Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Demand for Accounting from a Fiduciary

Description

How to fill out Demand For Accounting From A Fiduciary?

Are you currently in a situation where you will require documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, including the Wisconsin Request for Accounting from a Fiduciary, designed to meet federal and state requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Request for Accounting from a Fiduciary template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct city/region.

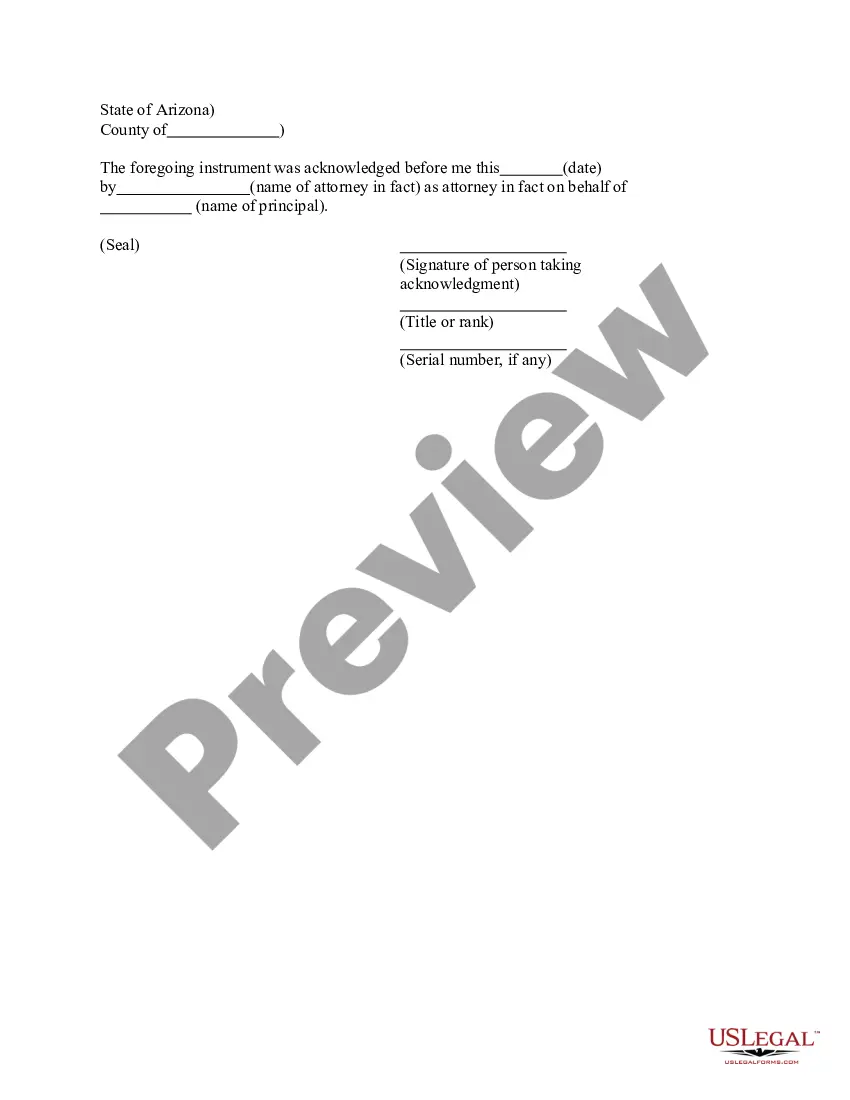

- Use the Review button to review the form.

- Examine the information to make sure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

To calculate income from a trust, you need to review the trust's documents and identify its assets. Start by listing all sources of income generated by these assets, such as interest, dividends, or rental income. Next, deduct any expenses related to managing the trust, which may include fees or taxes. For more complex situations, consider submitting a Wisconsin Demand for Accounting from a Fiduciary to ensure accurate reporting and full transparency on the trust's financial activities.

Generally, any beneficiary of a trust has the right to demand an accounting from the fiduciary. This right extends to both current beneficiaries and those who may receive assets in the future. By utilizing the Wisconsin Demand for Accounting from a Fiduciary, individuals can systematically and legally request the necessary information to maintain transparency.

Yes, a beneficiary can demand an accounting from the fiduciary managing the trust. This right ensures that beneficiaries stay informed about the trust's financial activities. Leveraging the Wisconsin Demand for Accounting from a Fiduciary provides beneficiaries with a structured approach to exercise this right effectively.

Fiduciary accounting income refers to the income generated by trust assets that is subject to distribution to beneficiaries. This includes interest, dividends, and other returns on investments. For those unsure about this concept, the Wisconsin Demand for Accounting from a Fiduciary can help demystify how these figures are reported and what beneficiaries can expect.

Compelling an accounting from a reluctant trustee may require taking formal legal steps, such as filing a petition in court. It’s crucial to document all communications with the trustee to support your case. The Wisconsin Demand for Accounting from a Fiduciary serves as an essential tool, providing clarity on the expectations and rights of all parties involved.

Yes, there is often a demand for accounting in trust management. Beneficiaries have a right to understand how the trust's assets are being managed and distributed. Engaging with the Wisconsin Demand for Accounting from a Fiduciary illuminates this process, making it easier for beneficiaries to assert their rights while maintaining clarity and legality.

To demand an accounting of a trust, you should send a formal demand letter that outlines your relationship to the trust and any specific information you need. It's important to be clear and concise in your letter to avoid any misunderstandings. Referencing the Wisconsin Demand for Accounting from a Fiduciary can guide you in creating a compelling demand that adheres to legal standards.

Requesting an accounting typically involves providing a formal written request to the fiduciary who manages the trust. Be sure to specify the time period you want the accounting for and include any relevant details that will help facilitate the request. Utilizing the Wisconsin Demand for Accounting from a Fiduciary ensures that your request is properly documented, increasing your likelihood of receiving a thorough response.

To calculate accounting income for a trust, you start by identifying all sources of income, such as dividends, interest, and rental income. Next, you subtract any expenses related to generating that income, including management fees and taxes. For those looking for a clear outline of the process, refer to the Wisconsin Demand for Accounting from a Fiduciary, which helps ensure that transparency and accuracy are maintained.

A fiduciary return must be filed by the fiduciary if the estate or trust has gross income exceeding a certain threshold. This requirement is typically determined by federal and state tax law. If you're unsure about the specifics, consulting with professionals or platforms like uslegalforms can provide clarity on handling a Wisconsin Demand for Accounting from a Fiduciary.