Wisconsin Nonrecourse Assignment of Account Receivables

Description

How to fill out Nonrecourse Assignment Of Account Receivables?

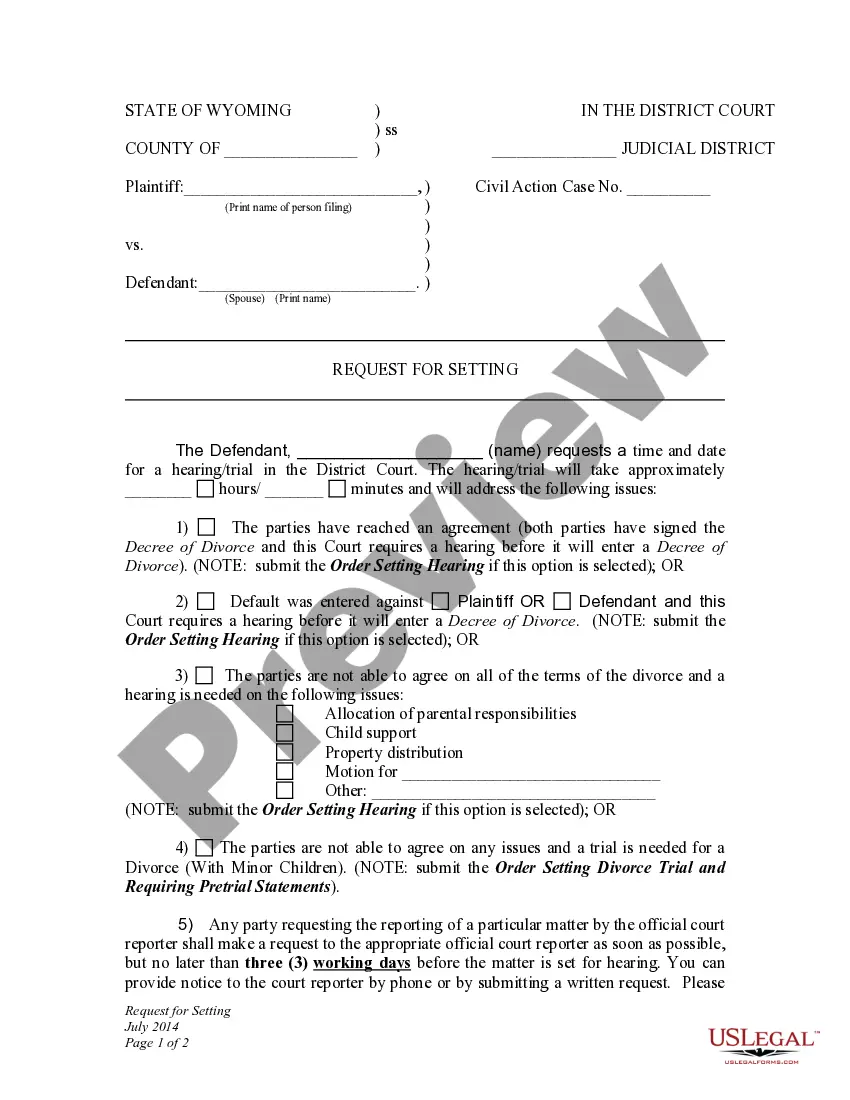

It is possible to invest several hours on the Internet searching for the lawful file design that meets the federal and state needs you need. US Legal Forms supplies a large number of lawful kinds which are reviewed by experts. You can actually download or produce the Wisconsin Nonrecourse Assignment of Account Receivables from my service.

If you already have a US Legal Forms account, you are able to log in and click the Down load switch. Afterward, you are able to total, change, produce, or sign the Wisconsin Nonrecourse Assignment of Account Receivables. Each lawful file design you acquire is your own property permanently. To acquire another copy of the acquired develop, visit the My Forms tab and click the related switch.

If you work with the US Legal Forms website the first time, stick to the basic directions beneath:

- Initially, make certain you have chosen the best file design for that state/town that you pick. Look at the develop outline to make sure you have chosen the right develop. If readily available, make use of the Review switch to appear with the file design as well.

- In order to get another edition in the develop, make use of the Research discipline to get the design that fits your needs and needs.

- Once you have found the design you need, just click Acquire now to continue.

- Pick the prices prepare you need, key in your references, and register for a free account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal account to purchase the lawful develop.

