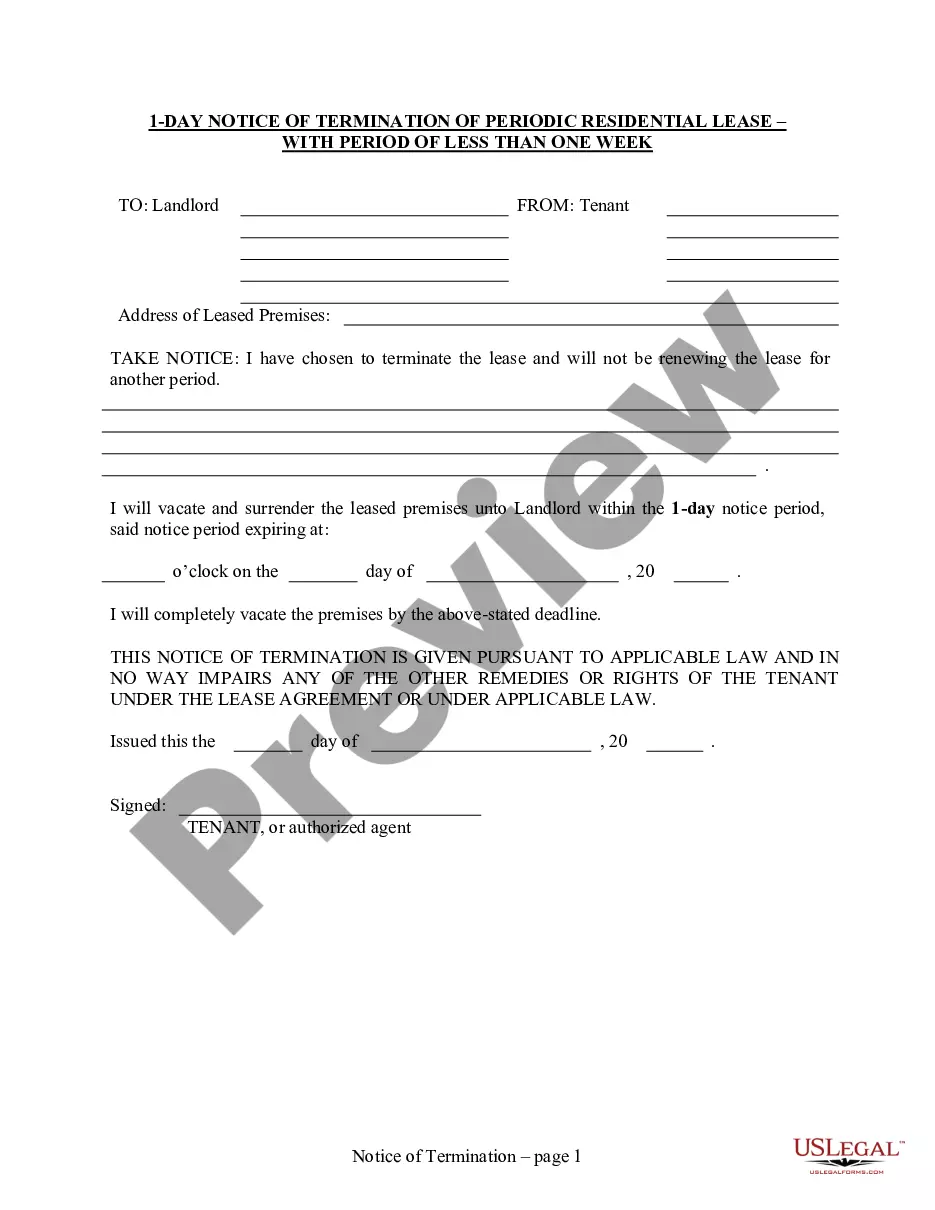

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Agreement to Extend Debt Payment Terms

Description

How to fill out Agreement To Extend Debt Payment Terms?

If you require thorough, download, or print valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal use are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other types of your legal form template.

Step 4. After locating the desired form, click the Acquire now button. Choose your preferred payment plan and enter your details to sign up for the account.

- Utilize US Legal Forms to acquire the Wisconsin Agreement to Extend Debt Payment Terms in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Wisconsin Agreement to Extend Debt Payment Terms.

- You can also access forms you previously purchased from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's details. Don’t forget to read through the description.

Form popularity

FAQ

In Wisconsin, the timeframe to back out of a contract typically depends on the nature of the agreement and the circumstances surrounding it. Generally, you may have a three-day period for certain types of agreements, like home solicitation sales. However, contracts involving debt repayment can vary, so it’s crucial to review your specific situation. If you need to extend your payment terms, a Wisconsin Agreement to Extend Debt Payment Terms can help facilitate this transition smoothly.

A debt repayment agreement is a legal document that outlines the terms under which you will repay a debt. It specifies the amount owed, payment schedule, and any interest rates involved. This agreement can help both parties understand their obligations and avoid disputes. Utilizing a Wisconsin Agreement to Extend Debt Payment Terms can simplify this process, ensuring clarity and legal protection for both sides.

A debt cancellation agreement works by outlining the specific terms under which a creditor agrees to forgive part or all of your debt. Typically, you'll need to negotiate terms that consider your financial situation, and a formal agreement is drafted to document the arrangement. Utilizing resources like the Wisconsin Agreement to Extend Debt Payment Terms can make this process clearer and help you understand your obligations moving forward.

The primary benefit of debt cancellation coverage is that it provides financial relief when you can no longer make payments. This coverage can prevent negative impacts on your credit score and allow for a more manageable repayment plan. When looking to explore options, consider utilizing a Wisconsin Agreement to Extend Debt Payment Terms to help you navigate your financial journey.

Cancellation of debt can be beneficial as it relieves you from the burden of financial obligations that you are unable to meet. However, it is essential to consider potential tax implications since forgiven debt may be treated as taxable income. In cases like a Wisconsin Agreement to Extend Debt Payment Terms, approach the options carefully and understand all consequences.

In Wisconsin, the statute of limitations on most consumer debts is six years. This means creditors have six years from the date of your last payment or written acknowledgment to take legal action to recover the debt. Knowing this timeframe helps you make informed decisions regarding your financial obligations, including any Wisconsin Agreement to Extend Debt Payment Terms.

In Wisconsin, it is generally six years. Wisconsin and Mississippi are the only states where certain debts are completely extinguished once they are past that statute of limitations. Debt that is past that date but which creditors continue to pursue has been referred to as zombie debt.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.