Wisconsin Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

Are you presently in a scenario where you frequently require documents for business or personal reasons.

There are numerous legal document templates accessible online, but locating reliable options can be challenging.

US Legal Forms offers a vast collection of templates, such as the Wisconsin Declaration of Gift with Signed Acceptance by Donee, designed to meet federal and state requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, complete the necessary details to create your account, and place your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Wisconsin Declaration of Gift with Signed Acceptance by Donee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require, ensuring it is suitable for your specific area/state.

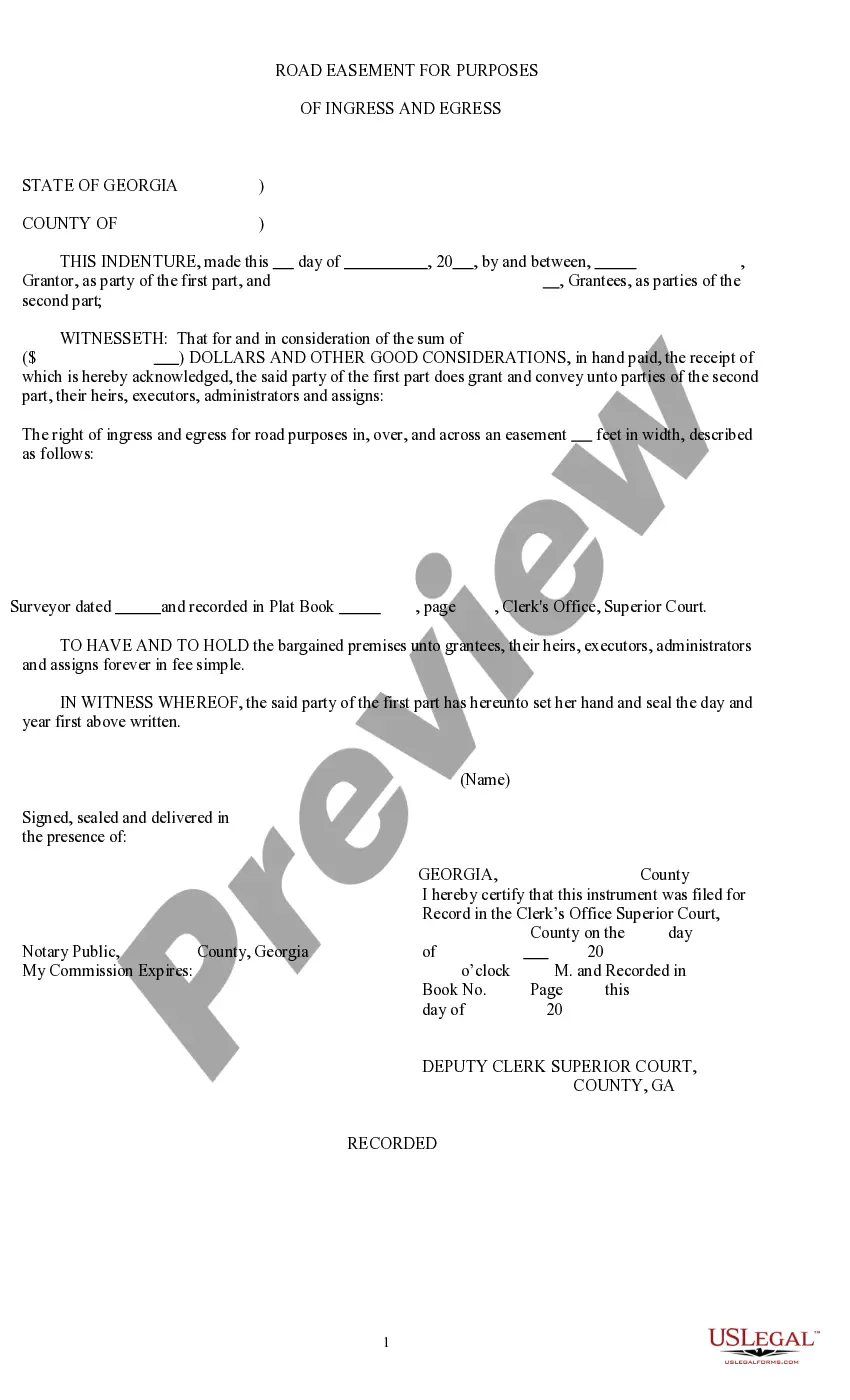

- Use the Preview button to check the form.

- Review the details to confirm you have selected the correct form.

- If the form is not what you need, use the Lookup feature to find a document that matches your needs.

Form popularity

FAQ

A donee may also be a person who is unable to express acceptance. A gift can be made to a child and could be accepted on the child's behalf. The donee must be an ascertainable person. A gift involves the process of giving and taking which are two simultaneous and reciprocal acts.

Three elements are essential in determining whether or not a gift has been made: delivery, donative intent, and acceptance by the donee.

Both types of gifts share three elements which must be met in order for the gift to be legally effective: donative intent (the intention of the donor to give the gift to the donee), the delivery of the gift to the donee, and the acceptance of the gift.

Acceptance of a gift by the donee can be done anytime during the lifetime of the donor. . Section 123 provides that for a gift of immovable property to be valid, the transfer must be effectuated by means of a registered instrument bearing the signature of the donor and attested by at least two witnesses."

Section 122 of Transfer of Property Act defines a gift as the transfer of an existing moveable or immovable property. Such transfers must be made voluntarily and without consideration. The transferor is known as the donor and the transferee is called the donee. The gift must be accepted by the donee.

According to The Transfer of Property Act, 1882, acceptance of gift must be made by the donee during the lifetime of the donor and while the donor is still capable of giving the gift. If the donee dies before accepting the gift, then it is void.

Make sure your gift letter includes the following:The donor's name.The donor's address.The donor's phone number.The donor's relationship to you.The exact dollar amount of the gift.The date the gift was given.More items...

Photographic documentation is a good way to prove that a gift was delivered to you. If there is no evidence to prove acceptance, then a claim is much harder to prove. Write up a statement describing what occurred between you, the donee, and the person who gave you the property, the donor.

Registration of Gift DeedThe donor and donee should sign on all pages of the gift deed and must be attested by at least two witnesses. The donee must accept the gift in the lifetime of the donor and when the donor is of sound mind for it to be valid.

A gift, if valid, is a legally enforceable transfer under general contract law. That means, if a gift meets all of the legal elements of a valid gift, then the gift is enforceable and cannot generally be rescinded and revoked.