Wisconsin Approval of Stock Option Plan

Description

How to fill out Approval Of Stock Option Plan?

You are able to commit hrs on-line looking for the legitimate papers web template that meets the federal and state specifications you want. US Legal Forms offers thousands of legitimate types which can be examined by pros. You can actually obtain or printing the Wisconsin Approval of Stock Option Plan from the service.

If you currently have a US Legal Forms account, you can log in and click on the Down load option. Afterward, you can total, revise, printing, or indicator the Wisconsin Approval of Stock Option Plan. Each and every legitimate papers web template you buy is yours for a long time. To acquire one more version of the purchased develop, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms internet site the very first time, keep to the simple directions beneath:

- First, make certain you have chosen the best papers web template to the area/metropolis of your liking. See the develop explanation to make sure you have selected the proper develop. If offered, take advantage of the Review option to search through the papers web template at the same time.

- If you want to get one more edition of the develop, take advantage of the Research field to get the web template that meets your requirements and specifications.

- When you have discovered the web template you would like, just click Get now to carry on.

- Select the prices prepare you would like, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal account to cover the legitimate develop.

- Select the formatting of the papers and obtain it to the product.

- Make changes to the papers if necessary. You are able to total, revise and indicator and printing Wisconsin Approval of Stock Option Plan.

Down load and printing thousands of papers web templates utilizing the US Legal Forms web site, that provides the largest assortment of legitimate types. Use specialist and state-distinct web templates to deal with your organization or person requirements.

Form popularity

FAQ

A rule under the Securities Act that provides a safe harbor from registration under the Securities Act for grants of equity securities by a non-reporting company to its employees and certain other persons under the terms of a written compensatory benefit plan or written compensation contract.

Rule 701 is a safe harbor exemption created by the Securities and Exchange Commission (SEC) that allows companies to issue stock options without the time and expense of registration of the stock under the Securities Act. Rule 701 only applies to private companies.

Rule 701 is a federal exemption under the Securities Act of 1933 that allows private companies to issue securities to employees and other service providers. This is especially useful when not all of your employees or service providers are accredited investors eligible for other securities exemptions like Regulation D.

Rule 701 is an exemption for the offer and sale of unregistered securities by the issuer company. The exemption that applies to sales of unregistered stock by the shareholder is Rule 144. Rule 144 is an entirely different discussion.

To pass Rule 701, your company must meet one of the following requirements: The dollar value of your Rule 701 shares is less than $1,000,000. The quantity of your Rule 701 shares must be less than 15% of the outstanding shares (15% of outstanding shares amount, excluding shares issued under Rule 701).

