Wisconsin Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

If you want to total, download, or print official document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Employ the site’s straightforward and user-friendly search to find the documents you require. Various templates for business and personal uses are organized by categories and states, or keywords.

Use US Legal Forms to locate the Wisconsin Assignment of Accounts Receivable with just a few clicks.

Every legal document template you buy is yours permanently. You have access to all forms you saved in your account. Select the My documents section and choose a form to print or download again.

Be proactive and download, and print the Wisconsin Assignment of Accounts Receivable with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Wisconsin Assignment of Accounts Receivable.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

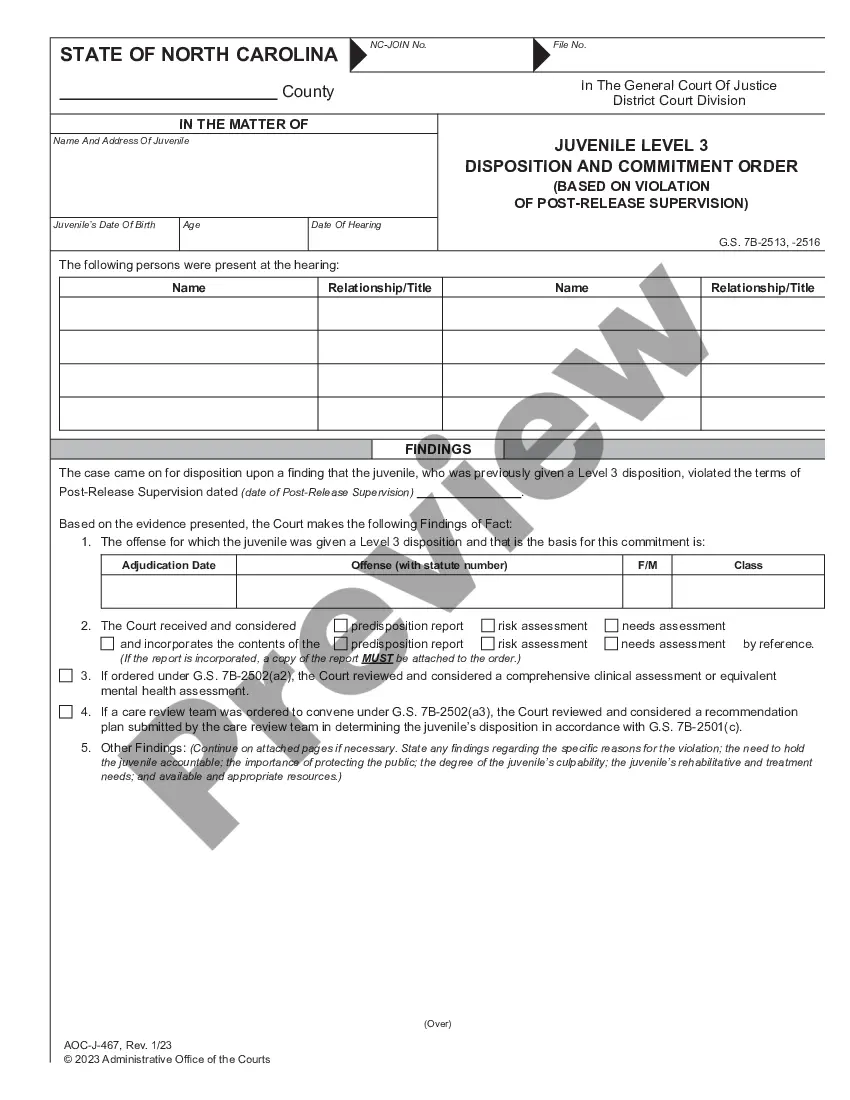

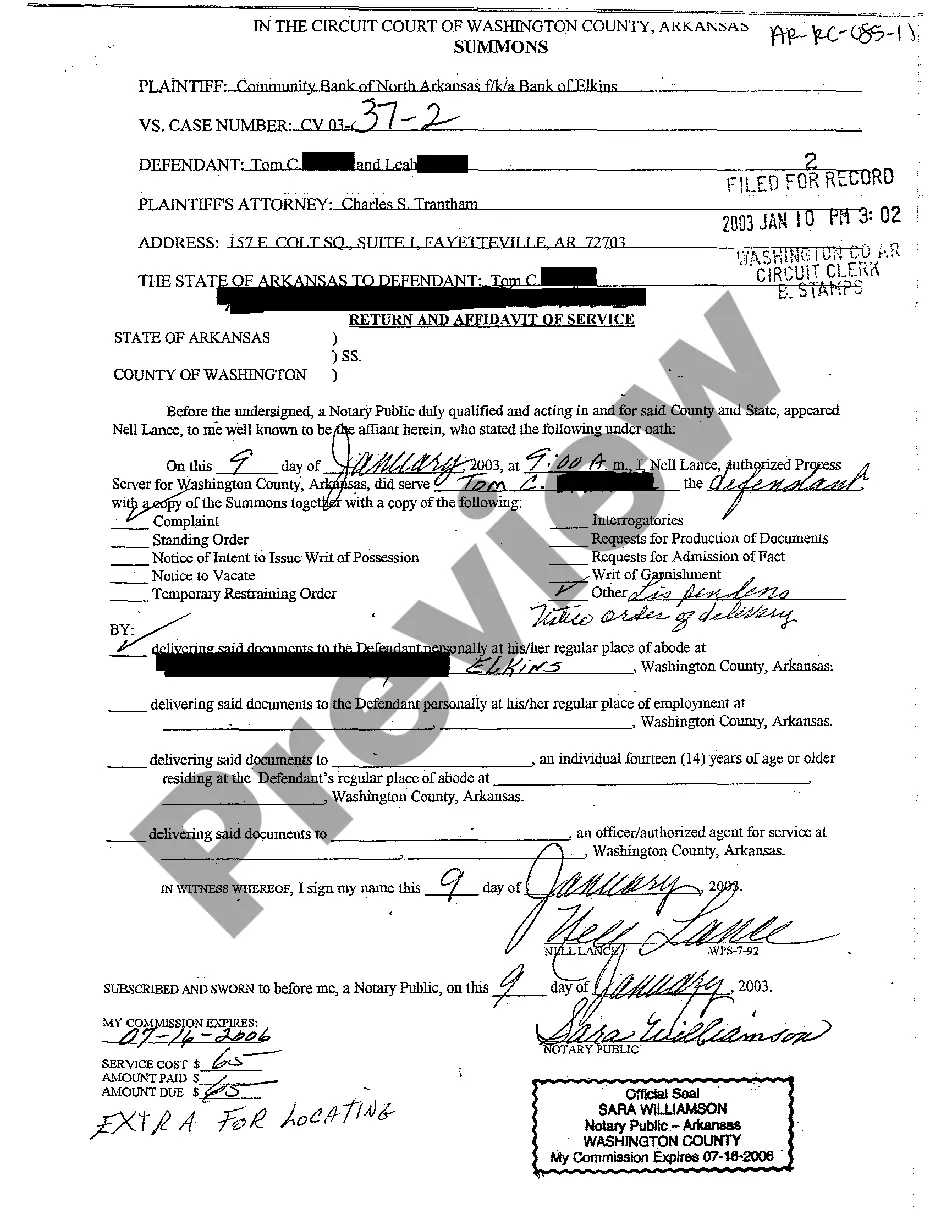

- Step 2. Utilize the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions in the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan that suits you and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Locate the format of the legal form and download it onto your device.

- Step 7. Fill out, modify and print or sign the Wisconsin Assignment of Accounts Receivable.

Form popularity

FAQ

An accounts receivable assignment grants a lender the right to collect payments directly from your customers, but you remain responsible for managing the relationship. On the other hand, factoring means you hand over ownership of your receivables and often relinquish direct customer interactions. When discussing Wisconsin Assignment of Accounts Receivable, the primary difference lies in control and potential relationship impacts. Understanding this distinction can help you make informed financial decisions.

A notice of assignment is a document that officially communicates the transfer of rights to collect payments on certain accounts. This notice is essential for keeping debtors informed and maintaining clarity in financial transactions. In a Wisconsin Assignment of Accounts Receivable context, sending this notice protects the interests of all parties involved. It clearly states who is responsible for collecting the debts, which promotes smoother operations.

The notice of assignment of accounts is a formal communication that informs debtors of the assignment. This notice is crucial because it establishes who is entitled to receive payment. In the case of Wisconsin Assignment of Accounts Receivable, providing this notice helps ensure all parties are aware of the change, minimizing confusion. By using a clear notice, businesses can maintain transparency and trust with their customers.

