Wisconsin Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

It is feasible to spend numerous hours online looking for the legal document template that meets the state and federal criteria you require.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

You can easily obtain or print the Wisconsin Qualifying Subchapter-S Revocable Trust Agreement from their services.

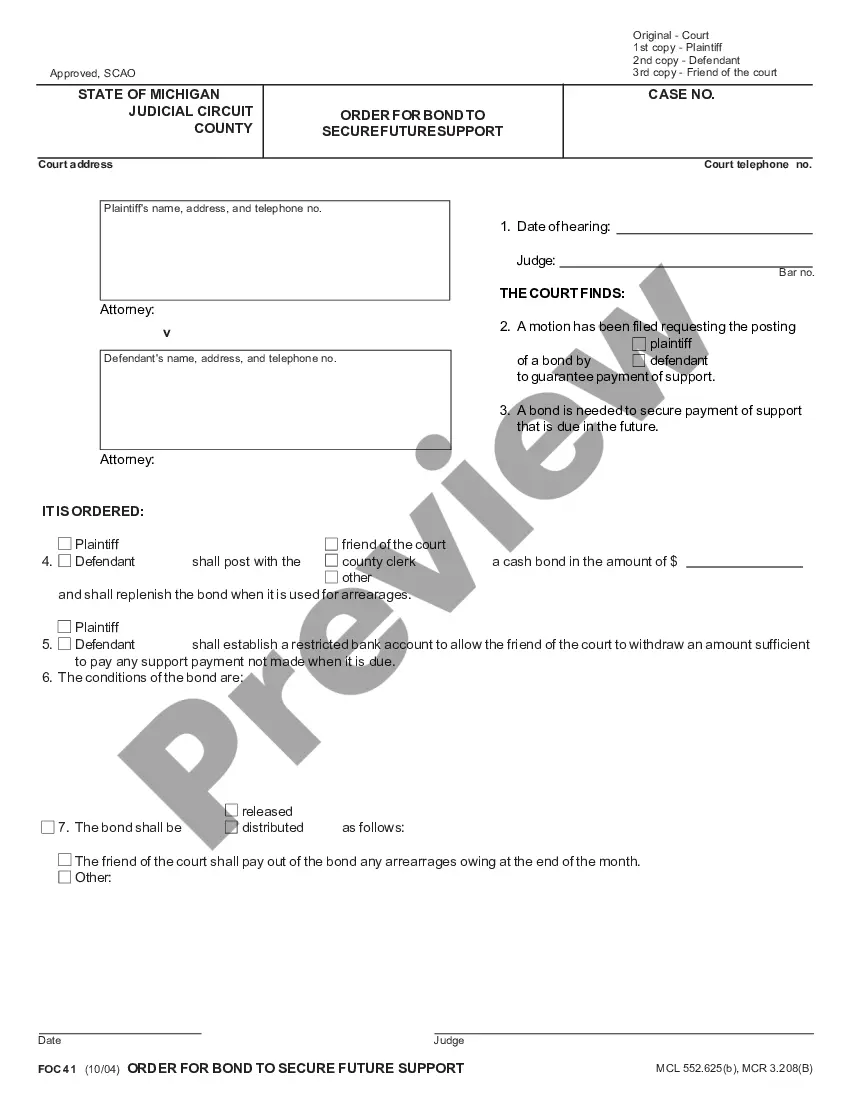

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Wisconsin Qualifying Subchapter-S Revocable Trust Agreement.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of the acquired document, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Check the document description to confirm you have selected the right form.

Form popularity

FAQ

If a trust is a grantor trust, then the grantor is treated as the owner of the assets, the trust is disregarded as a separate tax entity, and all income is taxed to the grantor.

Qualified trusts are revocable living trusts designed to protect retirement funds while facilitating the distribution of retirement assets held within IRAs, 401(k) accounts, 403(b) accounts, and Self-Employed IRAs (SEPs). Certain retirement accounts, including those listed above, are considered qualified accounts.

Revocable trusts are the simplest of all trust arrangements from an income tax standpoint. Any income generated by a revocable trust is taxable to the trust's creator (who is often also referred to as a settlor, trustor, or grantor) during the trust creator's lifetime.

For IRA beneficiary purposes, there generally are two types of trusts: one that meets certain IRS requirements is often called a qualified trust, also known as a look-through trust, and one that does not meet the IRS requirements if often called a nonqualified trust.

The IRS treats all revocable living trusts as disregarded entities. i This means that even though a trust legally owns the taxable property or taxable income, it does not need to file a separate tax return. This is because the IRS disregards the trust entity.

The assets, beneficiaries, and terms of the trust are never public record. If you choose to pass your assets through a will, it must go through probate and then becomes public record. A trust is more difficult to challenge or contest than a will, offering additional security.

A qualified revocable trust (QRT) is any trust (or part of a trust) that was treated as owned by a decedent (on that decedent's date of death) by reason of a power to revoke that was exercisable by the decedent (without regard to whether the power was held by the decedent's spouse).

A trust may be "qualified" or "non-qualified," according to the IRS. A qualified plan carries certain tax benefits. To be qualified, a trust must be valid under state law and must have identifiable beneficiaries. In addition, the IRA trustee, custodian, or plan administrator must receive a copy of the trust instrument.

Draw up the trust document: You can use an online program to do it yourself or get the help of an attorney. Get the trust document notarized: Sign the trust document before a notary public. Put your property into the trust: You can also do this yourself, but it does take some paperwork, so a lawyer may be helpful.

Revocable Trusts Often called a living trust, these are trusts in which the trustmaker: Transfers the title of a property to a trust. Serves as the initial trustee. Has the ability to remove the property from the trust during his or her lifetime.