Wisconsin Job Share Proposal and Agreement

Description

How to fill out Job Share Proposal And Agreement?

Are you in the situation where you require documentation for both corporate or personal purposes almost every working day.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides a vast array of template options, including the Wisconsin Job Share Proposal and Agreement, which are designed to comply with federal and state requirements.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can retrieve another copy of the Wisconsin Job Share Proposal and Agreement at any time, if required. Simply follow the necessary link to download or print the document template.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Wisconsin Job Share Proposal and Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you are looking for and ensure it corresponds to the correct city/county.

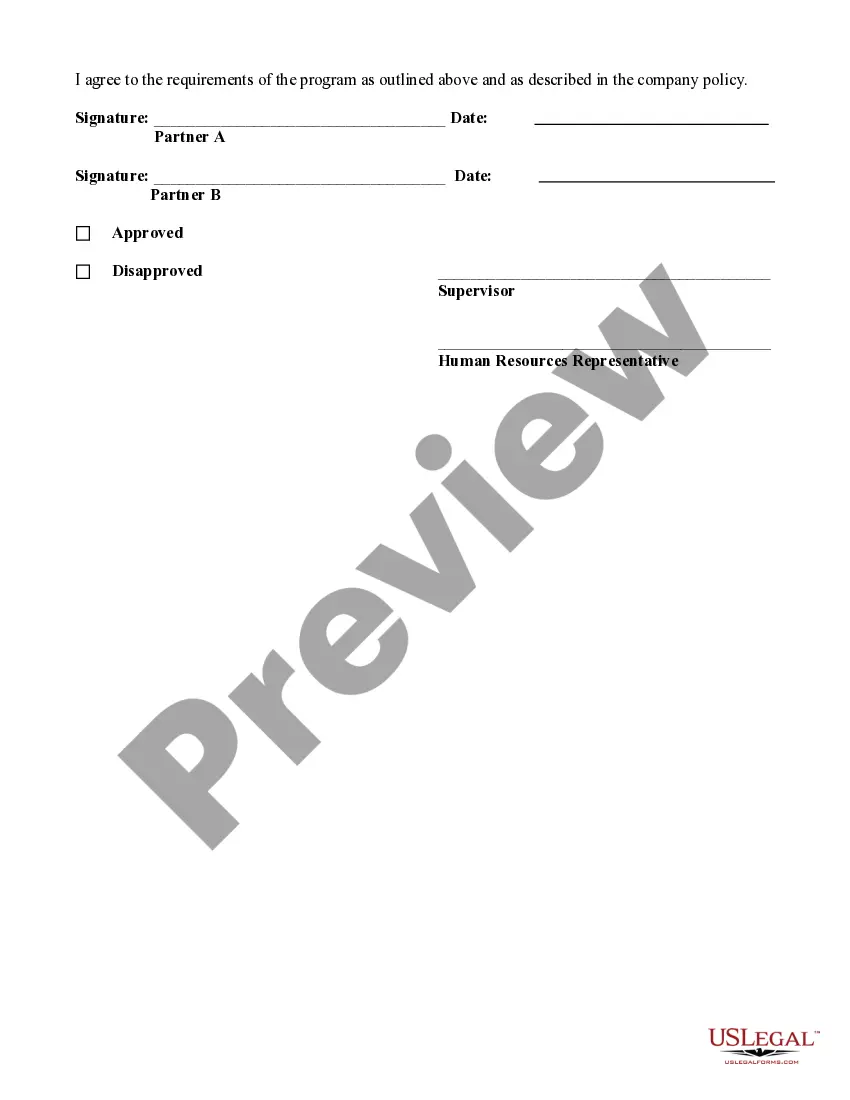

- Utilize the Review button to assess the form.

- Check the description to verify you have selected the correct template.

- If the template is not what you’re looking for, use the Research area to find the document that meets your needs and criteria.

- Once you acquire the appropriate template, click Get now.

- Select the pricing plan you desire, fill out the required information to create your account, and purchase the order using your PayPal or credit card.

Form popularity

FAQ

The Wisconsin WT-4 form is a crucial document used for state income tax withholding. It allows employees in Wisconsin to specify their withholding preferences and exemptions. Understanding this form is important, especially for those involved in arrangements like the Wisconsin Job Share Proposal and Agreement, as accurate tax withholding is necessary for proper financial planning.

The Work-Share Program (also called Short-Term Compensation or STC), is designed to help both employers and employees. Instead of laying off workers, a qualified employer can plan to reduce work hours for at least twenty employees.

Even if you have been paid enough wages from covered employment to qualify for unemployment benefits, you will not receive benefits if you: quit a job without good cause. UI law suspends your benefits until you earn 6 times your WBR. are fired for misconduct.

You must be available for full-time work to be eligible for unemployment insurance benefits. If you are available to work 32 hours per week, you may be eligible for benefits.

The Republican-controlled Wisconsin Legislature voted June 9 to eliminate the $300-a-week federal bonus for unemployed people. The federal payment, approved to help the unemployed during the coronavirus pandemic, is scheduled to end on Sept. 6.

In February 2021, the Department of Workforce Development (DWD) had published a new Emergency Rule that allowed DWD to continue to waive work searches for people who applied for Unemployment Insurance (UI) benefits, in response to the ongoing effects of the COVID-19 pandemic.

Even when sufficient wages qualify you for benefits, other reasons can disqualify you including: Leaving work voluntarily without good cause. Being discharged for misconduct connected with employment. Being discharged for cause, other than misconduct.

According to employment law attorney Ellen Frantz, the new law stated that if an employee makes the same mistake multiple times after being warned, the employee can be fired and denied unemployment benefits on the grounds of substantial fault.

Actively seeking suitable work. Register with Job Service. You must register as directed with Job Center of Wisconsin to be eligible to collect UI benefits. If the job hours were cut, you should not be working more than 32 hours a week to qualify for unemployment benefits.

The maximum and minimum benefit rates are determined by UI law. The minimum WBR is $54, requiring high quarter earnings of $1,350; and the maximum WBR is $370, requiring high quarter earnings of $9,250.