Wisconsin Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

US Legal Forms - one of the largest collections of legal documents in the USA - offers an extensive selection of legal document templates that you can download or print.

By using the site, you will find thousands of forms for commercial and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms like the Wisconsin Private Client General Asset Management Agreement in just moments.

If you currently hold a monthly subscription, Log In and retrieve the Wisconsin Private Client General Asset Management Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill in, modify, print, and sign the downloaded Wisconsin Private Client General Asset Management Agreement. Each template you save in your account has no expiration date and belongs to you indefinitely. Thus, if you want to download or print another copy, simply visit the My documents section and click on the form you need. Access the Wisconsin Private Client General Asset Management Agreement through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your commercial or personal needs and requirements.

- To start using US Legal Forms for the first time, here are simple steps to get you underway.

- Ensure you have selected the appropriate form for your locality/region.

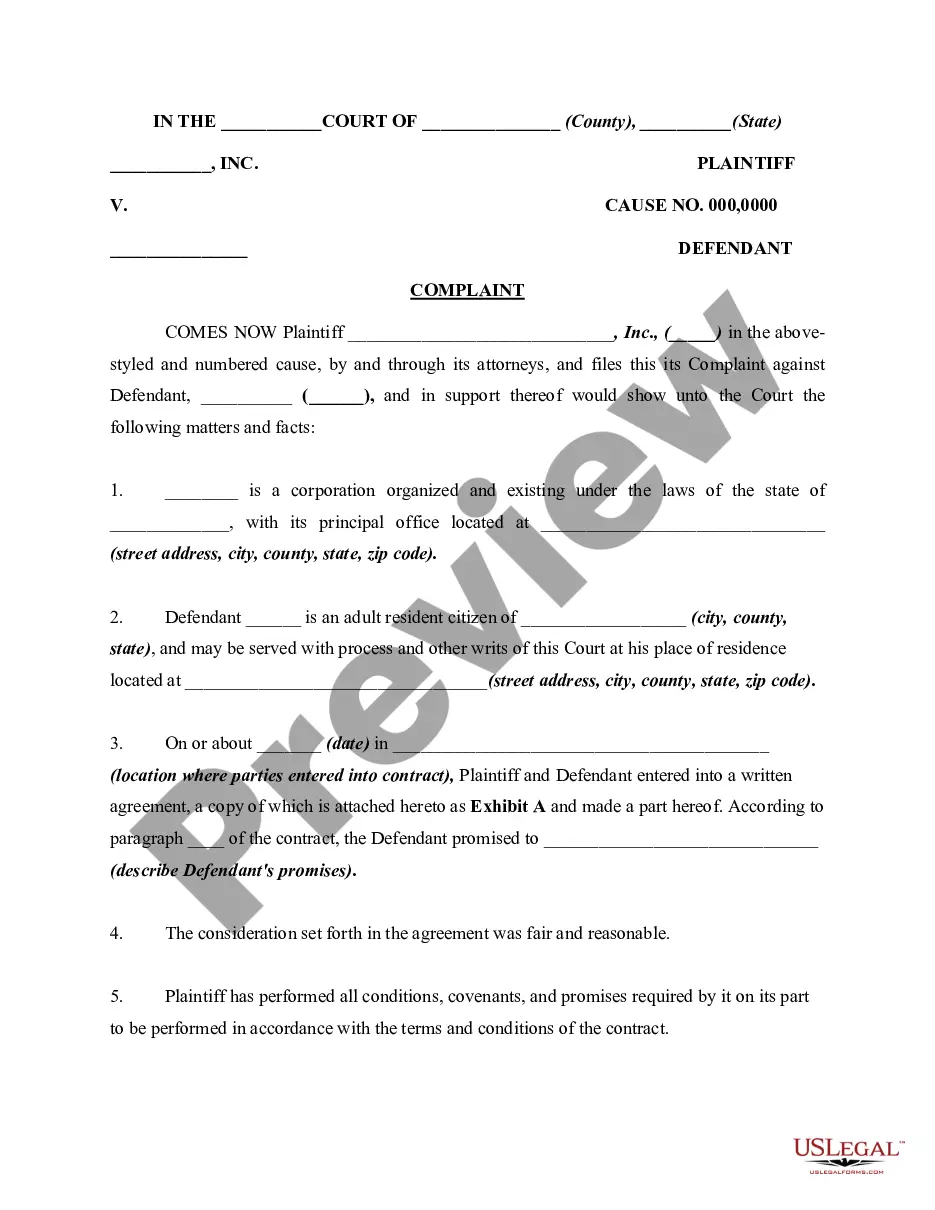

- Click the Review button to examine the form's content.

- Check the form summary to confirm you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Yes, earning $300k as a financial advisor is possible, especially as you build your client base and expand your services. Your income will depend on your experience, specialization, and the quality of services you provide. Familiarity with the Wisconsin Private Client General Asset Management Agreement can also help you attract high-net-worth clients, paving the way for higher earnings through customized asset management solutions.

Qualifying as a financial advisor involves obtaining the requisite education and relevant certifications. You'll typically need a bachelor's degree in finance or a related field, followed by passing the certification exams. By gaining knowledge of the Wisconsin Private Client General Asset Management Agreement, you can ensure that your qualifications resonate with prospective clients, demonstrating your capability to manage their financial assets effectively.

To work as a financial advisor, certifications like the Certified Financial Planner (CFP) designation are essential. These certifications validate your knowledge and ensure you meet industry standards. Additionally, understanding the Wisconsin Private Client General Asset Management Agreement can enhance your credibility with clients, as it showcases your expertise in managing their assets efficiently.

Becoming a financial advisor typically takes several years, depending on your educational background and the path you choose. Generally, you will need a bachelor's degree, which takes about four years, followed by specific certifications. Engaging in practical experience through internships or entry-level positions can expedite your journey. Once you understand the Wisconsin Private Client General Asset Management Agreement, you will find yourself better prepared to advise clients effectively.

