Wisconsin Software Support Agreement

Description

Software is often divided into two categories: Systems Software includes the operating system and all the utilities that enable the computer to function; and Applications Software includes programs that do real work for users (e.g., word processors, spreadsheets, and database management systems).

How to fill out Software Support Agreement?

If you wish to complete, acquire, or print legitimate document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Utilize the site's straightforward and user-friendly search function to locate the documents you require.

Numerous templates for businesses and individual needs are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and input your credentials to create an account.

Step 5. Process the payment. You can utilize your credit card or PayPal account to complete the transaction.

- Employ US Legal Forms to secure the Wisconsin Software Support Agreement with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to retrieve the Wisconsin Software Support Agreement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms in the legal form directory.

Form popularity

FAQ

Software as a Service (SaaS) is generally subject to sales tax in Wisconsin. This means that any SaaS included in a Wisconsin Software Support Agreement could incur tax charges. Businesses must stay informed of these tax guidelines to ensure correct billing practices and compliance.

Certain services, such as professional services that do not involve the sale of goods, may be exempt from sales tax in Wisconsin. However, software-related services often fall under taxable categories. When drafting your Wisconsin Software Support Agreement, it’s advisable to review which services may be exempt and consult tax regulations for clarity.

Yes, consulting fees are considered taxable income in Wisconsin. When you structure your fees in a Wisconsin Software Support Agreement, it’s crucial to consider how these fees will be treated for tax purposes. Accurate bookkeeping will help ensure compliance with state tax laws.

Website hosting services are taxable in Wisconsin. This means that if you include hosting as part of a Wisconsin Software Support Agreement, it may incur additional tax. It's essential to clarify the tax implications with your hosting provider to understand your total costs.

Yes, consulting income is generally considered taxable in Wisconsin. Whether you provide software support or other consulting services, any income earned through these activities is subject to state and federal taxation. If you're navigating this aspect while engaging in a Wisconsin Software Support Agreement, consider consulting a tax professional for detailed guidance.

In Wisconsin, service contracts, including those related to software, may be subject to sales tax depending on the nature of the service. If the service involves the sale of tangible personal property, it likely incurs tax. When entering into a Wisconsin Software Support Agreement, be sure to clarify the services provided to determine tax obligations.

Completing a Wisconsin Software Support Agreement involves double-checking all filled sections for accuracy. Ensure that all parties review and sign the document, confirming their acceptance of the terms. Additionally, it’s wise to keep a copy for your records. If you need assistance, using resources from US Legal Forms can help you finalize your agreement with confidence.

