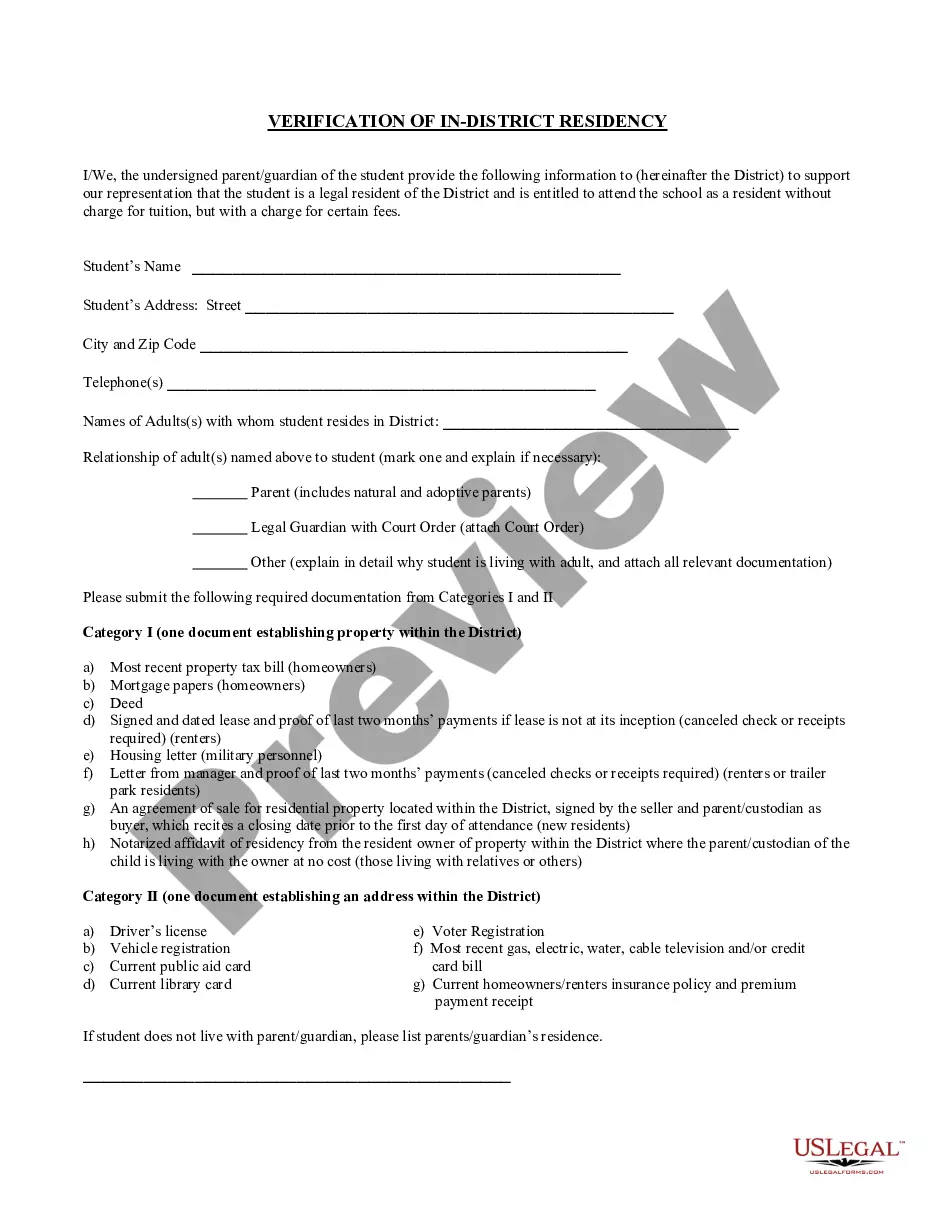

Wisconsin Proof of Residency for School District

Description

How to fill out Proof Of Residency For School District?

Have you been in a situation in which you will need documents for possibly enterprise or specific reasons just about every working day? There are plenty of legitimate file layouts accessible on the Internet, but getting types you can trust isn`t straightforward. US Legal Forms gives 1000s of kind layouts, much like the Wisconsin Proof of Residency for School District, that are composed to meet state and federal specifications.

Should you be already acquainted with US Legal Forms site and also have a merchant account, just log in. Following that, you may download the Wisconsin Proof of Residency for School District template.

Should you not come with an accounts and want to begin using US Legal Forms, adopt these measures:

- Discover the kind you will need and ensure it is for that right town/region.

- Use the Preview option to check the shape.

- Look at the outline to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you`re looking for, use the Lookup field to discover the kind that meets your needs and specifications.

- When you get the right kind, just click Acquire now.

- Choose the pricing strategy you want, submit the desired details to generate your account, and purchase the transaction with your PayPal or bank card.

- Decide on a practical file file format and download your version.

Discover each of the file layouts you might have bought in the My Forms food list. You can aquire a further version of Wisconsin Proof of Residency for School District anytime, if needed. Just go through the needed kind to download or printing the file template.

Use US Legal Forms, probably the most comprehensive selection of legitimate types, to conserve efforts and avoid faults. The service gives expertly created legitimate file layouts which you can use for a range of reasons. Create a merchant account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

All U.S. citizens are residents of at least one state for tax purposes. Your state of residence is determined by: Where you're registered to vote (or could be legally registered) Where you lived for most of the year.

Section 29.001(69) of the Wisconsin Statutes defines residency: "Resident" means a person who has maintained his or her place of permanent abode in this state for a period of 30 days immediately preceding his or her application for an approval.

A legal resident of Wisconsin is a person who maintains their domicile in Wisconsin, whether or not they are physically present in Wisconsin or living outside of the state.

What's the Difference between Residency and Domicile? Residency is where one chooses to live. Domicile is more permanent and is essentially somebody's home base. Once you move into a home and take steps to establish your domicile in one state, that state becomes your tax home.

Generally, to qualify as a Wisconsin resident for tuition purposes, an independent student (or the student's parent, if dependent) must qualify as a bona fide resident of Wisconsin for at least the full twelve-month period prior to enrollment to be eligible for resident tuition status.

Mobile phone bill. ?Financial statements: bank statement for a checking, savings, money market or brokerage account; credit card statement or loan statement for auto, home or personal. Valid Wisconsin hunting or fishing license. Medical billing statement from doctor or hospital.

District of residence means a school district in which the parent or guardian of a student resides.