Wisconsin Employee Compliance Survey

Description

How to fill out Employee Compliance Survey?

If you need to be thorough, acquire, or duplicating legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal use are organized by categories and indicates, or keywords and phrases.

Step 4. Once you found the form you need, click the Purchase now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to retrieve the Wisconsin Employee Compliance Survey with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Obtain button to locate the Wisconsin Employee Compliance Survey.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

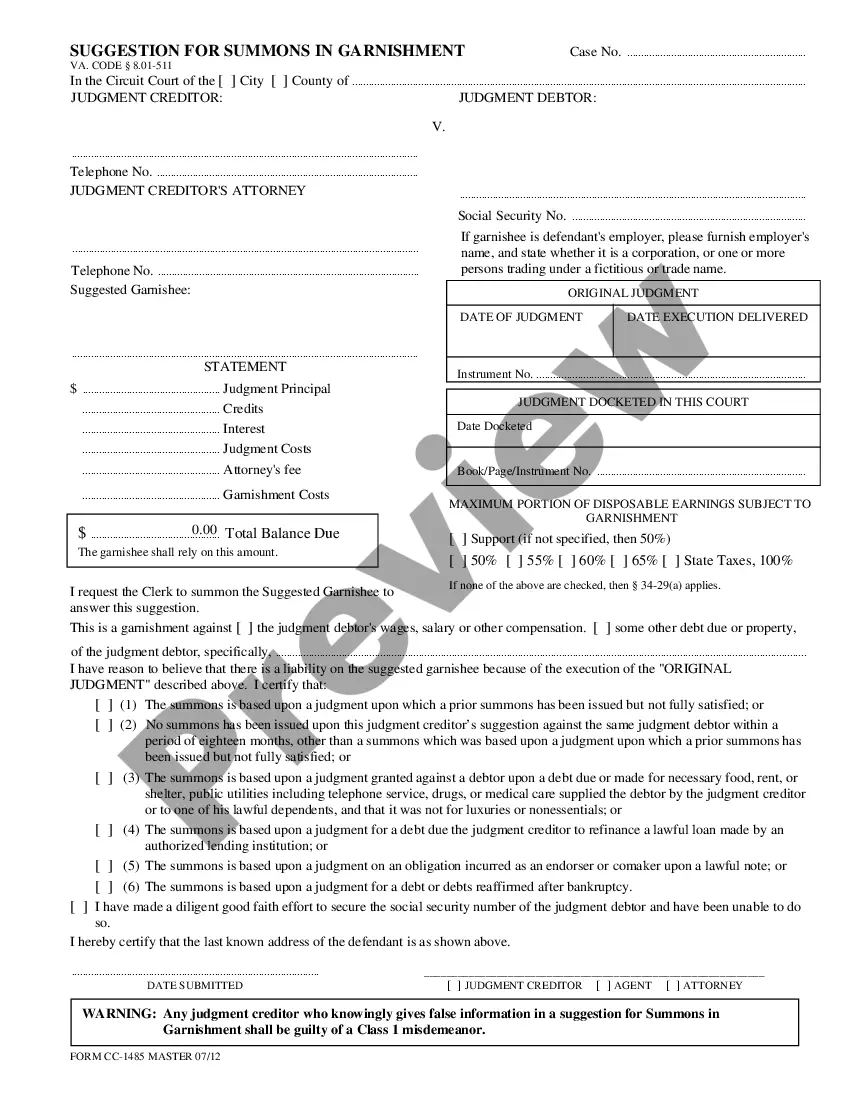

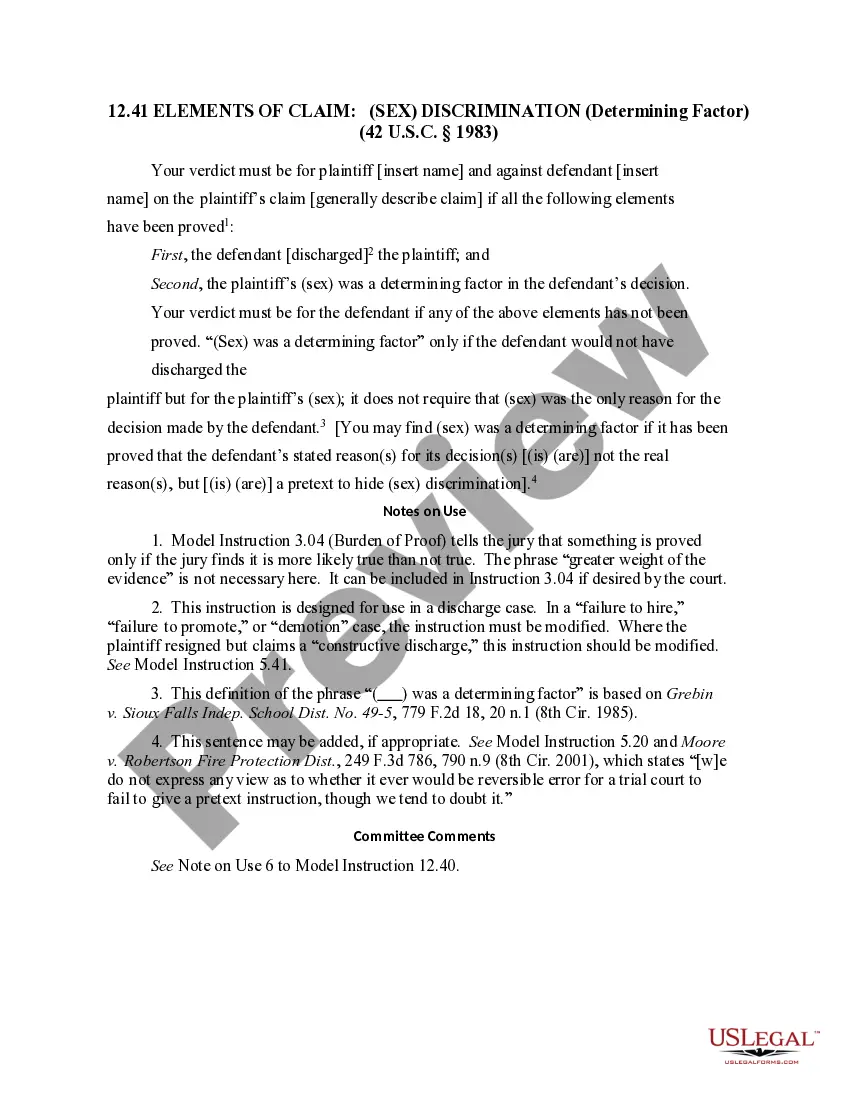

- Step 2. Utilize the Review option to examine the form's details. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

A compliance survey is an assessment tool used to ensure that businesses adhere to state and federal regulations. In the context of employee compliance, it helps identify gaps in hiring practices and training programs. Conducting a Wisconsin Employee Compliance Survey allows employers to maintain transparent hiring processes and foster a compliant workplace.

Typically, a Wisconsin background check takes about 1 to 3 business days to process. However, delays may occur if there are complications with the records. Understanding the processing time is essential, particularly for organizations conducting the Wisconsin Employee Compliance Survey, as timely background checks contribute to efficient hiring practices.

To obtain a background check in Wisconsin, you must submit a request to the Wisconsin Department of Justice. You can complete this process online or by mail, ensuring you provide necessary identification and payment. This background check is a crucial step in the Wisconsin Employee Compliance Survey, as it verifies potential employees' histories and qualifications.

In Wisconsin, employers are responsible for paying unemployment taxes to fund the state’s unemployment insurance program. These taxes support workers who become unemployed to ensure they have financial assistance during tough times. This aspect of employee compliance is a vital component of the Wisconsin Employee Compliance Survey.

