Wisconsin Involuntary Petition Against a Non-Individual

Description

How to fill out Involuntary Petition Against A Non-Individual?

Choosing the right legitimate file template could be a have difficulties. Naturally, there are a variety of layouts available on the net, but how can you get the legitimate develop you require? Make use of the US Legal Forms website. The service provides 1000s of layouts, like the Wisconsin Notice to Creditors and Other Parties in Interest - B 205, which can be used for organization and personal needs. Every one of the forms are inspected by professionals and fulfill state and federal demands.

Should you be presently authorized, log in to your bank account and click the Obtain button to have the Wisconsin Notice to Creditors and Other Parties in Interest - B 205. Use your bank account to check through the legitimate forms you possess purchased previously. Proceed to the My Forms tab of your bank account and have another version in the file you require.

Should you be a brand new user of US Legal Forms, here are basic recommendations that you can comply with:

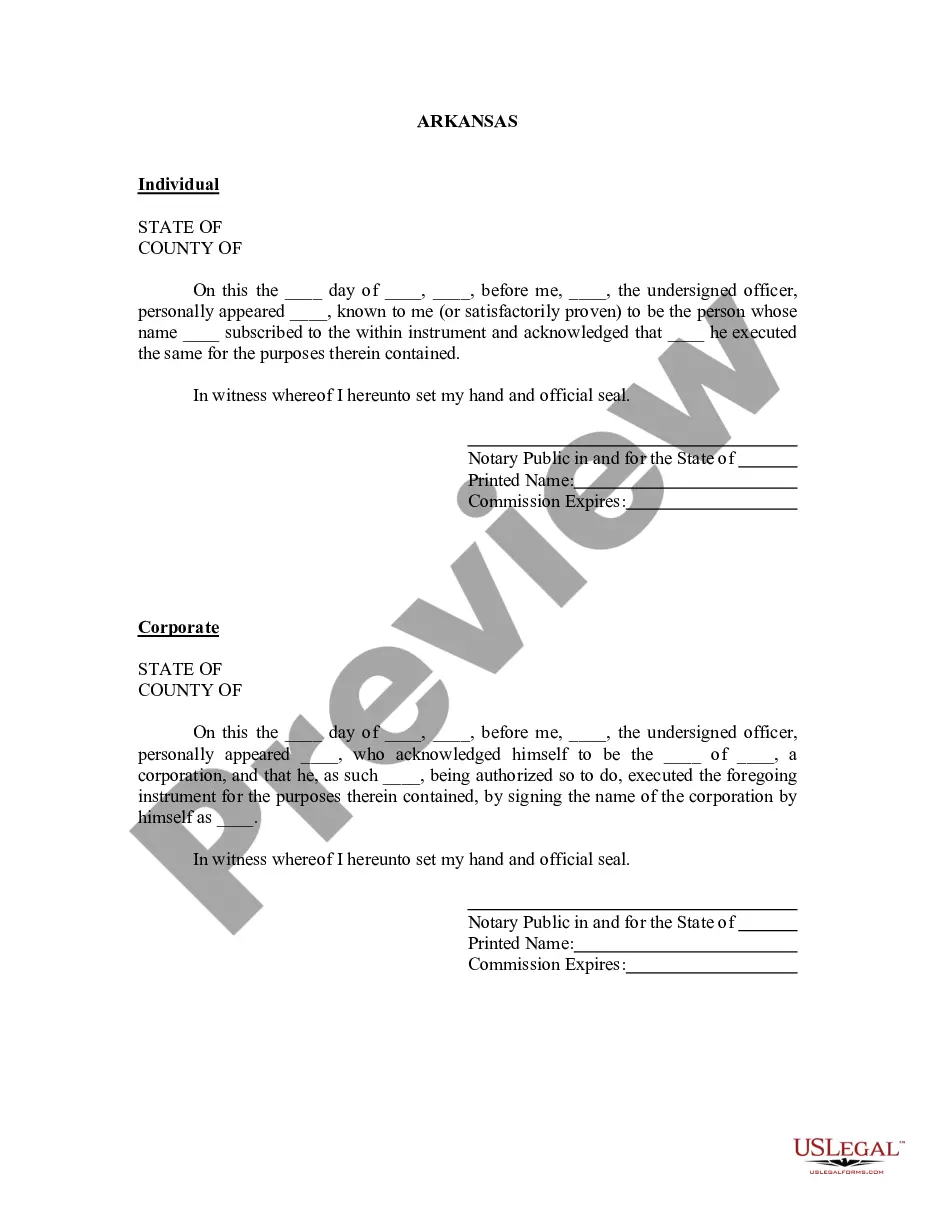

- First, make certain you have chosen the correct develop for your personal town/state. You can check out the shape utilizing the Review button and study the shape explanation to guarantee it is the right one for you.

- When the develop is not going to fulfill your expectations, take advantage of the Seach field to discover the appropriate develop.

- Once you are certain the shape is suitable, select the Buy now button to have the develop.

- Select the costs strategy you desire and type in the essential information. Design your bank account and pay for the transaction using your PayPal bank account or charge card.

- Select the data file format and obtain the legitimate file template to your gadget.

- Total, edit and print and indication the obtained Wisconsin Notice to Creditors and Other Parties in Interest - B 205.

US Legal Forms is the biggest collection of legitimate forms in which you can find a variety of file layouts. Make use of the service to obtain professionally-created papers that comply with status demands.

Form popularity

FAQ

Thus, the time needed for probate depends on such factors as estate size, type of assets owned, form of ownership, tax issues, complexity of creditors' claims, marital property issues, and whether a business is involved. State law requires that an estate be closed within 18 months.

WI Form PR-1806, which may also referred to as Proof Of Heirship (Informal And Formal Administration), is a probate form in Wisconsin. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

The Transfer by Affidavit process may be used to close a person's estate when the deceased had $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

Interested Person: Includes one or more of the following: 1) an heir of the deceased if named in the Will or not; 2) a beneficiary named in the Will who may include a beneficiary of a trust and a nominated trustee; 3) the Personal Representative named in the Will.

A Wisconsin small estate affidavit, also known as a Transfer by Affidavit, helps heirs, successors and beneficiaries of estates valued at $50,000 or less receive what they are entitled to more quickly than through traditional means.

Filing in Filing in Probate: A Will needs to be filed in the probate court. There may be other paperwork the decedent needs to file at the same time. Gathering Information: The executor needs to begin gathering information, such as identifying the heirs of the decedent as well as the decedent's assets and debts.

Pursuant to Wisconsin State Statute Section 867.03, Transfer by Affidavit is used for solely owned property within this state valued under $50,000. Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate.

Pursuant to Wisconsin State Statute Section 867.03, Transfer by Affidavit is used for solely owned property within this state valued under $50,000. Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate.