Wisconsin Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a range of lawful document templates that you can download or print.

By utilizing the website, you can access thousands of documents for business and personal needs, organized by categories, states, or keywords.

You can quickly obtain the latest versions of documents such as the Wisconsin Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner.

If the form does not meet your needs, utilize the Search box at the top of the page to find the suitable one.

If you are satisfied with the form, affirm your selection by clicking on the Purchase now button. Then, choose the payment plan you prefer and provide your details to create an account. Process the transaction. Use your credit card or PayPal account to complete the payment. Select the format and download the document to your device. Make edits. Fill out, modify, print, and sign the downloaded Wisconsin Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner. Each template you added to your account does not expire and is yours indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the form you need.

Access the Wisconsin Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you have an active monthly subscription, Log In and download the Wisconsin Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner from the US Legal Forms library.

- The Download button will appear on each document you review.

- You can view all previously downloaded documents in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some straightforward steps to start.

- Ensure that you have selected the correct form for your city/county.

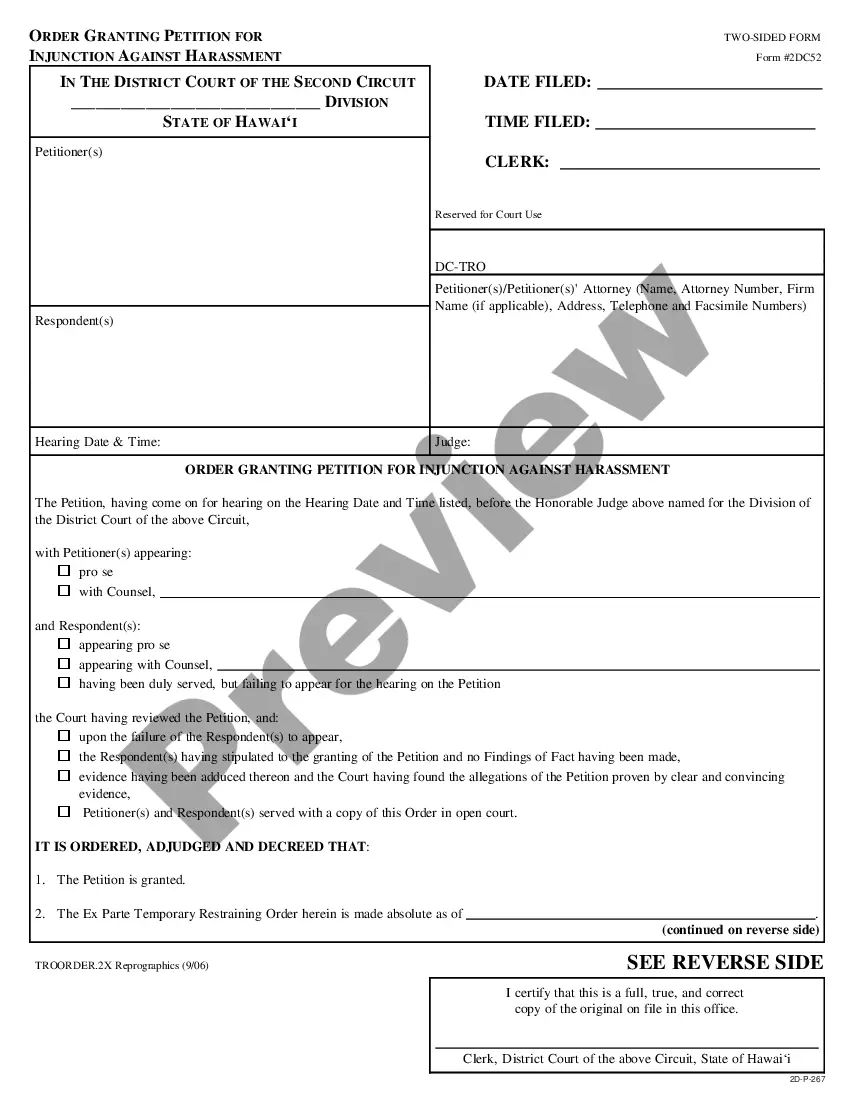

- Select the Review option to scrutinize the form’s content. Read the description of the form to confirm you have chosen the right one.

Form popularity

FAQ

Death of the partner If there are only two partners, and one of the partner dies, the partnership firm will automatically dissolve. If there are more than two partners, other partners may continue to run the firm.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

A partnership can be dissolved when:An agreement between yourself and all other partners have been reached;One partner gives written notice to the other partners;The life of the partnership, according to the partnership agreement, has expired;Any partner dies or becomes bankrupt;More items...?22-Jan-2021

Generally, a majority vote, or sometimes a unanimous vote, is necessary to dissolve a company. In partnerships, the partnership agreement should address the process for dissolution. If it does not, you must make sure that you follow Wisconsin business statutes.

Dissolution of partnership means putting an end to a business partnership between all the partners of the firm. Any partnership can be dissolved by the mutual consent of all the partners and is carried out by way of executing a written agreement, referred to as a Partnership Dissolution Agreement.

In an at-will partnership, the death (including termination of an entity partner), bankruptcy, incapacity, or expulsion of a partner will not cause dissolution.

If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally. The agreement outlines the rights, responsibilities, and duties each partner has to the company and to each other.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

Accordingly, the partnership's tax year closes for all partners on the date of death. The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec.

It is likely, therefore, that following the death of the partner, the legal title to any non-real estate partnership assets will be held by the surviving partner and the personal representatives of the deceased partner on trust for the surviving partner and the estate.