Wisconsin Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

You have the ability to spend several hours online trying to locate the approved document template that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can easily download or print the Wisconsin Bill of Sale of Personal Property - Reservation of Life Estate in Seller from your service.

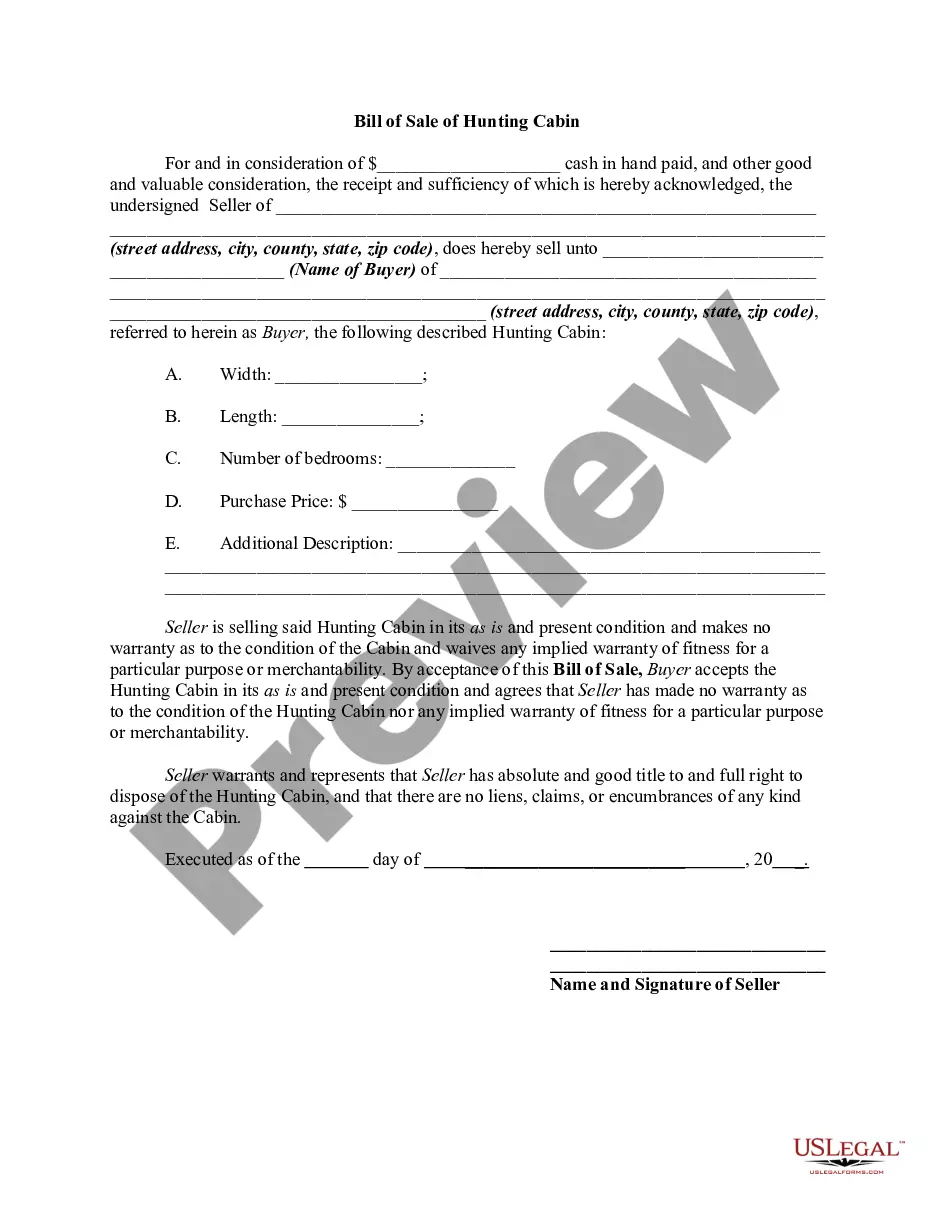

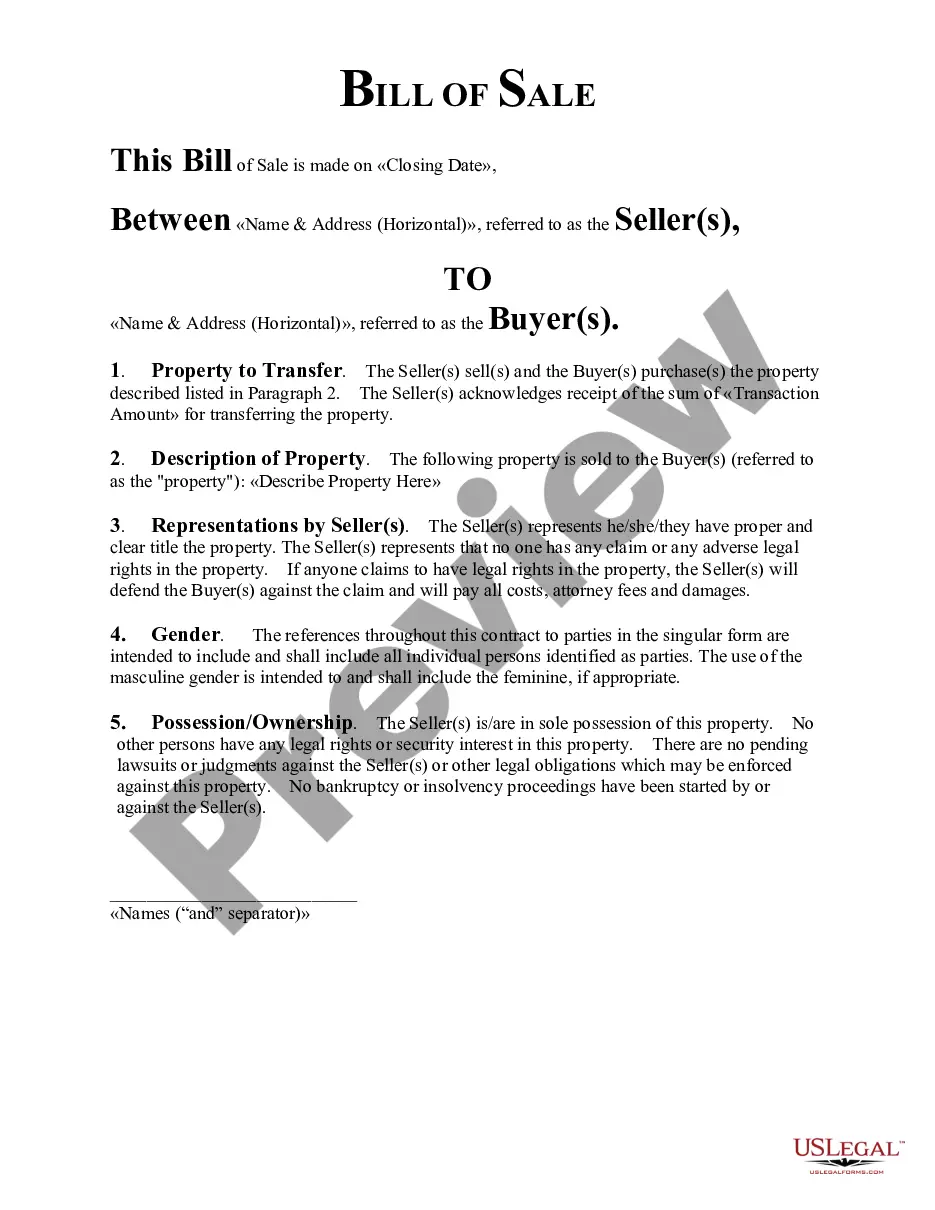

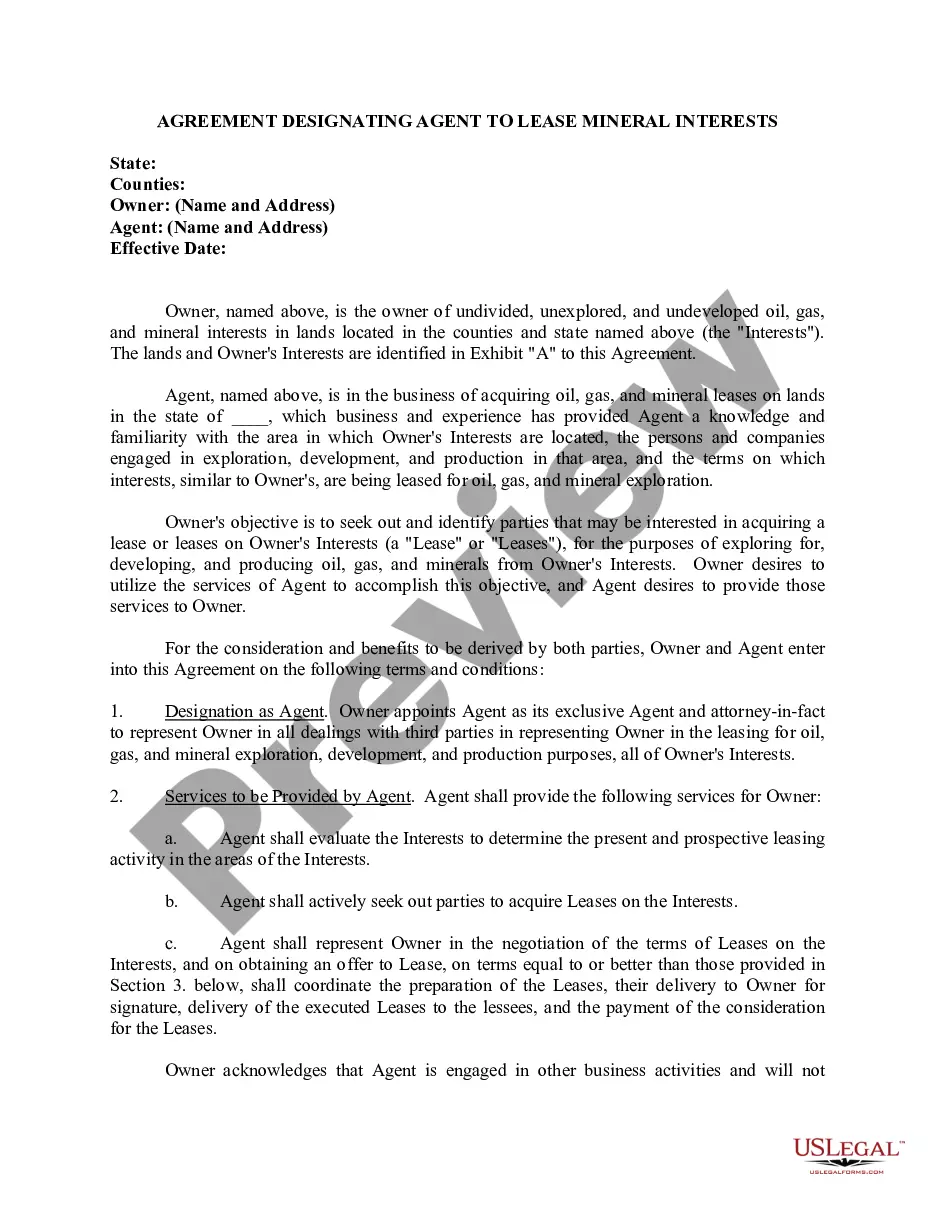

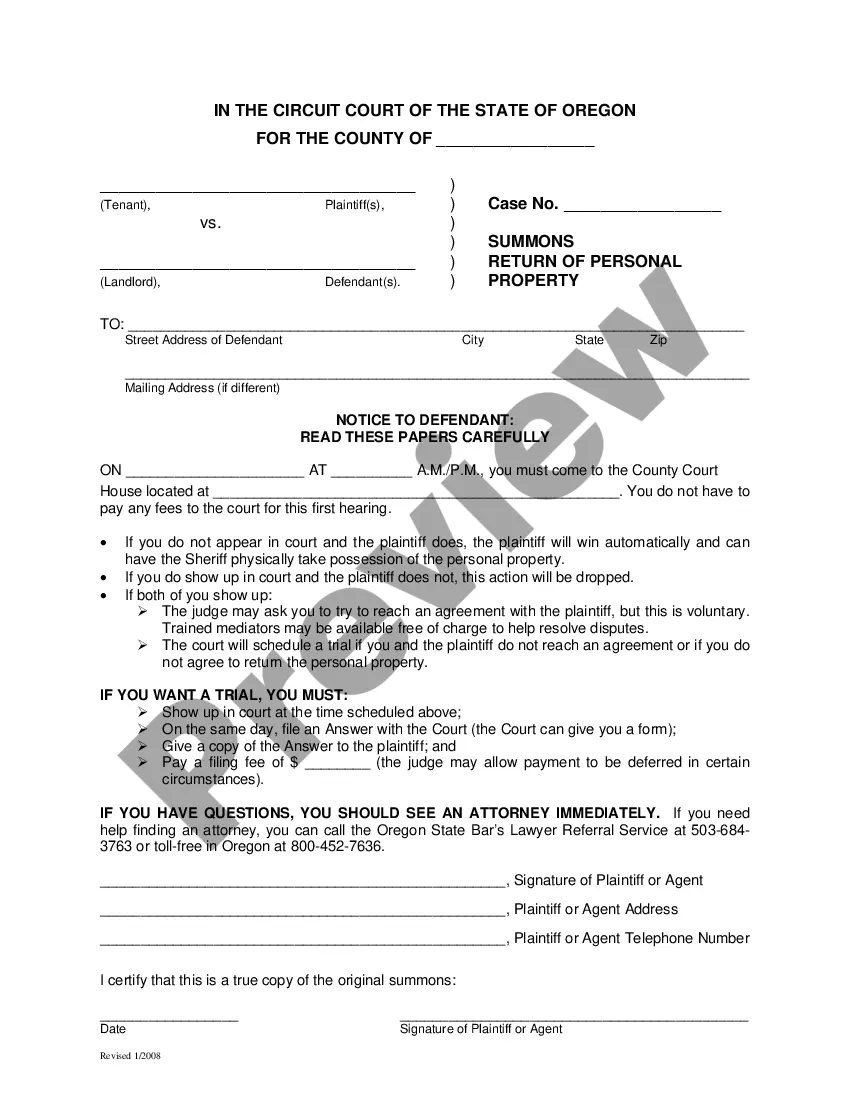

If available, take advantage of the Preview button to view the document template as well. If you wish to obtain an additional version of the form, utilize the Search field to find the template that suits your needs.

- If you possess a US Legal Forms account, you can Log In and press the Download button.

- Afterward, you can complete, modify, print, or sign the Wisconsin Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

