Wisconsin Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

US Legal Forms - one of the largest libraries of legitimate forms in America - offers a variety of legitimate record web templates you are able to down load or printing. Making use of the site, you can find thousands of forms for organization and personal functions, categorized by groups, claims, or keywords and phrases.You will discover the newest versions of forms just like the Wisconsin Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty within minutes.

If you already have a membership, log in and down load Wisconsin Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty from the US Legal Forms catalogue. The Down load switch will appear on every form you perspective. You get access to all earlier acquired forms from the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, listed here are straightforward instructions to obtain started:

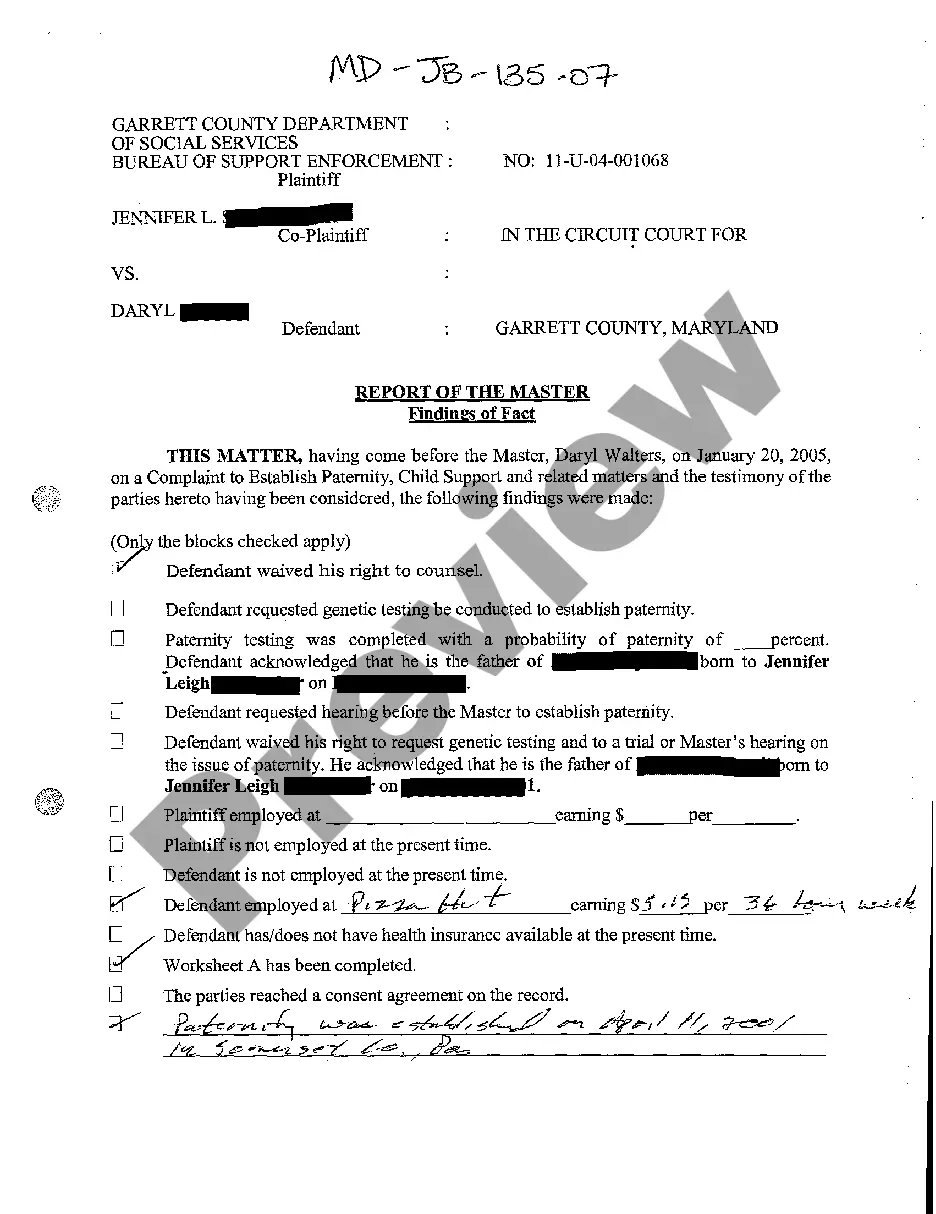

- Be sure you have selected the right form for the metropolis/county. Go through the Review switch to examine the form`s articles. Browse the form explanation to actually have selected the right form.

- In the event the form doesn`t satisfy your demands, take advantage of the Lookup industry towards the top of the display to get the the one that does.

- If you are content with the form, affirm your option by clicking the Purchase now switch. Then, pick the rates plan you want and supply your references to register on an profile.

- Approach the financial transaction. Make use of credit card or PayPal profile to accomplish the financial transaction.

- Find the formatting and down load the form in your product.

- Make adjustments. Fill up, change and printing and signal the acquired Wisconsin Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

Each and every web template you included in your money lacks an expiry day which is your own for a long time. So, if you would like down load or printing yet another copy, just proceed to the My Forms section and click on about the form you want.

Obtain access to the Wisconsin Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty with US Legal Forms, probably the most substantial catalogue of legitimate record web templates. Use thousands of skilled and condition-distinct web templates that satisfy your small business or personal requires and demands.