and manage security deposits.

- Document the condition of the property before and after tenancy.

- Establish agreements for lease-to-own options.

- Settle disputes amicably with tenants by having clear documentation in place.

Who needs this form package

- Landlords seeking to lease residential or commercial properties in North Carolina.

- Property managers responsible for managing rental properties.

- Investors considering purchasing property to lease.

- Individuals who want to formalize rental agreements with potential tenants.

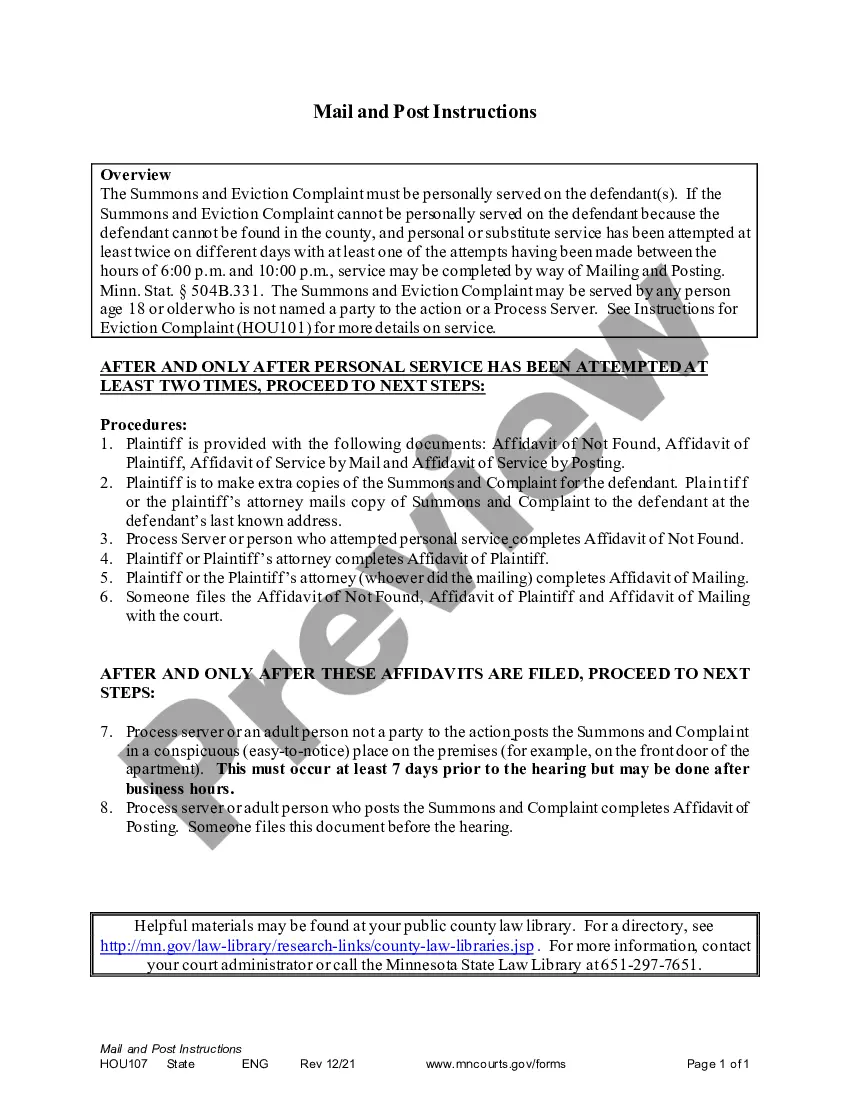

Steps to complete these forms

- Review included forms to understand their purpose and requirements.

