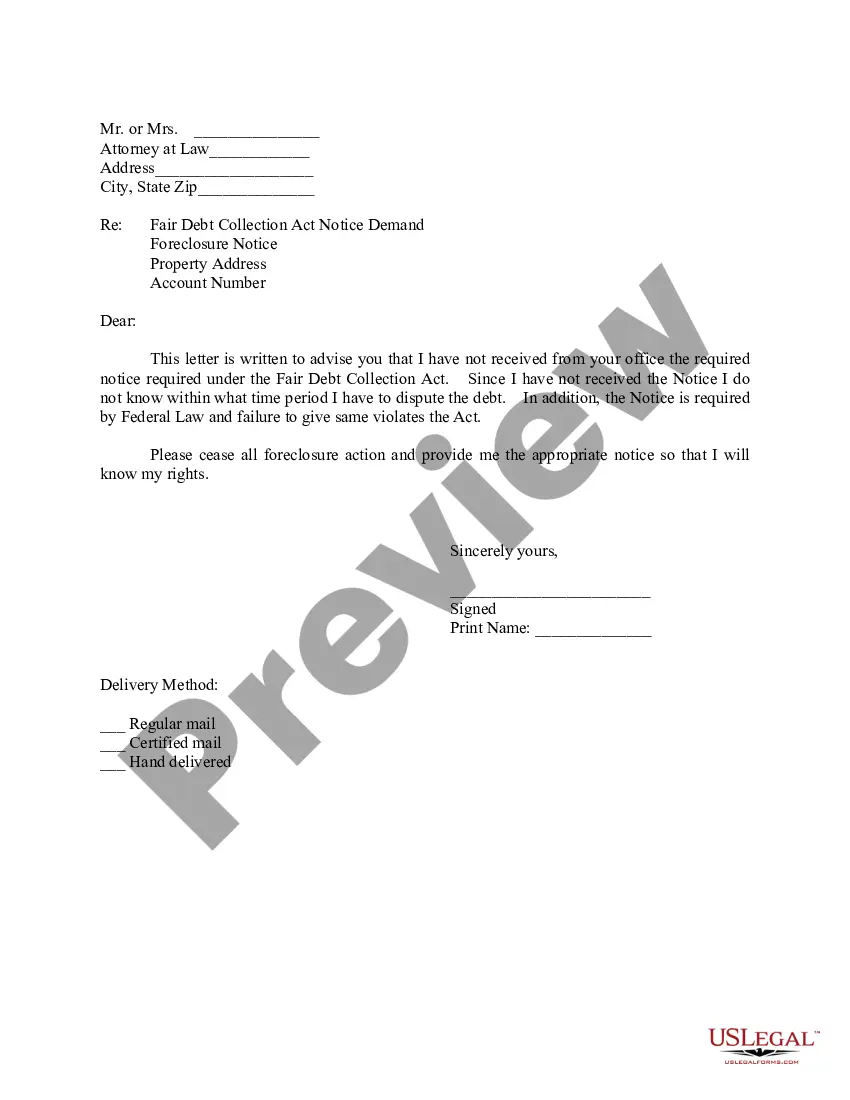

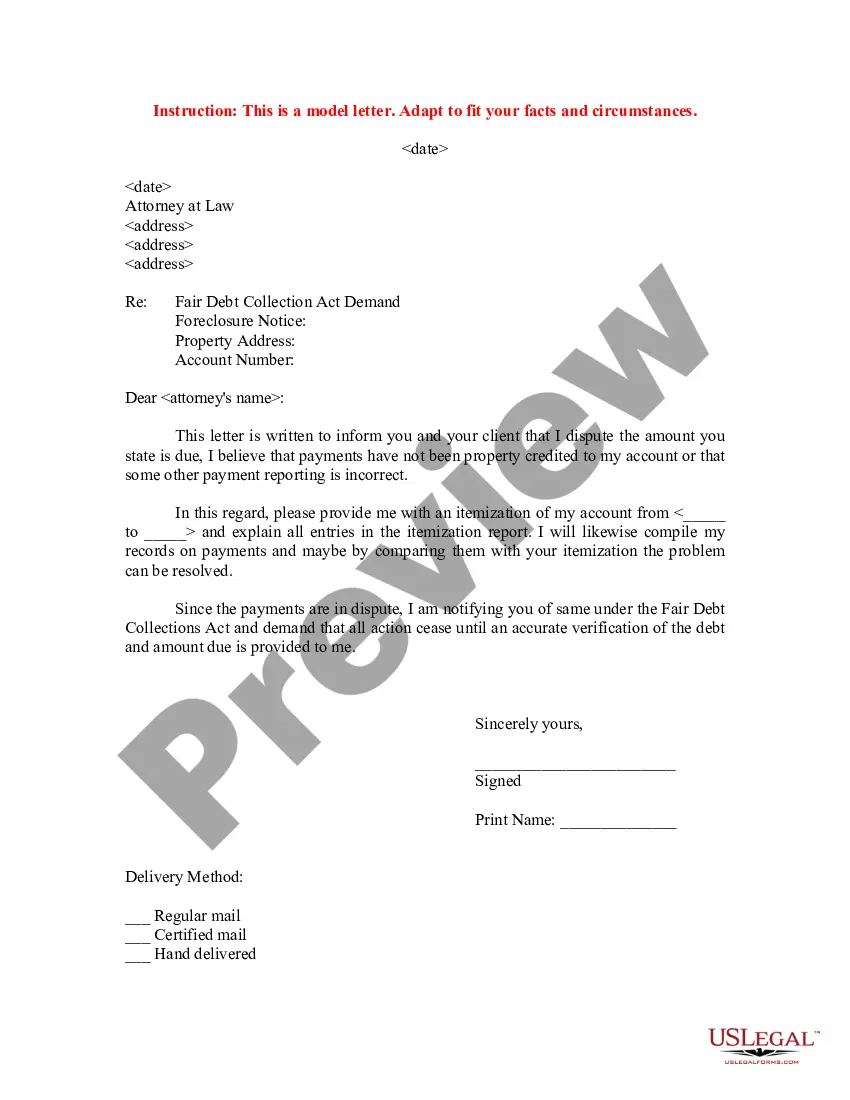

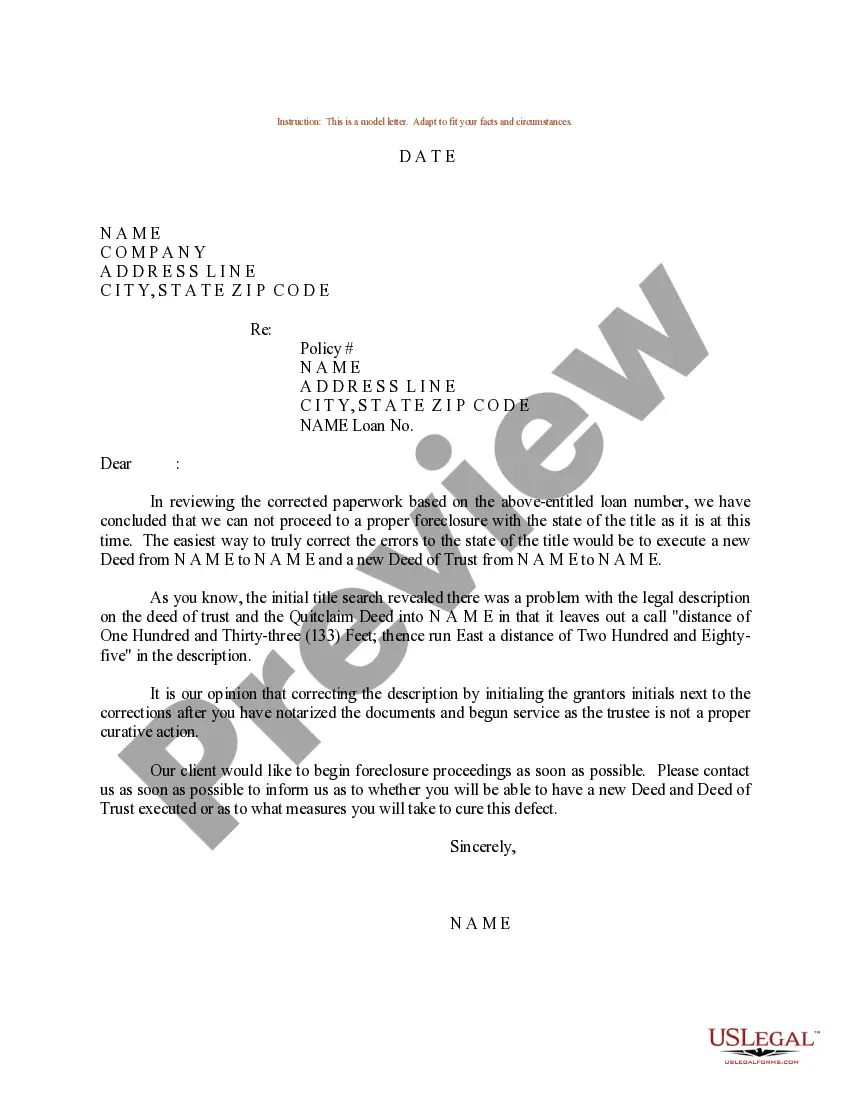

Wisconsin Letter to Foreclosure Attorney - Payment Dispute

Description

How to fill out Letter To Foreclosure Attorney - Payment Dispute?

You are able to devote time on-line looking for the authorized document web template which fits the state and federal needs you will need. US Legal Forms gives thousands of authorized kinds which can be reviewed by specialists. It is simple to download or printing the Wisconsin Letter to Foreclosure Attorney - Payment Dispute from my service.

If you currently have a US Legal Forms account, you are able to log in and click on the Acquire option. Afterward, you are able to complete, change, printing, or signal the Wisconsin Letter to Foreclosure Attorney - Payment Dispute. Every authorized document web template you acquire is your own property eternally. To obtain one more backup of the bought kind, check out the My Forms tab and click on the related option.

If you use the US Legal Forms website initially, stick to the simple guidelines beneath:

- Very first, ensure that you have chosen the proper document web template for that region/area of your choice. See the kind information to ensure you have picked the appropriate kind. If available, make use of the Preview option to look throughout the document web template at the same time.