- Each legal document template you purchase is yours for eternity.

- To obtain another copy of a purchased form, navigate to the My documents tab and select the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple guidelines below.

- First, ensure that you have chosen the correct document template for the area of your preference.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

To list a house for sale by owner in Wisconsin, start by preparing your property for sale. Clean, declutter, and make any necessary repairs to enhance its appeal. Next, you can list your property online on various platforms or use social media to reach potential buyers. Don’t forget to prepare a Wisconsin Bill of Sale of Personal Property - Reservation of Life Estate in Seller to ensure a smooth transaction when you find a buyer.

Legally, the items you listed are personal property because they are not permanently attached to the house. Unless specifically itemized, such personal property is not included in the home sale.

Advantages of a Life Estate No probate proceeding will be required to transfer title. The transfer/gift of the property to the persons who are deeded the property is a completed gift/transfer.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

In a nutshell, real property is anything that's immovable and attached to the house - walls, windows, blinds, light fixtures, doors, and (most) appliances. Personal property is anything that can be moved or taken from the house - furniture, artwork, above-ground hot tubs, and more.

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

A seller of any type of property may choose to sell the property as-is. Generally, an as-is clause means the seller (1) will not complete a RECR or other condition reports, leaving the buyer primarily responsible for determining the condition of the property being purchased, and (2) will not repair the property or

Life Estates are simple and inexpensive to establish; merely requiring that a new Deed be recorded. Life Estates avoid probate; the property automatically transfers to your heirs upon the death of the last surviving Life Tenant. Transferring title following your death is a simple, quick process.

Under a life estate deed, however, the remainder owner's tax basis is the value of the home at the time of the life tenant's death (a stepped-up basis), greatly reducing or even eliminating any capital gains tax consequences of future sale of the property. Medicaid Exemption After Five Years.

Gift Taxes: In most cases, no gift tax should be owed as a result of the creation of the Life Estate form. However, since you may be required to file a gift tax return, it is important to consult your accountant prior to filing your income tax return for the year in which the transfer was made.