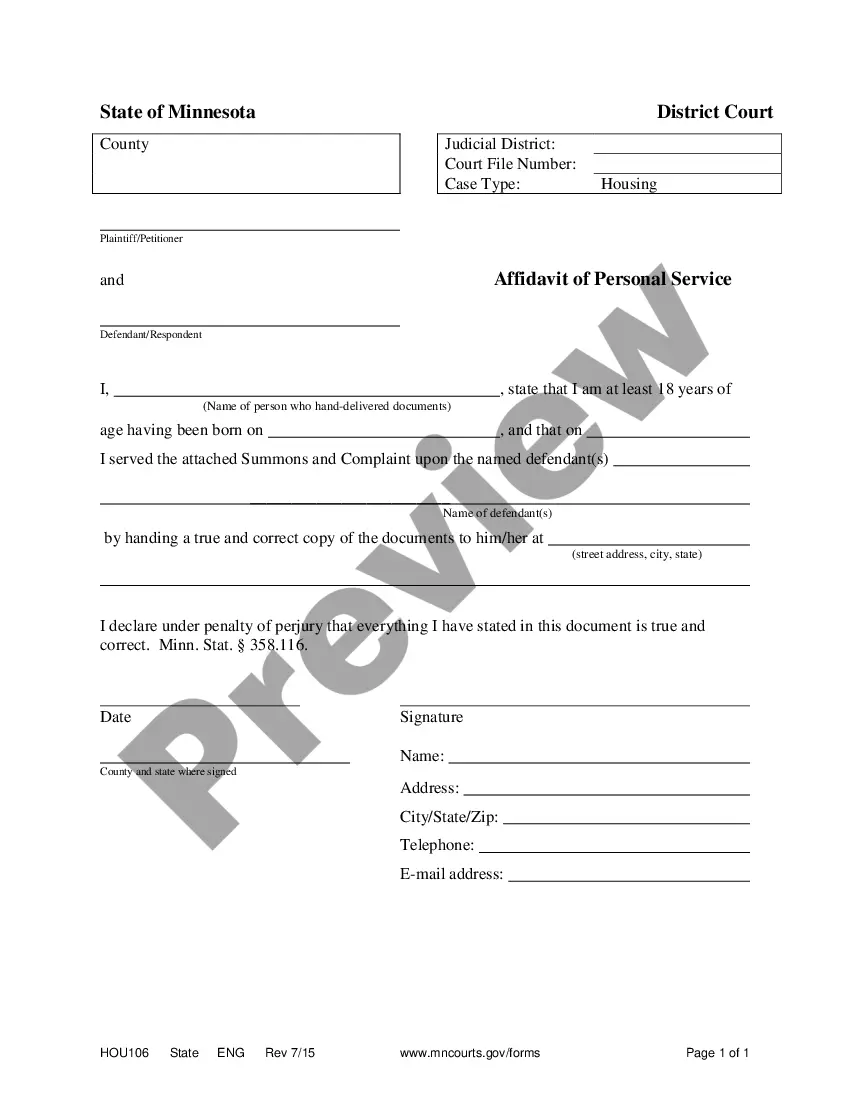

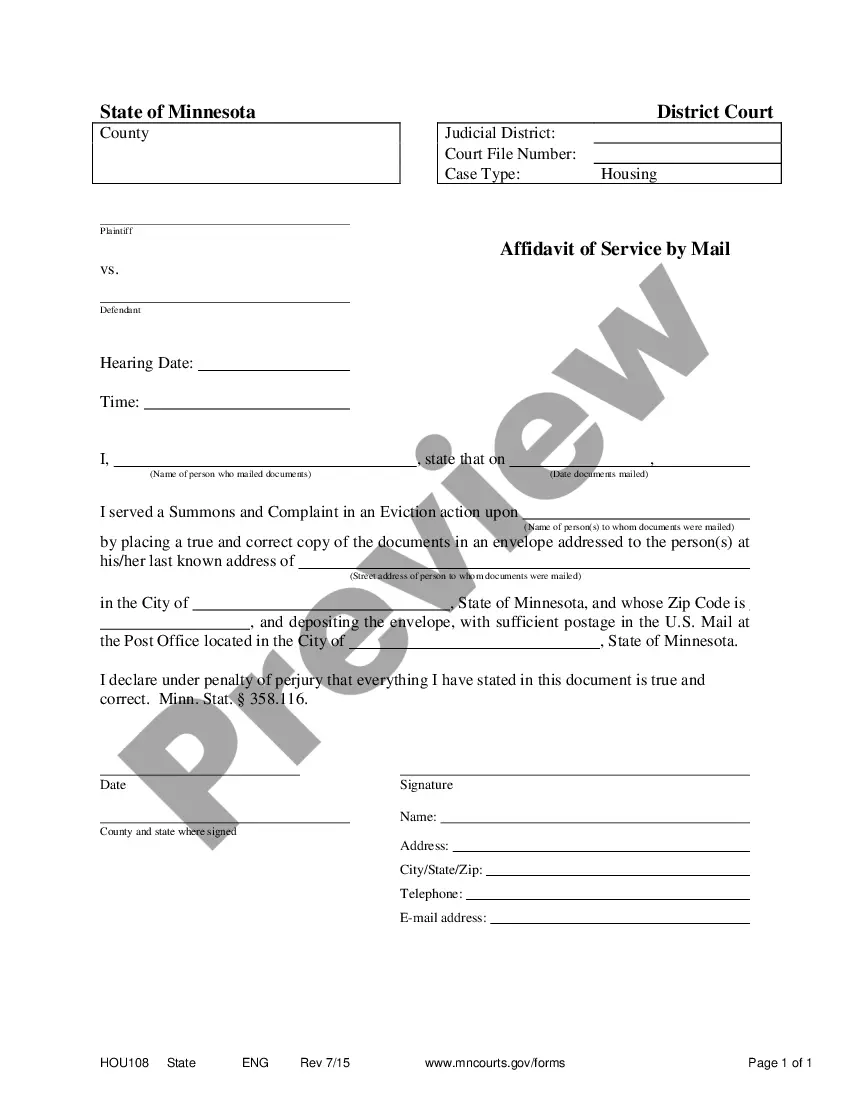

- Identify the parties involved (landlord and tenant).

- Complete each form by entering relevant information, such as names, dates, and property details.

- Sign and date the forms where indicated.

- Maintain copies of all completed forms for record-keeping and legal purposes.

Do documents in this package require notarization?

Forms in this package usually don’t need notarization, but certain jurisdictions or signing circumstances may require it. US Legal Forms provides a secure online notarization option powered by Notarize, accessible 24/7 from anywhere.

Typical mistakes to avoid

- Failing to clearly define terms in the lease agreements.

- Not documenting the condition of the property at the start and end of the lease.

- Skipping necessary disclosures required for residential rental applications.

- Not keeping copies of signed agreements for personal records.

Advantages of online completion

- Convenience of immediate access and downloadable forms.

- Editability of forms to fit specific needs and circumstances.

- Reliability of legally vetted documents drafted by licensed attorneys.

- Time-saving by having all necessary forms in one package rather than purchasing individually.

State law considerations

This Property Management Package is tailored specifically for North Carolina. It includes forms that comply with state laws regarding leasing, security deposits, and tenant rights, ensuring that users meet all necessary legal requirements in this jurisdiction.

Form popularity

FAQ

Must North Carolina property management companies have a real estate broker's license? YES.If a property manager is going to lease, rent, or list, or offers to perform any of those acts, he or she will need a broker's license. A salesperson working under a broker may engage in such activities.

A Property Management Company Needs Strong Communication. Property Managers Must Exemplify Responsive Customer Service. Managers Need to be Exceptionally Organized. Managers Need to Know the Basics of Marketing. A Property Management Company Needs to Have Hands-On Skills.