- If you want to discover one more edition of your kind, make use of the Lookup discipline to get the web template that meets your needs and needs.

- After you have discovered the web template you would like, just click Acquire now to continue.

- Select the rates plan you would like, type your qualifications, and register for an account on US Legal Forms.

- Comprehensive the transaction. You should use your charge card or PayPal account to fund the authorized kind.

- Select the structure of your document and download it in your product.

- Make adjustments in your document if needed. You are able to complete, change and signal and printing Wisconsin Letter to Foreclosure Attorney - Payment Dispute.

Acquire and printing thousands of document themes making use of the US Legal Forms web site, that offers the largest collection of authorized kinds. Use skilled and state-certain themes to handle your business or specific requirements.

Form popularity

FAQ

The right of redemption, also known as the redemption period, can vary slightly in Wisconsin. All redemption periods start when the judgment of foreclosure is entered. Typically, if it is a residential property, you have six months to try and arrange to keep your home.

How Do I Stop Foreclosure in Wisconsin? Reinstating the Loan. The state's law gives mortgagors the right to reinstate the loan before the judgment. ... Redeeming the Property. Wisconsin has a redemption period wherein they can repurchase their properties once it goes on sale. ... File for Bankruptcy.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

The right of redemption, also known as the redemption period, can vary slightly in Wisconsin. All redemption periods start when the judgment of foreclosure is entered. Typically, if it is a residential property, you have six months to try and arrange to keep your home.

A typical foreclosure may take 12-18 months from start to finish.

If the lender does not waive the right to a deficiency judgment, the redemption period is usually 12 months. If the property is deemed abandoned, the timeline is different.

Next, you have to understand that Wisconsin is a judicial foreclosure state, which means there must be, at minimum, notice, an opportunity for the borrower to respond, and a hearing held before a foreclosure is granted.

How to Respond to a Foreclosure Summons Step 1: Read the Summons. ... Step 2: Speak to Foreclosure Lawyer. ... Step 3: Decide If You Want to Contest. ... Step 4: Prepare a Mortgage Foreclosure Appearance and Answer to the Complaint. ... Step 5: File the Form with the Court Clerk. ... Step 6: Send a Copy of Your Answer to the Other Parties.