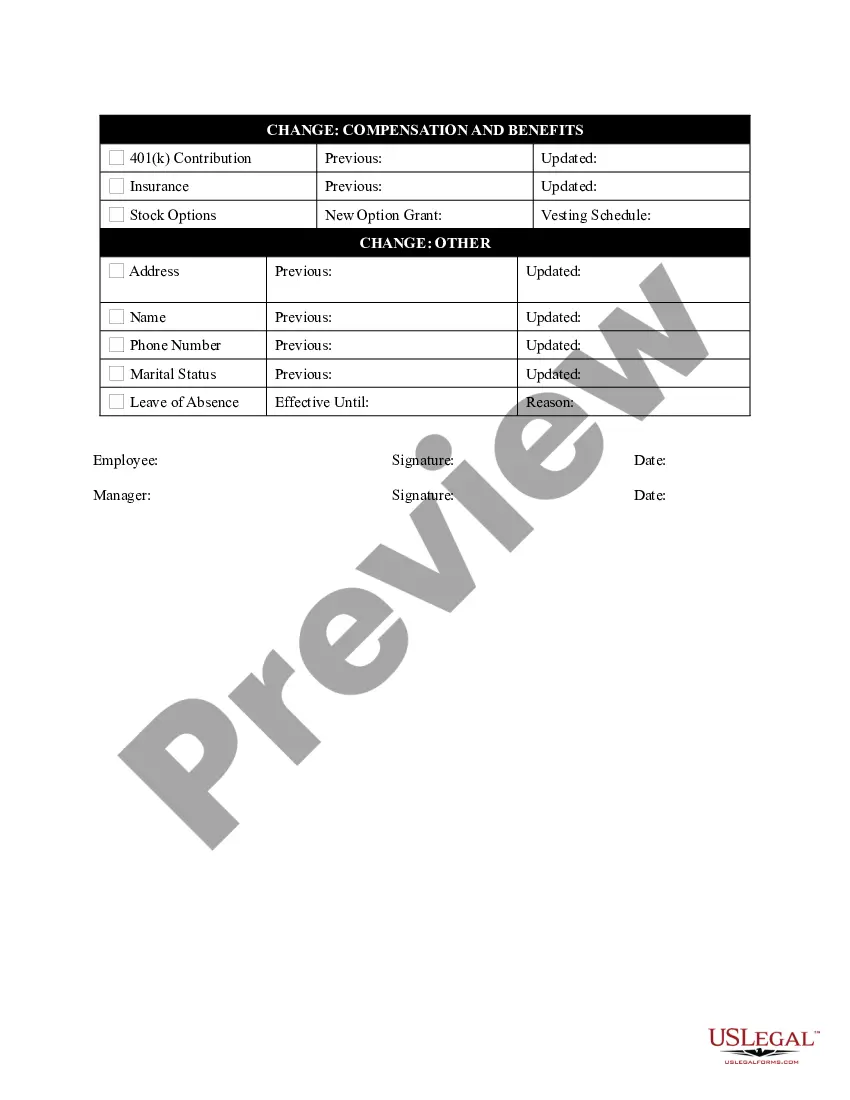

Wisconsin Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

You can invest hours online looking for the legal document template that fulfills the federal and state requirements you have.

US Legal Forms offers a vast selection of legal forms that can be evaluated by professionals.

It is easy to acquire or print the Wisconsin Personnel Status Change Worksheet from our service.

If available, utilize the Review option to look through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you may complete, modify, print, or sign the Wisconsin Personnel Status Change Worksheet.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased document, visit the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Check the document description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. (For example you're a college student and your parents claim you). This ensures the maximum amount of taxes are withheld from each paycheck.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck.

If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages. This applies only to income tax, not to Social Security or Medicare tax.

Form WT-4A is an agreement between the employee and employer that a lesser amount will be withheld from the employee's wages than is provided for in the Wisconsin income tax withholding tables.