The specific licensing requirements vary from state to state, but in North Carolina you will need to be a licensed real estate broker. Plus, different rules apply depending on the properties you manage. For example, managers of government-subsidized public housing are usually required to obtain special certifications.

Fees and services. The exact breakdown and total of all services and associated fees should be included in the property management contract. The responsibilities of the property owner. Equal opportunity housing. Liability. Contract duration. Termination clause.

The fee covers the time it takes to make any adjustments to the leaseincluding performing a Comparative Market Analysis to recommend rent changes (if any)and obtain the tenant's signature. Whether the property managers charge a set fee or a percentage, the lease-renewal fee is typically around $200 or less.

Trust accounts for property managers are typically used to keep tenant deposits and rent payments separate from operating capital. Some states require that all owner funds be maintained in a separate federally insured checking account.

As The Landlord: As an investor or property owner signing a property management agreement is a legal document that allows you to enter into a business relationship with a property management company that allows you to have your property managed for a monthly or agreed upon fee.

Most property managers are required to hold a property management license or a real estate broker's license in order to conduct real estate transactions, which includes those related to managing and leasing rental properties. Only a couple of states do not have this requirement.

A property management agreement is a contract between a property owner and the company or person hired to manage the property.A well-drafted agreement includes a clause about the type of insurance coverage a building owner must carry for the building.