Wisconsin Exempt Survey

Description

How to fill out Exempt Survey?

You can invest hours online attempting to locate the authentic document template that complies with the federal and state requirements you need.

US Legal Forms provides thousands of valid forms that have been reviewed by professionals.

You can easily obtain or create the Wisconsin Exempt Survey from the service.

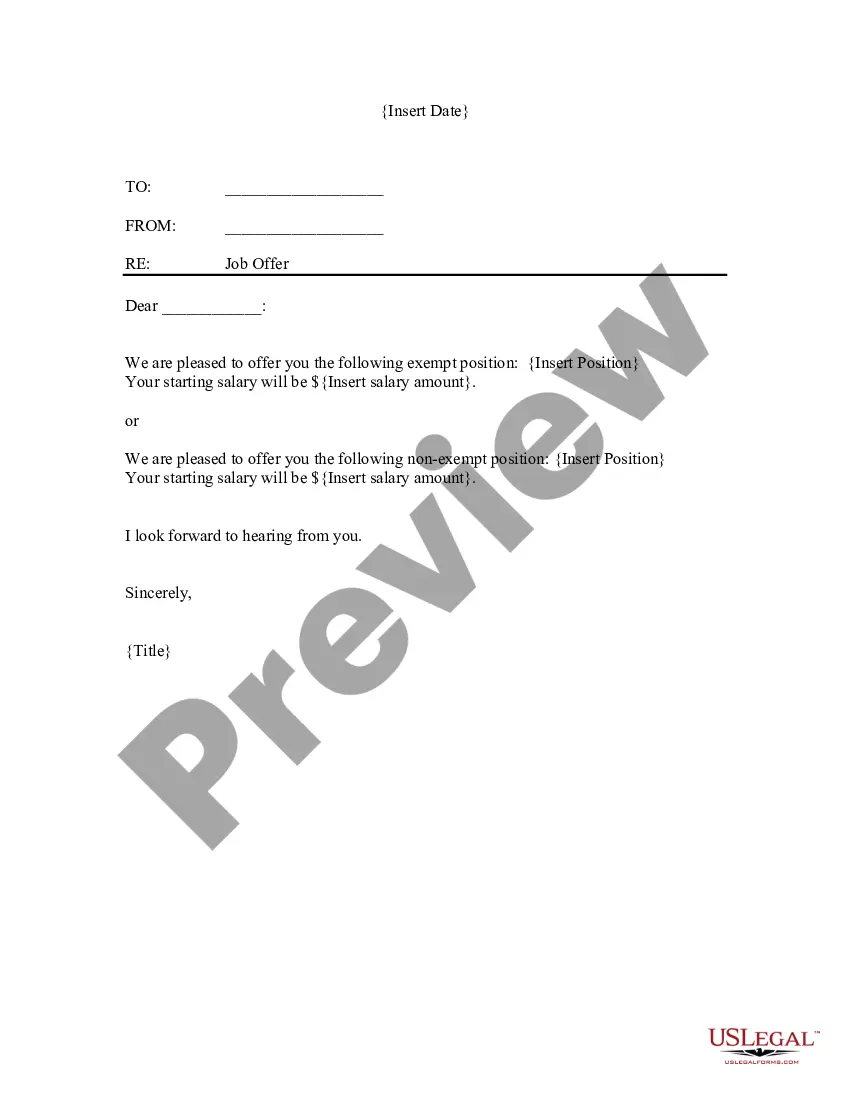

If available, use the Review button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Wisconsin Exempt Survey.

- Each valid document template you obtain is yours permanently.

- To get another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Check the form details to confirm you've selected the correct document.

Form popularity

FAQ

Register online with the Department of Revenue by selecting Register Qualified WI Business. It generally will take a few business days for you to receive your tax number. For more information, visit the Department of Revenue website.

Section 77.54 (30) (a) 5., Stats., exempts the sales price from the sale of fuel sold for use in farming, including but not limited to agriculture, dairy farming, floriculture, silviculture, beekeeping, and horticulture. Tax 11.12(4)(c)1.

Description. A Certificate to be accomplished and issued by a Payor to recipients of income not subject to withholding tax. This Certificate should be attached to the Annual Income Tax Return - BIR Form 1701 for individuals, or BIR Form 1702 for non-individuals. Filing Date.

Send a Certificate of Exemption information can be sent to Wisconsin Public Service Customer Service, P.O. Box 19001, Green Bay, WI 54307-9001 or fax it to 800-305-9754. Prior to sending in your certificate of exemption. Please review our certificate of exemption checklist.

Exempt occasional sales by nonprofit organizations. Sales by neighborhood associations, churches, social clubs, civic clubs, garden clubs, and other nonprofit organizations which conduct one or more fundraising events during the year are exempt if certain conditions are met.

(a) Continuous or blanket exemption certificates do not expire and need not be renewed at any prescribed interval. However, they should be renewed at reasonable intervals in case of a business change, registration number change, or discontinuance of the specific business claiming the exemption.

The U.S. Department of Agriculture defines a farm as any place from which $1,000 or more of agricultural products were produced and sold or normally would have been sold during the year.

Form 1NPR (fillable) Nonresident and Part-Year Resident Wisconsin Income Tax Return · Instructions. Tax Information for Part-Year Residents and Nonresidents of Wisconsin (including information for Aliens) This document outlines state requirements for part-year residents and nonresidents of Wisconsin.

Apply for a CES number by completing Form S-103, Application for Wisconsin Sales and Use Tax Certificate of Exempt Status. Include a copy of your organization's 501(c)(3) determination letter from the IRS.

Typically, though, you can be exempt from withholding tax only if two things are true:You got a refund of all your federal income tax withheld last year because you had no tax liability.You expect the same thing to happen this year.