To report an employer for misclassification of employees in Wisconsin, you can contact the state's Department of Workforce Development or file a complaint online. Misclassification undermines fair labor practices and reporting it helps protect workers' rights. Understanding this process is included in the insights provided in the Wisconsin Employee Compliance Survey.

Employers in Wisconsin can submit required new hire reporting either online through the state’s portal or via mail using physical forms. Choosing the online submission method can streamline the process and ensure quicker compliance. This efficiency is a key point discussed in the Wisconsin Employee Compliance Survey.

In Wisconsin, employers must ensure that job postings include the job title, duties, qualifications, and application process. Adhering to state job posting requirements not only helps in attracting the right candidates but also aligns with practices outlined in the Wisconsin Employee Compliance Survey.

Filing for unemployment in Wisconsin typically takes about 10 to 14 days after you submit your application. It is crucial to provide accurate information to prevent delays in processing. Keeping track of this timeline is part of the essential knowledge shared in the Wisconsin Employee Compliance Survey.

Employees in Wisconsin must complete the W-4 form and the I-9 form upon their hiring. The W-4 form determines the amount of federal income tax withheld, while the I-9 form assists in confirming work eligibility. Understanding these requirements can be beneficial, as discussed in the Wisconsin Employee Compliance Survey.

New hire reporting in Wisconsin requires the completion of the New Hire Reporting Form and the employee's Social Security Number. Reporting new hires accurately helps the state monitor compliance with child support and unemployment benefit laws, which are covered in the Wisconsin Employee Compliance Survey.