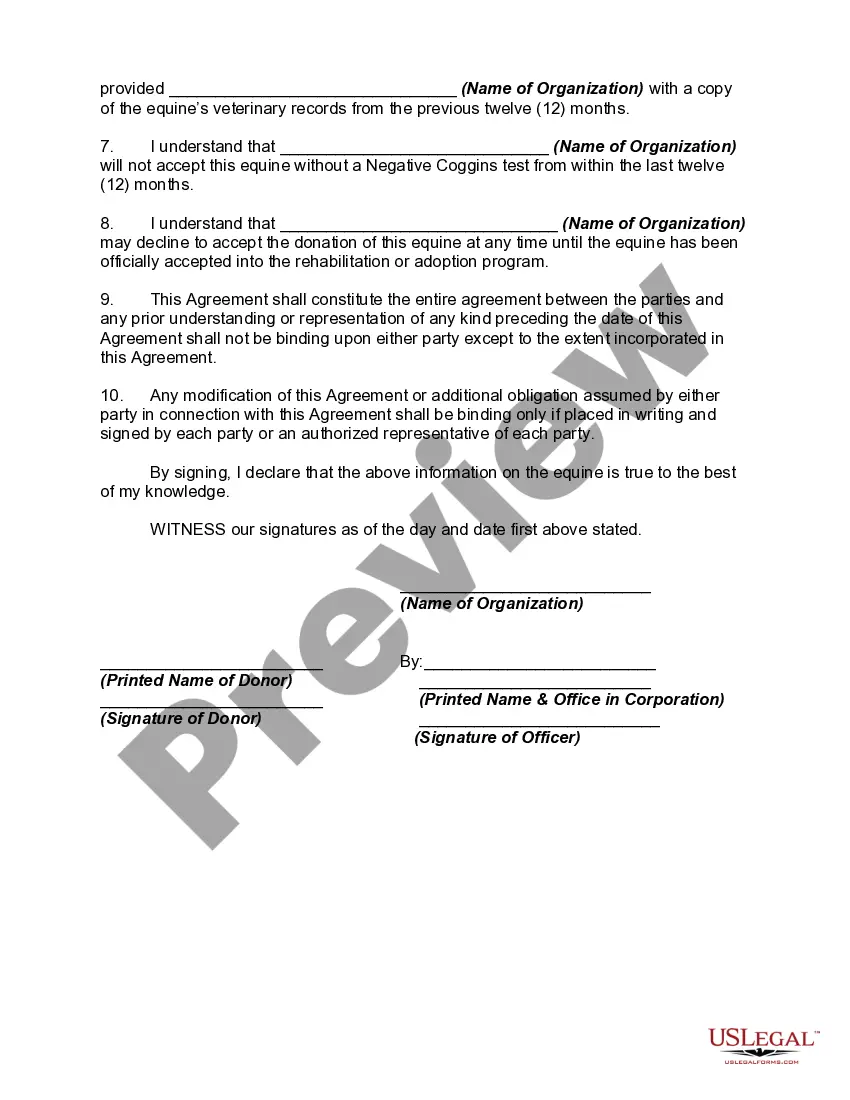

This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

You might spend time online searching for the valid document template that meets the federal and state requirements you seek.

US Legal Forms provides thousands of valid forms that are examined by professionals.

You can obtain or create the Wisconsin Equine or Horse Donation Contract from the services.

First, ensure you have chosen the correct document template for your state/area of preference. Review the form description to confirm you have selected the right form. If available, use the Preview button to examine the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, amend, create, or sign the Wisconsin Equine or Horse Donation Contract.

- Every legal document template you obtain is your permanent property.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

