Wisconsin Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

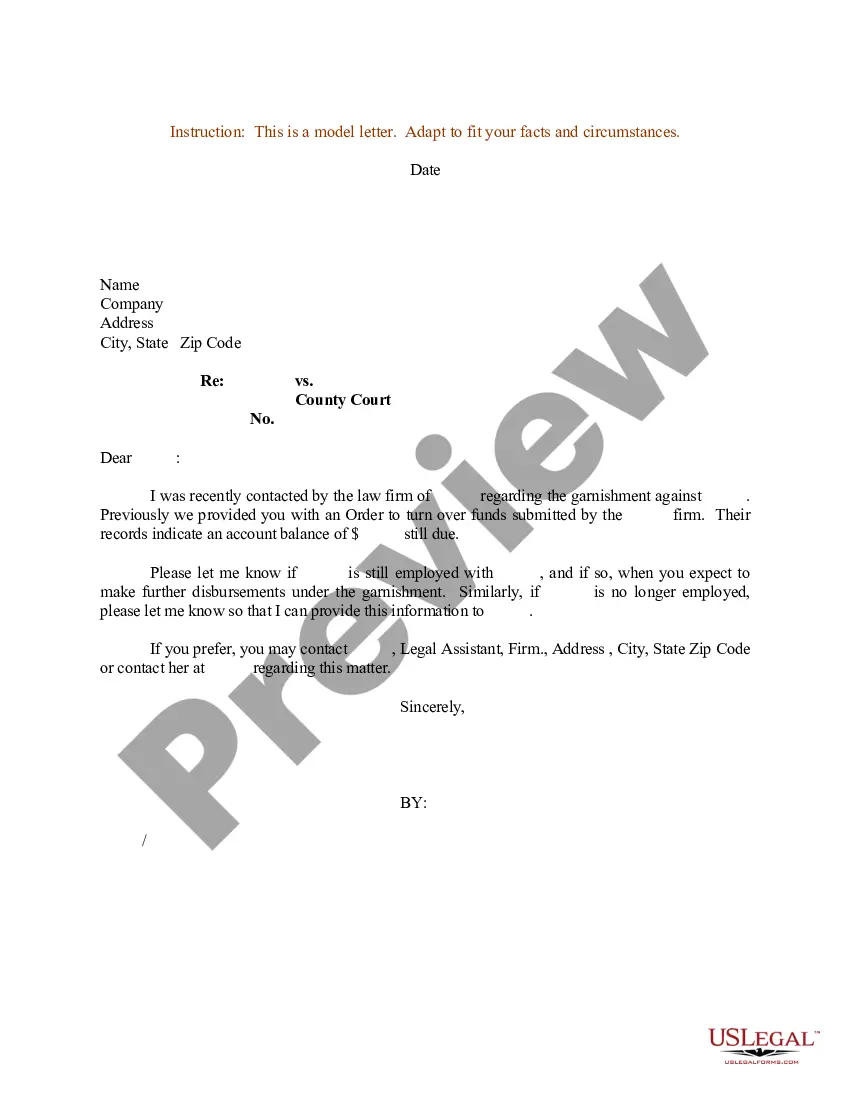

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Are you in a place that you need documents for sometimes company or specific uses almost every time? There are tons of legal record layouts available online, but locating types you can rely isn`t effortless. US Legal Forms gives a huge number of type layouts, such as the Wisconsin Sample Letter regarding Information for Foreclosures and Bankruptcies, that happen to be written to meet federal and state needs.

In case you are currently acquainted with US Legal Forms internet site and also have a merchant account, just log in. Following that, you are able to down load the Wisconsin Sample Letter regarding Information for Foreclosures and Bankruptcies template.

If you do not come with an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you need and make sure it is to the appropriate city/region.

- Utilize the Review switch to examine the form.

- See the outline to actually have selected the proper type.

- In case the type isn`t what you`re trying to find, use the Search industry to obtain the type that meets your requirements and needs.

- Once you find the appropriate type, click on Get now.

- Opt for the rates program you desire, submit the desired info to produce your money, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Select a handy document format and down load your version.

Locate each of the record layouts you possess purchased in the My Forms food selection. You can get a more version of Wisconsin Sample Letter regarding Information for Foreclosures and Bankruptcies any time, if needed. Just click the required type to down load or print the record template.

Use US Legal Forms, one of the most considerable variety of legal types, to conserve time and stay away from errors. The service gives appropriately produced legal record layouts that you can use for an array of uses. Generate a merchant account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Next, you have to understand that Wisconsin is a judicial foreclosure state, which means there must be, at minimum, notice, an opportunity for the borrower to respond, and a hearing held before a foreclosure is granted.

How Do I Stop Foreclosure in Wisconsin? Reinstating the Loan. The state's law gives mortgagors the right to reinstate the loan before the judgment. ... Redeeming the Property. Wisconsin has a redemption period wherein they can repurchase their properties once it goes on sale. ... File for Bankruptcy.

The servicer will typically send a Notice of Default when the mortgage falls ninety days past due. This timeline is usually governed by the requirements set forth by the investor in the servicing agreement. This Notice is also often accompanied by a Notice of Right to Cure Default.

Wisconsin Redemption Period The right of redemption, also known as the redemption period, can vary slightly in Wisconsin. All redemption periods start when the judgment of foreclosure is entered. Typically, if it is a residential property, you have six months to try and arrange to keep your home.

If there shall be any surplus paid into court by the sheriff or referee, any party to the action or any person not a party who had a lien on the mortgaged premises at the time of sale, may file with the clerk of court into which the surplus was paid, a notice stating that the party or person is entitled to such surplus ...

Reinstating the Loan Wisconsin law gives you the right to reinstate the loan before the judgment. The court will then dismiss the foreclosure. You may also reinstate after the judgment (before the sale), which will stay (postpone) the foreclosure, but if you default on payments again, the foreclosure will go ahead.

The lender will specify in the complaint which redemption period will apply to your situation. The period is usually 6 months if the lender agrees to waive its right to a deficiency judgment, which is the right to sue you for the difference between the sale price of the house and the amount you owe on the loan.