An asset management agreement is a contract between a client and a manager that governs the management of investment assets. It outlines the specific services to be provided, the management fees, and the performance objectives desired by the client. This agreement allows clients to ensure their assets are handled according to their investment strategy and personal financial goals. Properly understanding and utilizing an asset management agreement can lead to more successful investment outcomes.

To become a financial advisor in Wisconsin, one must typically earn a relevant degree in finance or business. Gaining experience through internships can be beneficial, and acquiring necessary licenses is essential. Additionally, obtaining certifications such as CFP can enhance your credibility and attract clients. Platforms like USLegalForms can assist you in understanding legal requirements required for a career as a financial advisor.

The IMA agreement, also known as the Investment Management Agreement, defines the scope and expectations of investment management services offered to a client. It includes details on service fees, investment objectives, and the types of investments to be managed. By establishing clear terms, it mitigates potential misunderstandings between the client and the investment manager. Understanding this agreement is essential for successful asset management.

An IMA agreement, or Investment Management Agreement, is a binding document between a client and an investment manager. This agreement details how the manager will manage the client's investment portfolio, including the assets involved, management fees, and investment objectives. It is crucial for clients to understand this agreement as it outlines the duties of the manager while providing guidelines for performance expectations. Clients can rely on this agreement to ensure their investments are managed effectively.

The IMA contract, or Investment Management Agreement contract, serves as a legal framework that governs the relationship between an investor and an investment manager. This contract outlines the investment manager's duties, fees, and the specific investment strategies they will employ. It protects both parties by clearly stating expectations, legal responsibilities, and performance benchmarks. A well-drafted IMA contract can enhance a client’s investment experience and success.

The investment management agreement's purpose is to clearly establish the terms under which the investment manager will manage a client’s assets. This includes defining investment strategies, risk tolerance, and fees associated with management services. By signing this agreement, clients ensure their assets are handled with professionalism and in a manner that aligns with their personal financial objectives. Ultimately, this agreement fosters a transparent relationship between the client and manager.