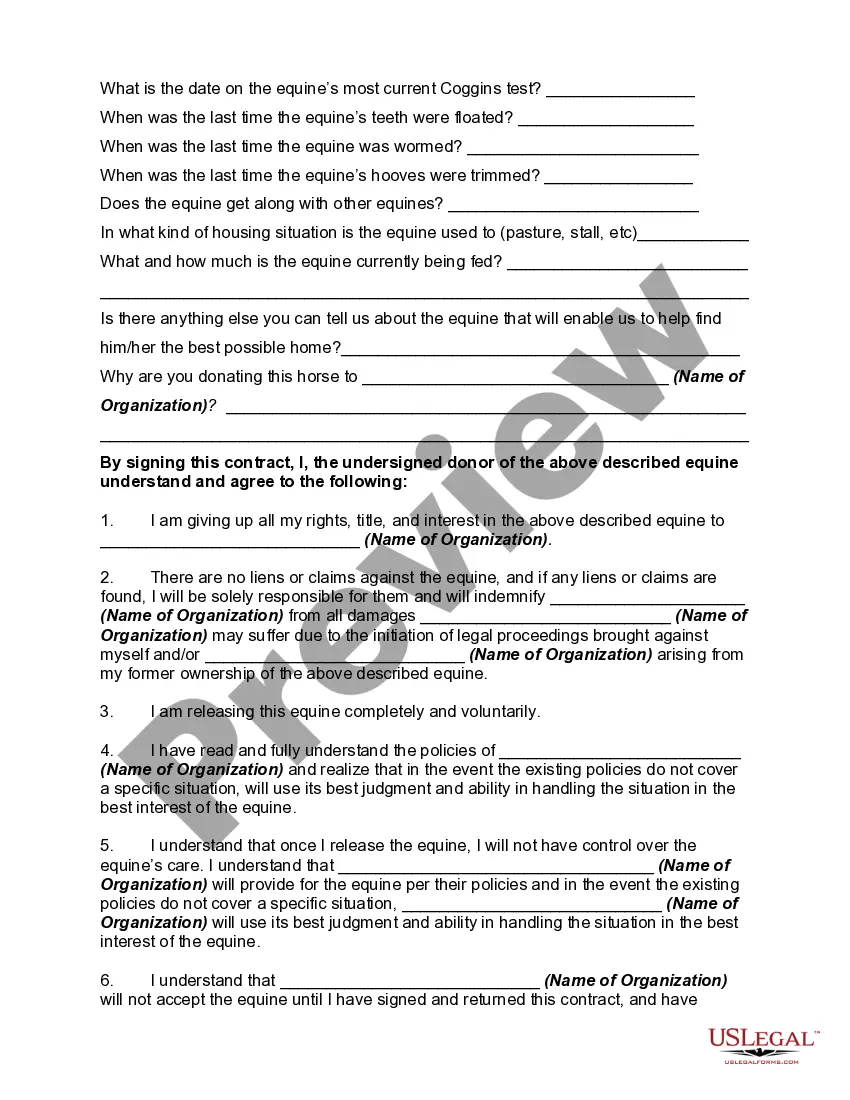

Donations made to a horse rescue organization are generally tax-deductible if the organization is a qualified charity. You can maximize your deduction potential by providing a detailed description of the horse's value. A well-crafted Wisconsin Equine or Horse Donation Contract can solidify the details of your clean donation to the rescue.

A buy back contract for horses is an agreement that allows donors to repurchase a horse after its donation under specific terms. This type of contract may provide peace of mind for owners who want to ensure their horse’s well-being. When creating such contracts, a Wisconsin Equine or Horse Donation Contract can serve as a useful template for inclusion of terms.

Yes, donating a horse is tax-deductible if you donate to an IRS-approved charitable organization. It’s important to document the donation properly to support your write-off claims. Using a Wisconsin Equine or Horse Donation Contract helps ensure you follow the necessary guidelines to obtain your tax deduction.

The best horse charity to donate to often depends on your values and the cause you wish to support. Many reputable organizations actively work to rescue, rehabilitate, or rehome horses in need. Researching charities that align with your mission can lead you to a great option. A Wisconsin Equine or Horse Donation Contract can facilitate your donation process to these organizations.

Horses are classified as personal property for tax purposes. This means that the value of the horse can impact your tax deductions when you donate it. Utilizing a Wisconsin Equine or Horse Donation Contract helps you comply with tax regulations related to personal property.

To receive a tax write-off for your horse donation, you need to donate a horse valued at over $500. Additionally, obtaining a qualified appraisal can maximize your tax benefits. By using a Wisconsin Equine or Horse Donation Contract, you can ensure that your donation meets IRS requirements for tax deductions.

The general consensus suggests a minimum of one acre for a horse, although more space is preferable for their well-being. This allows for adequate grazing and movement, reducing stress on the animal. When setting up ownership, consider using a Wisconsin Equine or Horse Donation Contract tailored to your land size needs.

In Wisconsin, the customary recommendation is about one acre for every horse, though local ordinances might dictate specific requirements. Your property should provide enough room for safe grazing and shelter. Utilizing a Wisconsin Equine or Horse Donation Contract can assist in navigating these legal requirements quickly.

Legally, the acreage needed to own a horse varies by state and local zonings. In general, many experts recommend at least one to two acres per horse to provide adequate space for grazing and exercise. Crafting a Wisconsin Equine or Horse Donation Contract ensures you comply with local laws and promotes best practices for horse ownership.

Yes, you can have a horse on 2 acres, and this amount of land can provide sufficient space for one or two horses. It is essential to consider factors such as pasture quality and fencing. A Wisconsin Equine or Horse Donation Contract may include considerations on land usage to promote healthy living for your horse.