- Pick the formatting in the file and download it for your product.

- Make modifications for your file if possible. It is possible to total, change and sign and produce Wisconsin Nonrecourse Assignment of Account Receivables.

Down load and produce a large number of file layouts while using US Legal Forms site, which provides the largest collection of lawful kinds. Use expert and condition-particular layouts to handle your business or personal requirements.

Form popularity

FAQ

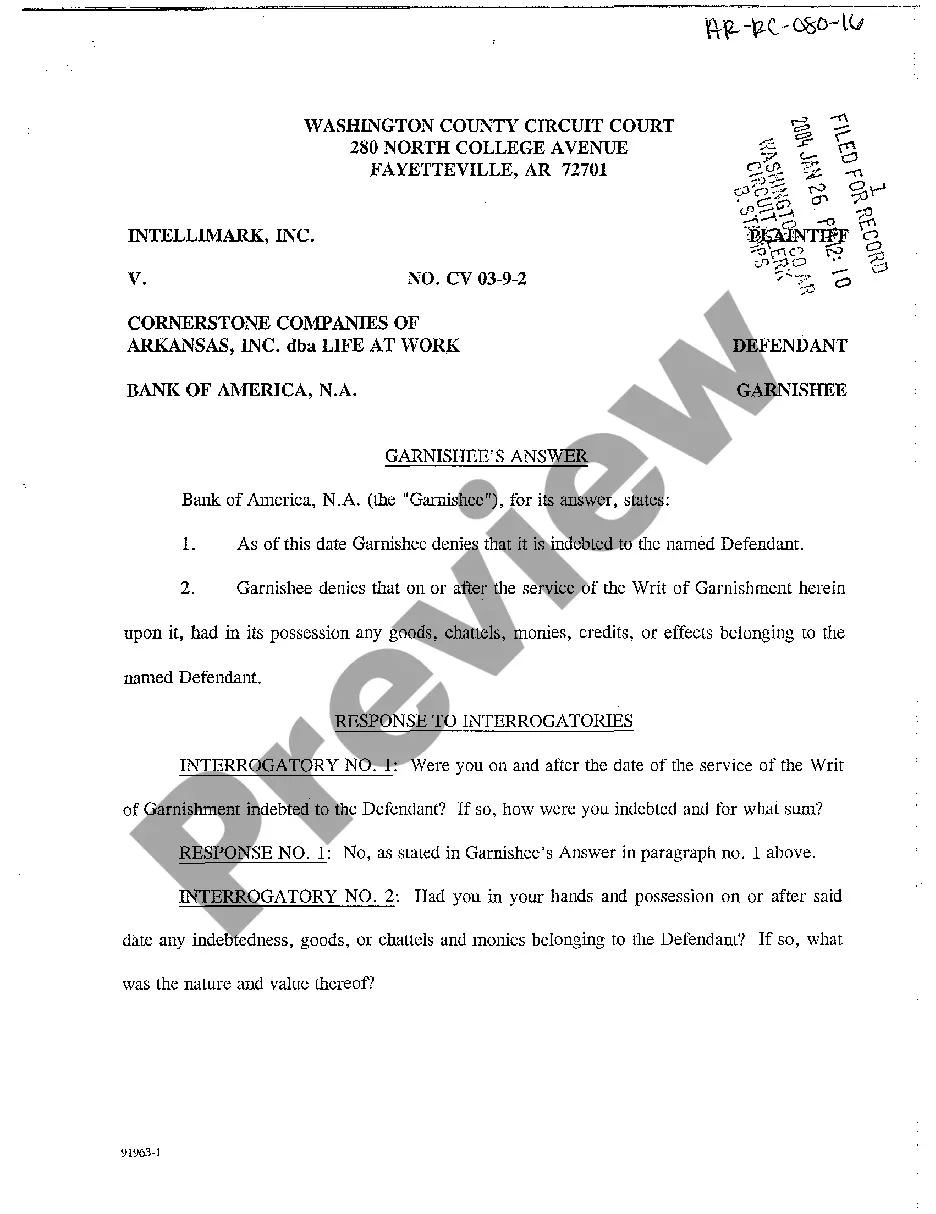

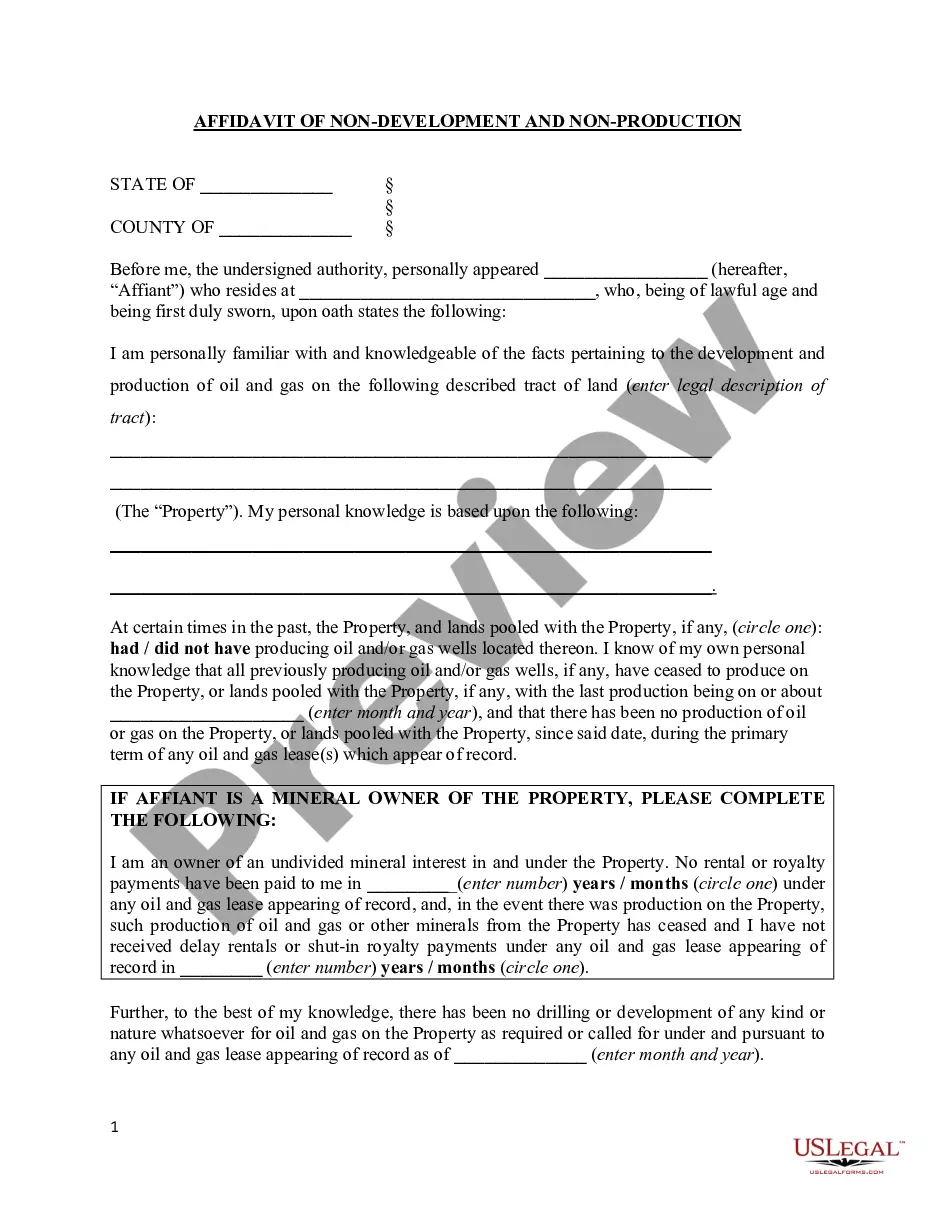

A factoring agreement can be used to transfer an account receivable referenced in the underlying sale contract, whilst assignment can also apply to accounts receivable resulting from loan agreements, business co-operation agreements, and the like.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

A receivable assignment agreement is an agreement by which a creditor ? the ?assignor? ? assigns to another person ? the ?assignee? ? a receivable it holds against a third person ? the ?assigned debtor?. The assigned debtor is not a party to the assignment agreement.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

With factoring accounts receivables without recourse, the factoring company assumes the credit risk on invoices when there's non-payment because of the debtor's insolvency, effectively insulating the client from this credit risk.

Example of the Assignment of Accounts Receivable ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).