To reverse a write-off of accounts receivable, you would debit accounts receivable and credit bad debt expense. This action reinstates the previously written-off amount if it becomes collectible again. For organizations dealing with Wisconsin Assignment of Accounts Receivable, knowing how to reverse write-offs helps navigate potential recovery of debts.

To record the write-off of accounts receivable, a company will debit the bad debt expense and credit the accounts receivable account. This entry effectively removes the uncollectible amount from active receivables. In the scope of Wisconsin Assignment of Accounts Receivable, maintaining accurate records is vital for assessing financial health and managing outstanding debts.

The entry for a write-off in accounting typically involves debiting the bad debt expense account and crediting the accounts receivable account. This action represents the recognition that certain amounts will no longer be collected. For businesses engaged in Wisconsin Assignment of Accounts Receivable, accurate write-off procedures can enhance financial clarity and assist decision-making processes.

When an account receivable is written off, it means that the business has determined it is unlikely to collect the owed amount. This write-off reduces the company's total receivables and impacts the financial statements. In the context of Wisconsin Assignment of Accounts Receivable, understanding write-offs helps in making informed decisions about whether to assign accounts to third parties for collection.

Consent to assignment of receivables refers to the approval required from debtors for the assignment to be valid. Without this consent, the assignment may not be enforceable. It is important to secure this consent to maintain sound business practices. You can find templates for consent on the US Legal Forms platform, making the process smoother.

A notice of assignment of receivables is a formal notification that informs debtors about the assignment of their debts. This document essentially transitions the responsibility of collecting debts to the assignee. By using a notice, you maintain clarity and minimize the risk of confusion among all parties. Utilizing the US Legal Forms platform can help you craft a notice that meets legal requirements.

The formula for calculating accounts receivable involves taking total credit sales within a specified period, and then subtracting any returns or allowances. You can use this information to assess how well your business collects its debts. Keeping a close watch on these figures can be crucial, especially when managing your Wisconsin Assignment of Accounts Receivable. Regular calculations help ensure your accounts remain healthy.