Wisconsin Startup Package

Description

How to fill out Startup Package?

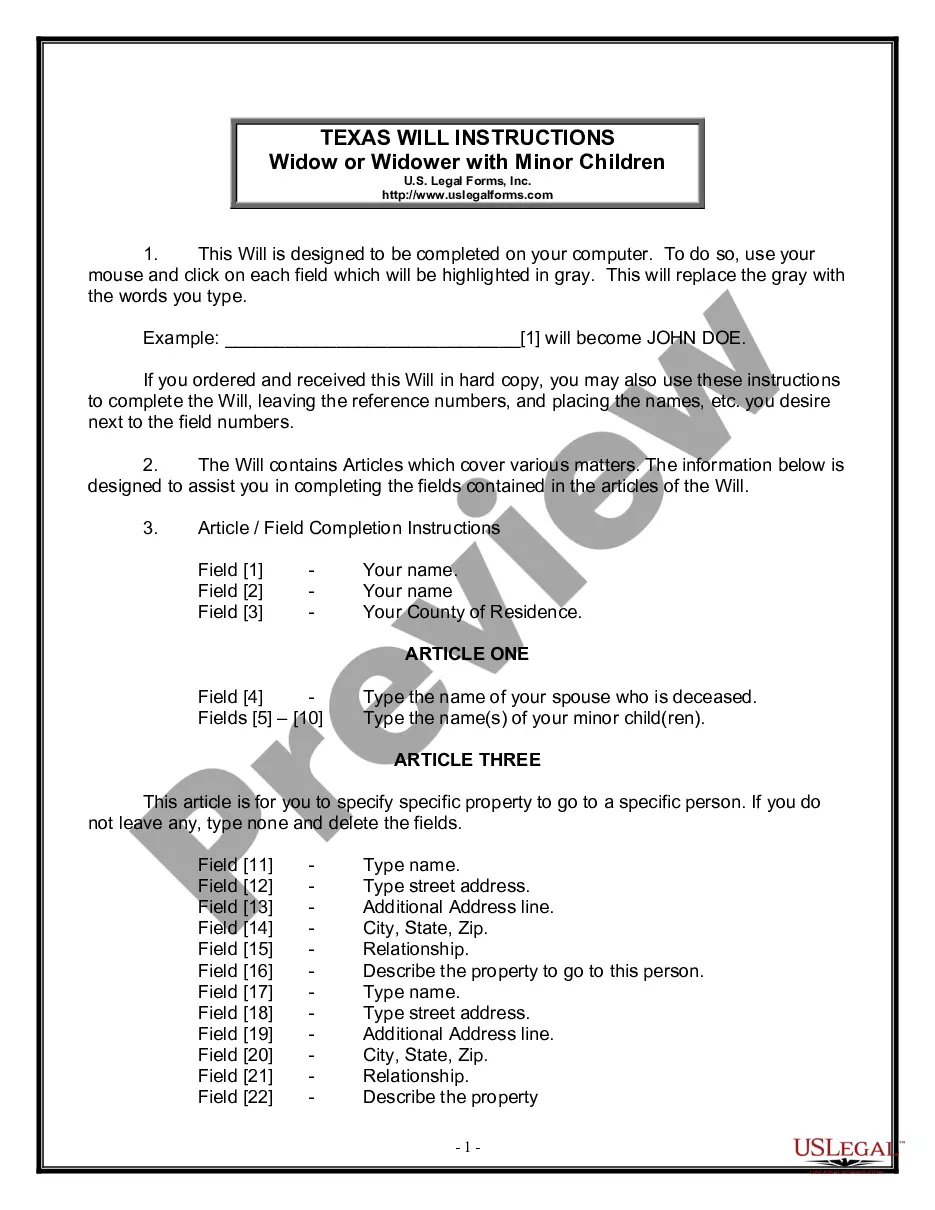

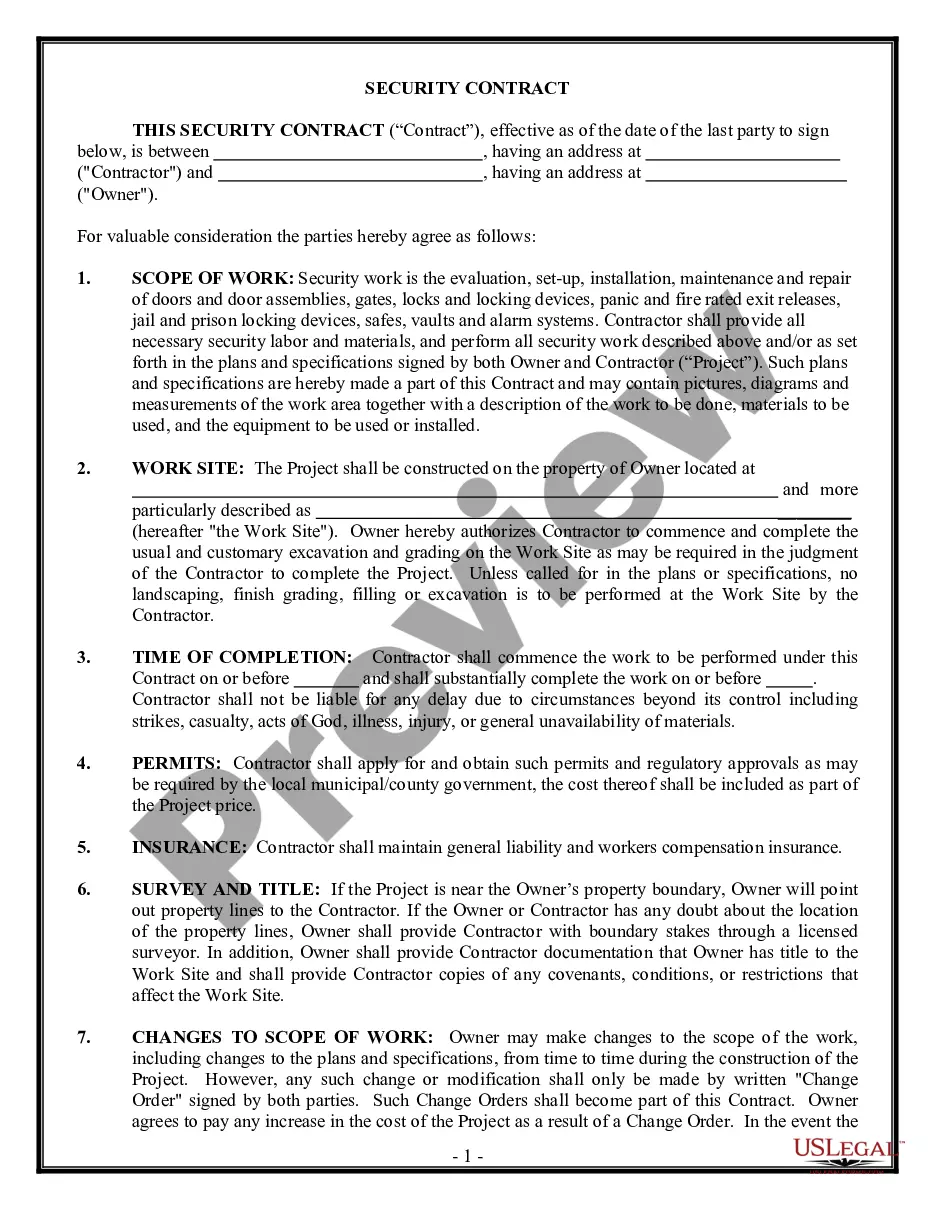

You can devote hrs on-line attempting to find the legal document web template that meets the federal and state requirements you will need. US Legal Forms gives a large number of legal varieties that are examined by pros. It is possible to acquire or printing the Wisconsin Startup Package from the assistance.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Acquire button. Following that, you are able to complete, modify, printing, or sign the Wisconsin Startup Package. Each and every legal document web template you get is your own for a long time. To acquire an additional backup associated with a bought form, check out the My Forms tab and then click the related button.

If you use the US Legal Forms internet site the very first time, adhere to the easy instructions under:

- First, make certain you have selected the proper document web template for the region/town that you pick. Read the form description to ensure you have selected the appropriate form. If available, use the Preview button to search throughout the document web template too.

- If you would like discover an additional version of the form, use the Lookup field to discover the web template that meets your requirements and requirements.

- After you have found the web template you need, simply click Buy now to move forward.

- Choose the prices program you need, enter your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal accounts to cover the legal form.

- Choose the file format of the document and acquire it for your device.

- Make alterations for your document if required. You can complete, modify and sign and printing Wisconsin Startup Package.