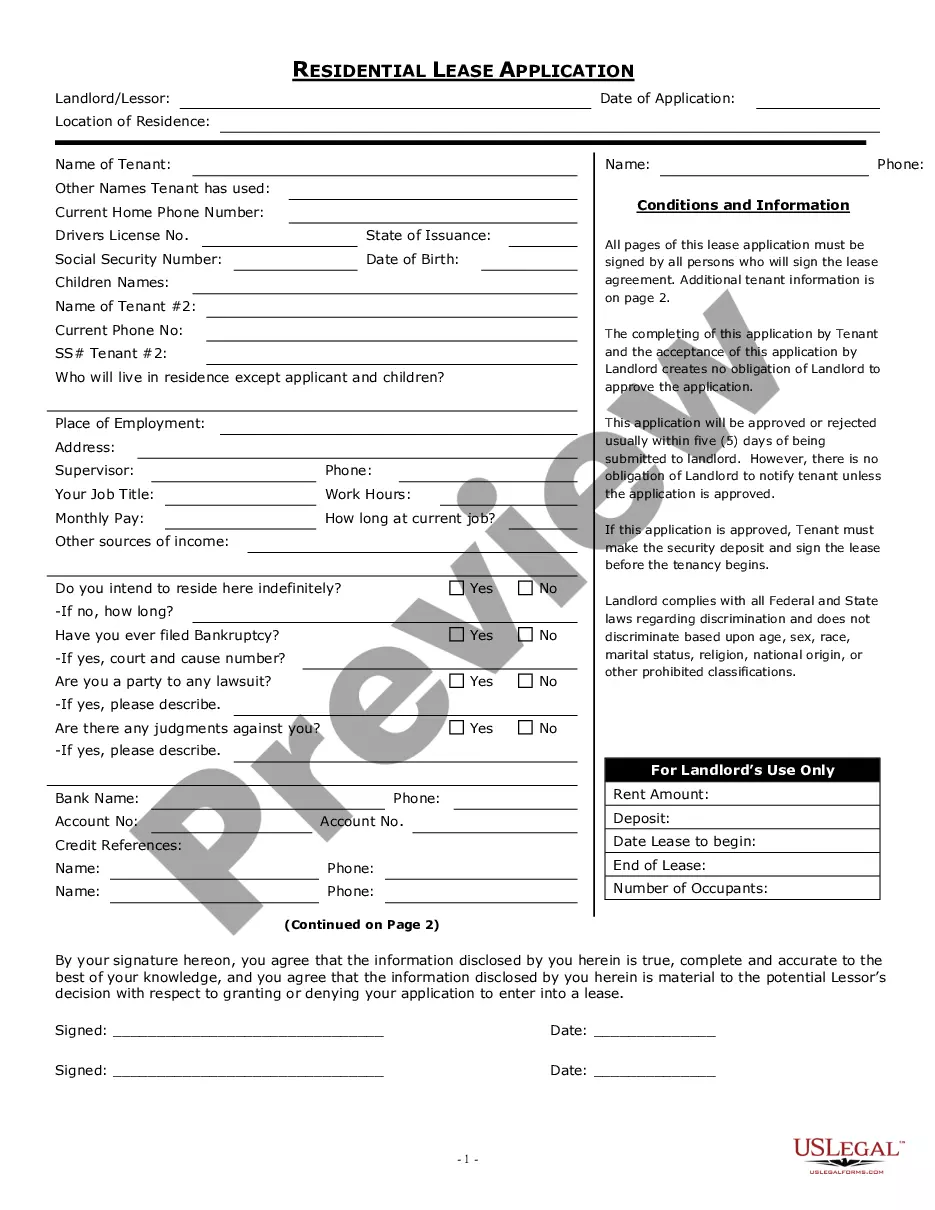

To fill out an agreement form for a Wisconsin Software Support Agreement, first read the form thoroughly to understand its requirements. Provide accurate information for all requested sections, including service details and financial terms. Don’t forget to sign and date the form where indicated. To simplify this process, you might explore template options on US Legal Forms for a comprehensive approach.

Filling out a Wisconsin Software Support Agreement requires careful attention to detail. Begin by inputting the names and addresses of the parties involved. Next, clarify the scope of services, payment details, and any specific terms that apply. Always review the entire document for completeness, and consider using US Legal Forms to guide you through the process.

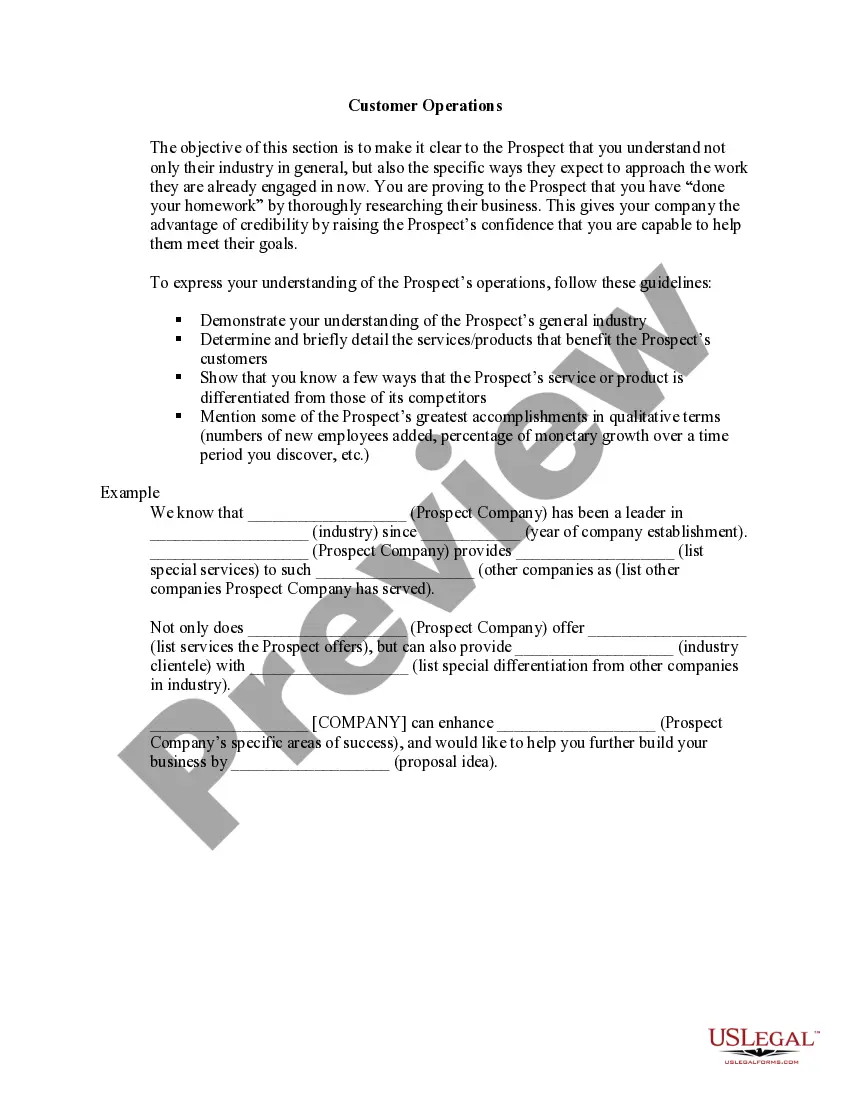

To write a Wisconsin Software Support Agreement, start by defining the parties involved and the purpose of the agreement. Include key details such as the services provided, payment terms, and the duration of the support. Also, outline the responsibilities of each party, alongside any confidentiality or termination clauses. Using a template from US Legal Forms can simplify this process, ensuring you cover all necessary aspects.