Wisconsin Articles of Association of Unincorporated Charitable Association

Description

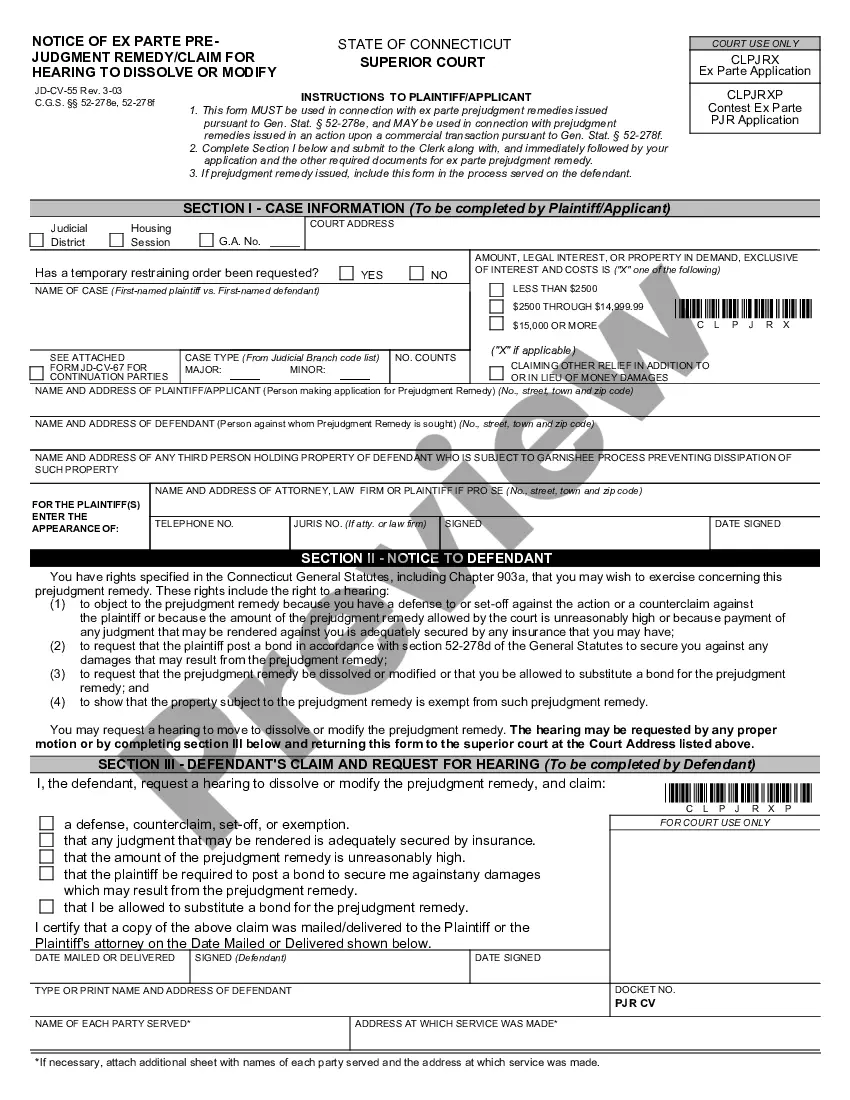

How to fill out Articles Of Association Of Unincorporated Charitable Association?

If you want to complete, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and user-friendly search tool to locate the documents you require.

Various templates for business and individual purposes are categorized by types and categories, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose your desired payment method and enter your credentials to register for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Wisconsin Articles of Association of Unincorporated Charitable Association in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Wisconsin Articles of Association of Unincorporated Charitable Association.

- You may also access forms you've previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct town/country.

- Step 2. Use the Review option to check the form's details. Be sure to read the overview.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

A nonprofit is an organization established for a charitable purpose, often with formal incorporation. An unincorporated association, on the other hand, is an informal group that operates without a formal charter. The Wisconsin Articles of Association of Unincorporated Charitable Association detail how such associations can still engage in charitable activities effectively, despite lacking incorporation.

No. Sole proprietorshipsindividual or spousaland unincorporated associations are not legal entity customers as defined by the Rule, even though such businesses may file with the Secretary of State in order to register a trade name or establish a tax account.

If an unincorporated association does not apply for tax-exempt status, it files Form 100, California Corporation Franchise or Income Tax Return, with us and computes its tax using the general corporation tax rate. It does not pay the minimum franchise tax.

An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose. Accounts of a sole proprietorship or a DBA are not insured under this account category.

An unincorporated association is not a legal entity. It is an organisation of two or more persons, who are the members of the association. The membership may change from time to time. The members agree, usually in a written constitution, to co-operate in furthering a common purpose.

Differences from a Nonprofit Corporation The nonprofit corporation, however, is different from an unincorporated nonprofit association because, as its name suggests, it is a corporation formed with the primary goal of benefiting the public, as opposed to being just an association of people.

A nonprofit corporation is able to contract directly with suppliers, financial institutions, and other organizations or individuals. With an unincorporated association, one or more of the association's members must personally enter into such contracts.

3. An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose. Accounts of a sole proprietorship or a DBA are not insured under this account category.

Clubs and charities are often constituted as unincorporated associations. The members of a management committee of a charity that is formed as an unincorporated association are likely to be charity trustees.