Acquire and printing a large number of document web templates while using US Legal Forms web site, which provides the greatest variety of legal varieties. Use specialist and condition-particular web templates to deal with your small business or individual requires.

Form popularity

FAQ

File Wisconsin Certificate of Formation Agency:Wisconsin Department of Financial Institutions (DFI) - Division of Corporate and Consumer Services - Corporations BureauForm:Articles of OrganizationFiling Method:Mail or online.Agency Fee:$170 via mail or $130 online.Turnaround:~4-7 business days2 more rows

SBA provides limited small business grants and grants to states and eligible community organizations to promote entrepreneurship.

What are the requirements to form an LLC in Wisconsin? You must file articles of organization, appoint a registered agent, and pay a $130 filing fee. An operating agreement is recommended but not required.

You'll need to obtain a business license from the Wisconsin Department of Transportation, and you'll also need to obtain insurance. In addition, you'll need to pass a background check.

Main Street Bounceback Grants spur economic well-being in communities throughout Wisconsin by providing $10,000 to help new or existing businesses move into and revitalize vacant commercial properties.

$10,000 grants will be awarded to eligible businesses to assist with costs associated with leases, mortgages, operational expenses and other business costs related to the newly opened location.

A: Yes, these funds are taxed. Q: How long is the grant approval process?

Are payments from the Wisconsin Tomorrow Small Business Recovery Grant program taxable income? Income from the program is included in federal income under sec. 61 of the Internal Revenue Code, unless an exemption applies.