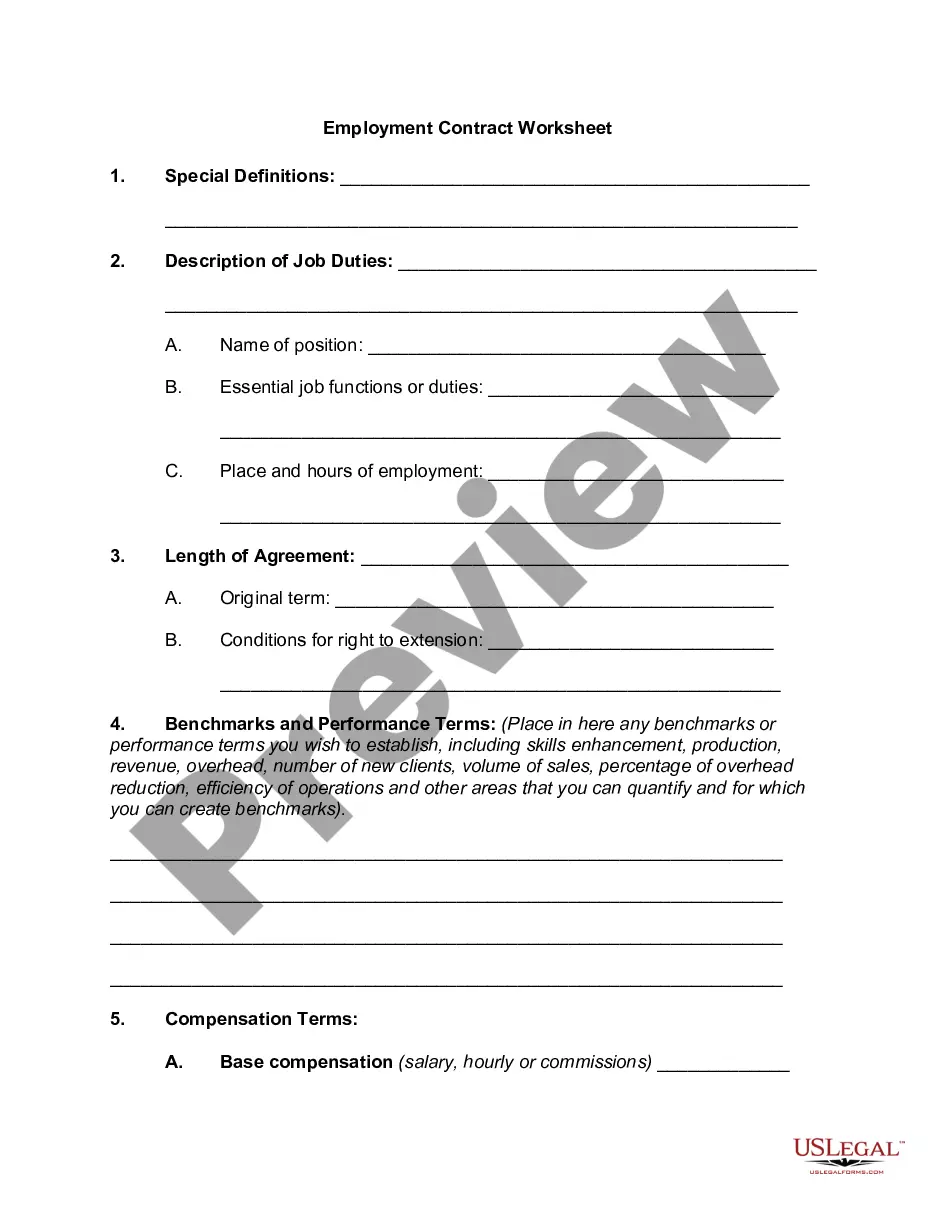

Wisconsin Worksheet for Job Requirements

Description

How to fill out Worksheet For Job Requirements?

If you require extensive, acquire, or print legal document templates, utilize US Legal Forms, the largest compilation of legal forms accessible online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Wisconsin Worksheet for Job Requirements with just a couple of clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to find the Wisconsin Worksheet for Job Requirements.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's contents. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The ideal number of deductions to claim on a W-4 can vary based on your specific financial scenario. To find the most suitable number for your situation, consult the Wisconsin Worksheet for Job Requirements. This worksheet can guide you through the process, ensuring you only claim what benefits your tax situation. Proper deductions help maintain a balanced withholding that aligns with your financial goals.

Your filing status on the W-4 should reflect your current personal situation. Common options include single, married filing jointly, and married filing separately. Correctly choosing your status is crucial for accurate withholding as outlined in the Wisconsin Worksheet for Job Requirements. Consider your overall financial picture to select the most beneficial status.

Wisconsin currently experiences high demand for jobs in healthcare, information technology, and skilled trades. Occupations like registered nurses, software developers, and electricians are sought after in many regions. Utilizing tools like the Wisconsin Worksheet for Job Requirements can help you identify emerging trends and opportunities in the job market. This resource can assist you in tailoring your job search effectively.

Form WT-4A is an agreement between the employee and employer that a lesser amount will be withheld from the employee's wages than is provided for in the Wisconsin income tax withholding tables.

OVER WITHHOLDING: If you are using Form WT20114 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected income tax liability, you may use Form WT20114A to minimize the over withholding. WT-4 Instructions Provide your information in the employee section.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Forms and PublicationsWisconsin New Hire Pamphlet.Form WT-4 - This form IS intended for New Hire reporting.Form W-4 - This form CAN be used for New Hire reporting if it includes the employee's date of birth and date of hire.Form I-9 - This form typically is NOT adequate for New Hire reporting.Multistate Reporting.More items...

Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

If an employee is claiming the maximum number of exemptions allowed and withholding is still more than the employee's estimated net tax liability for the year, the employee should then file Form WT-4A.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.