Wisconsin Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

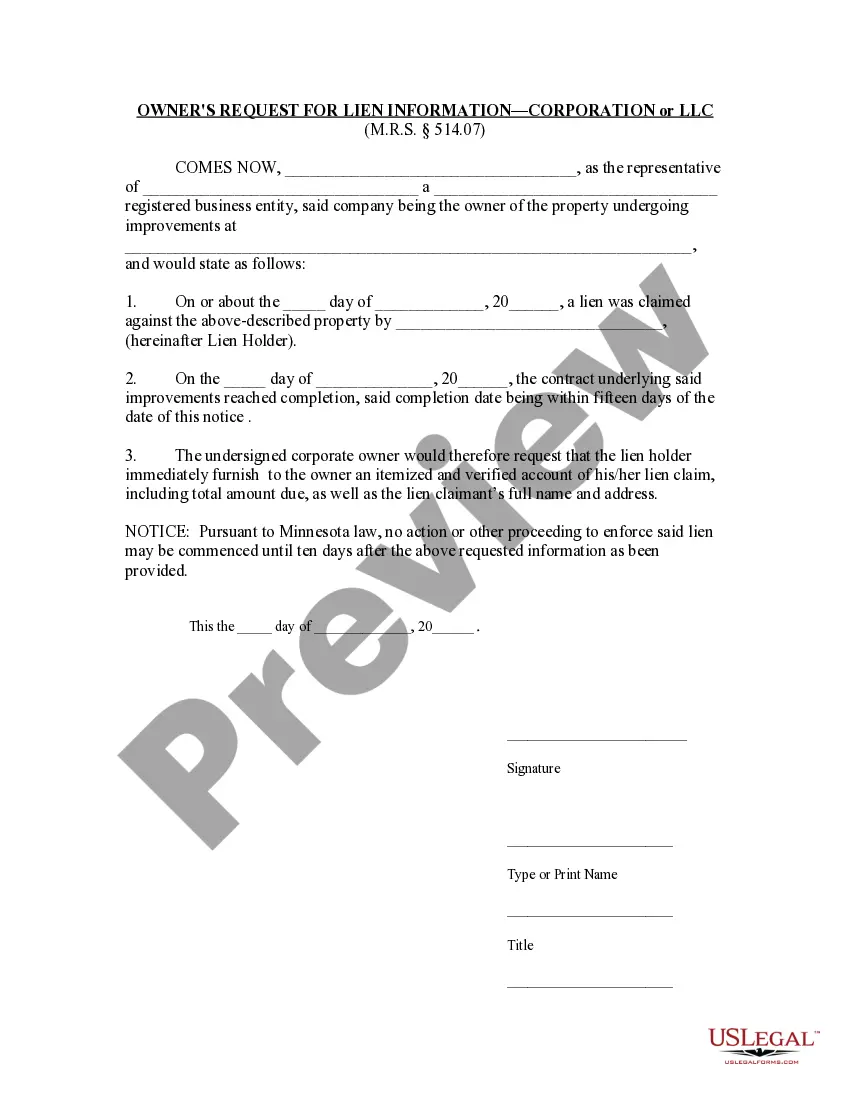

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

If you need to finalize, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's simple and user-friendly search to find the documents you require. Different templates for business and personal purposes are categorized by groups and states, or keywords.

Use US Legal Forms to obtain the Wisconsin Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase in just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to every form you downloaded through your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Wisconsin Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Wisconsin Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the form you need, click the Buy now button. Choose the pricing plan you prefer and input your credentials to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Wisconsin Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

Form popularity

FAQ

Equipment rental in Wisconsin is indeed taxed under the state's sales tax guidelines. Depending on how the equipment is used, there may be various tax implications. When considering a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding these taxes helps you make informed decisions about your rental agreements and budget.

Yes, Wisconsin imposes a sales tax on leases, including equipment leases. This tax applies to the total amount of the lease, including any additional fees. Being aware of these details when entering into a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase will help you effectively calculate your overall expenses.

Yes, rental income is generally taxable in Wisconsin. If you receive income from leasing equipment, it must be reported on your state tax return. When utilizing a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's essential to account for this income as part of your overall financial strategy.

Training services are not typically subject to sales tax in Wisconsin. If your business involves a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding the nuances of taxable and non-taxable services will help you allocate your budget effectively. Engage with a tax consultant if needed.

In Wisconsin, extended warranties are generally considered taxable. When you consider a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, remember that any warranties you choose to add could incur sales tax, impacting your financial planning. Awareness of this can guide your decisions.

Towing services are typically taxable in Wisconsin. If you are involved in a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, keep this in mind for potential additional costs. Understanding these taxes can assist you in comprehensive planning for your expenses.

In Wisconsin, the sales tax on a leased car applies to the total rental of the vehicle. If you are entering a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, be aware of how this tax impacts your overall costs. Calculating the tax effectively can help you manage your lease expenses better.

Catering services in Wisconsin are typically subject to sales tax unless specific exemptions apply. For businesses utilizing Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding these tax implications can guide budgeting for catering services. Stay informed about any changes in legislation that could affect your obligations.

Service contracts in Wisconsin are generally considered taxable. However, if you enter into a Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, you might find that associated service fees fall under different guidelines. It's advisable to consult a tax professional to explore potential exemptions or obligations.

In Wisconsin, certain services are exempt from sales tax, including some personal property leases. One relevant example is the Wisconsin Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. This type of lease allows businesses to finance equipment without incurring immediate tax burdens.