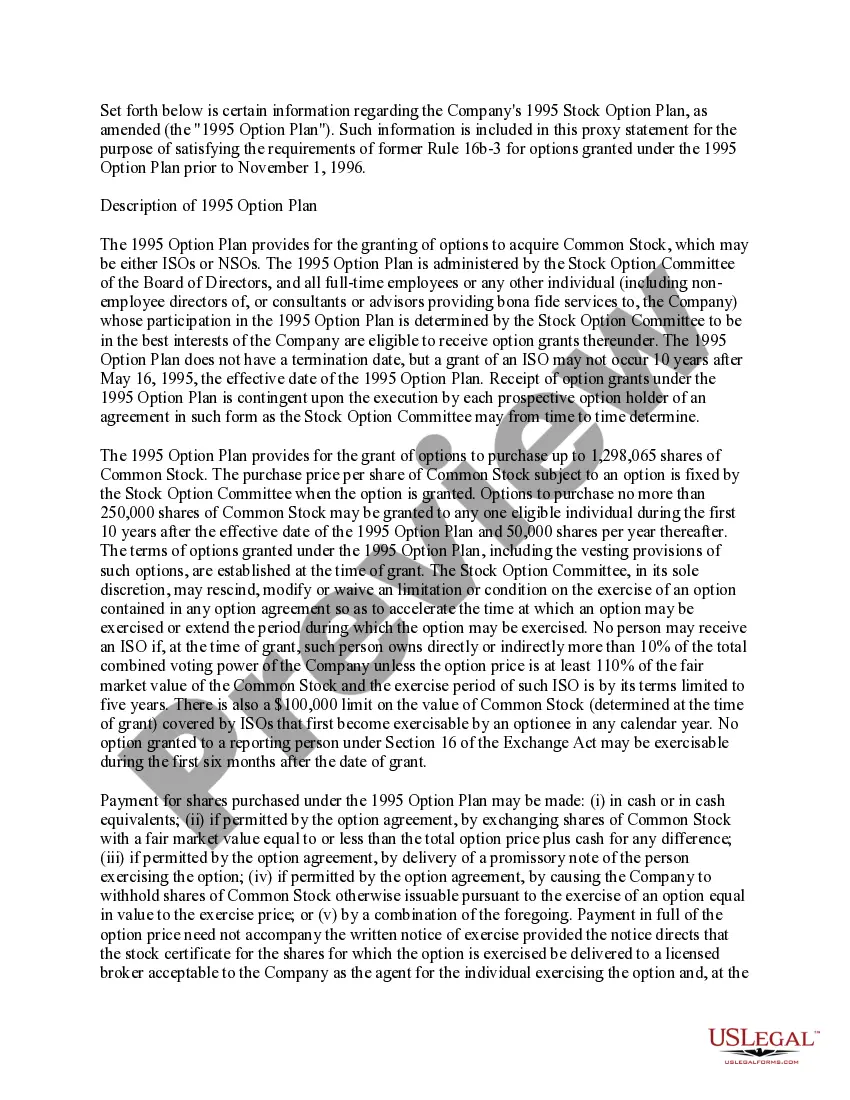

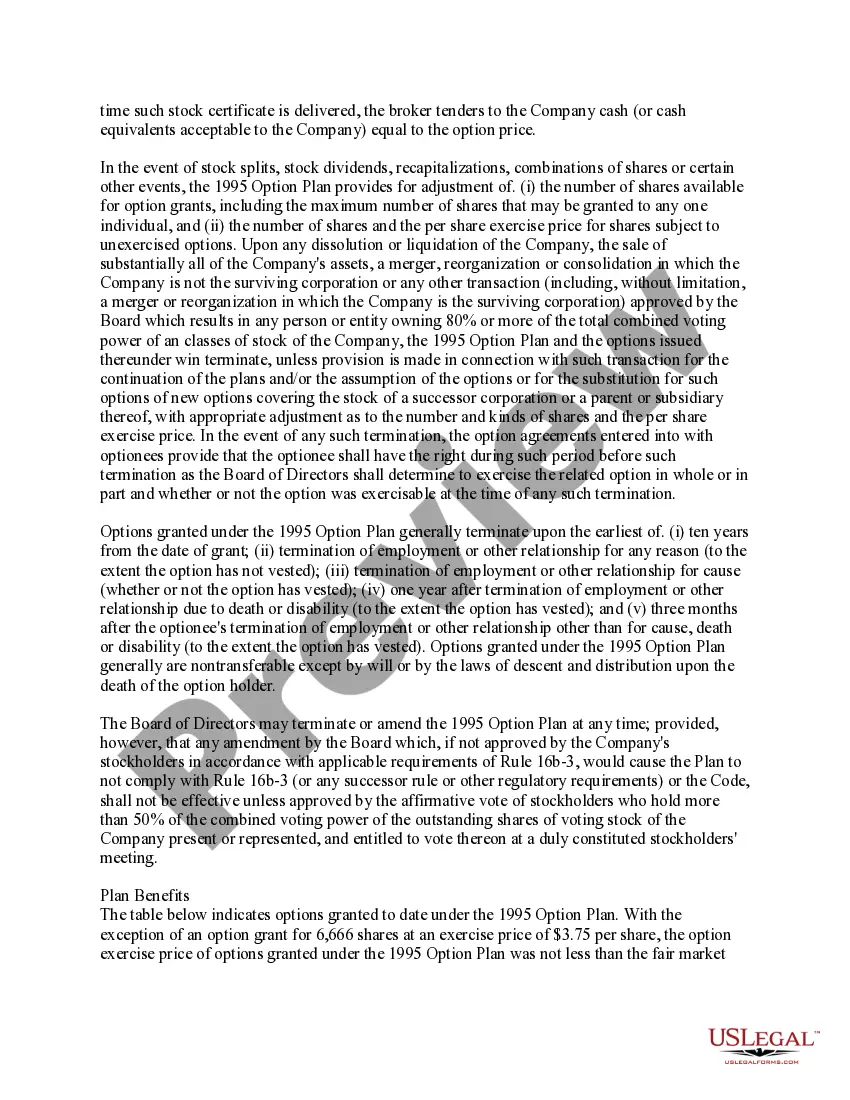

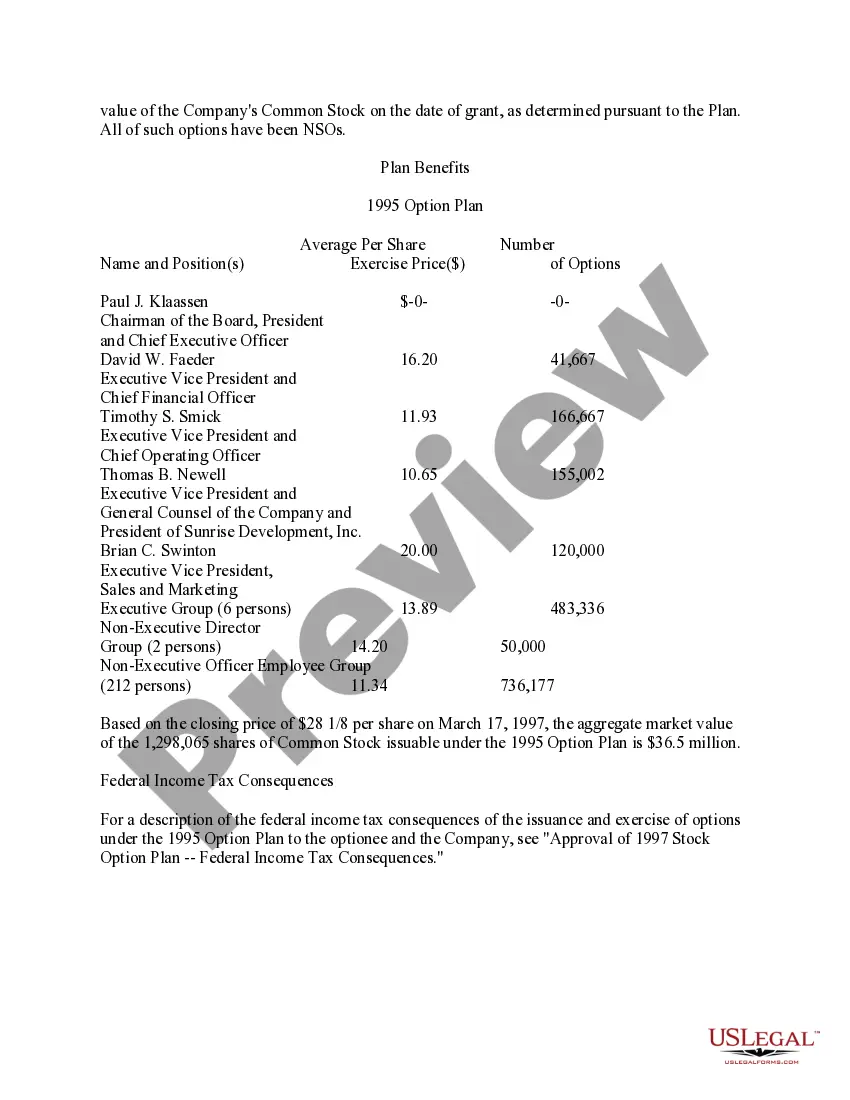

Stock options are only for people Finally, Rule 701 generally provides that only natural persons can be granted options under a stock option plan. This issue often arises when a consultant provides services to the company and asks to have their options titled in the name of their LLC.